Break-Even Analysis

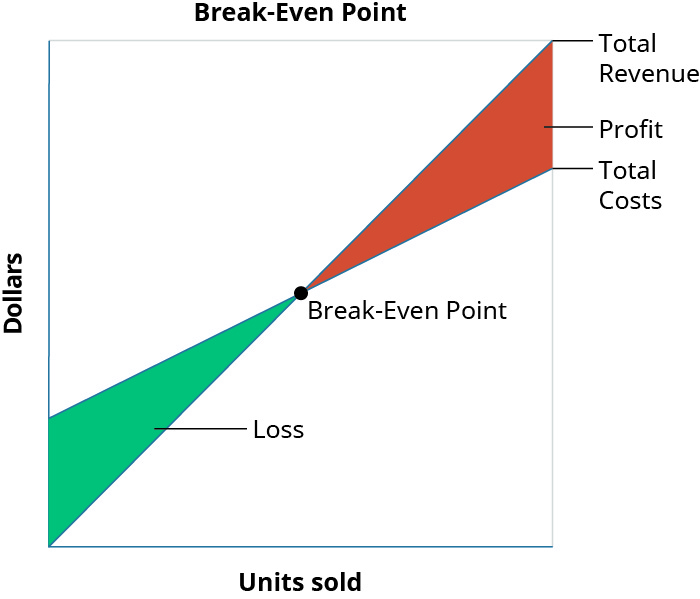

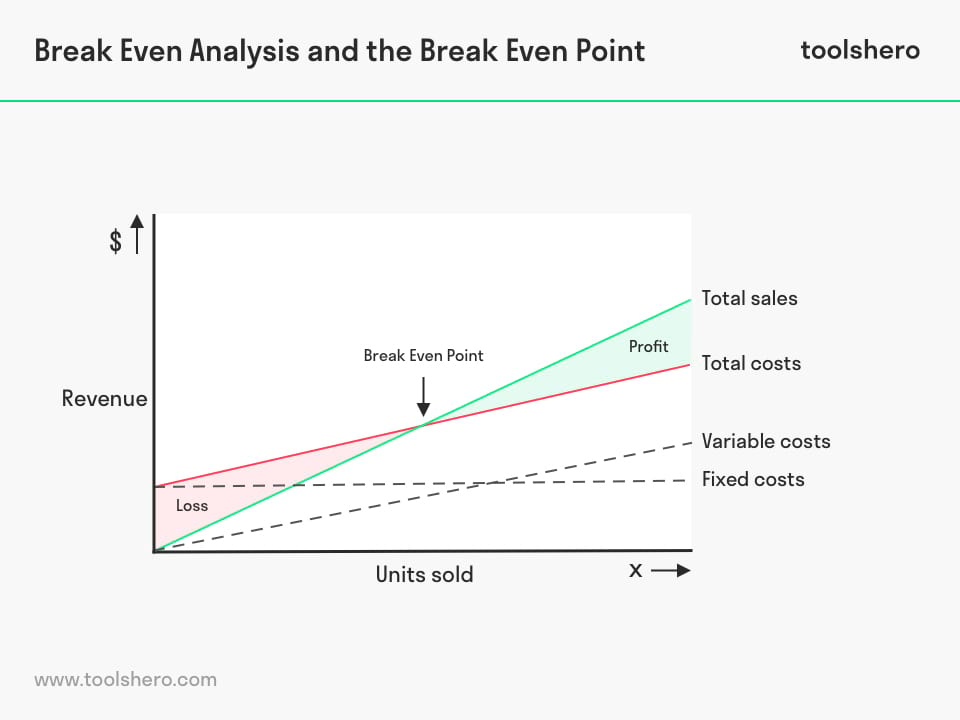

A break-even analysis helps determine the point at which total revenues equal total costs.

A break-even analysis helps to determine the number of product units that need to be sold for a business to be profitable, knowing the price and the cost of the product. It is crucial to understand the concept of fixed and variable costs to correctly calculate the break-even point during your case interview , but also in your daily work as a consultant. If the fixed costs are greater than zero, then it is important to have a positive contribution margin per unit (i.e. price>variable costs) to reach a break-even point at all.

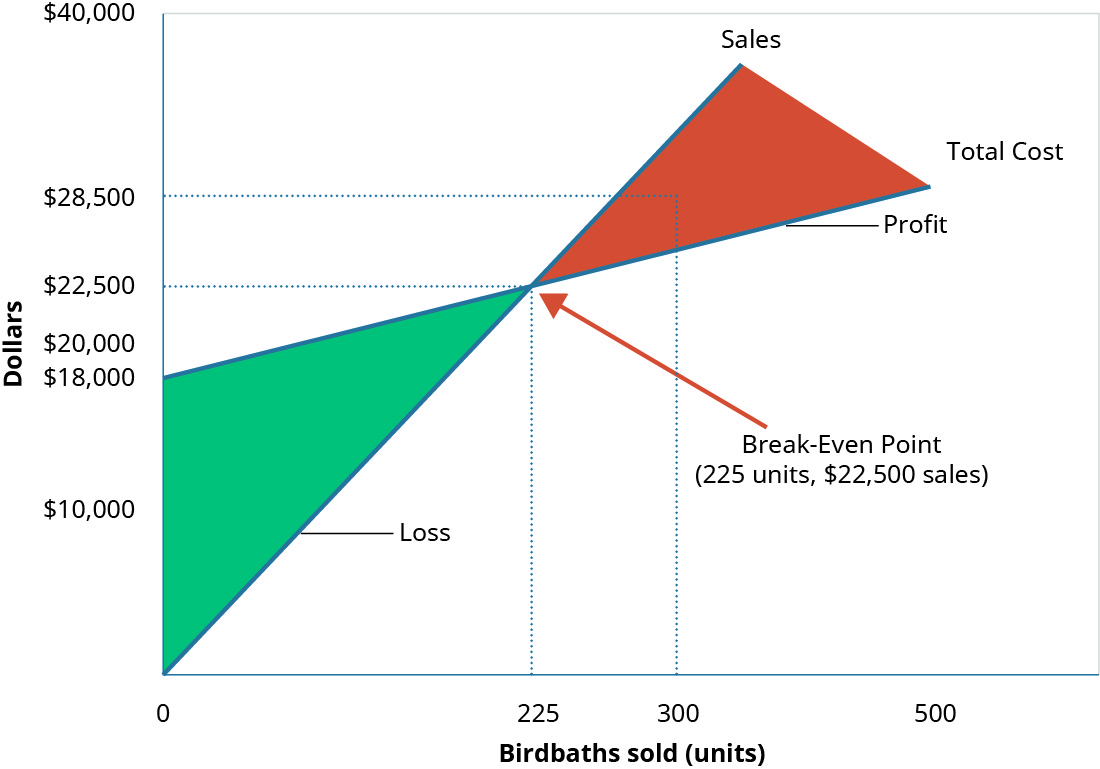

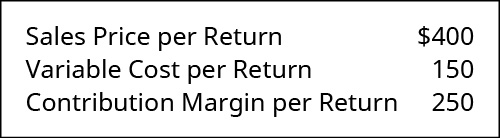

A break-even analysis helps illustrate the relationship between profits, revenues, and costs

Because of the positive contribution margin, the slope of the revenue line is steeper than the slope of the total costs line . Therefore, revenue per unit is higher than cost per unit. If there were no fixed costs, then obviously the business would be profitable from the beginning. In the example shown above, the costs involved when zero units are sold are the fixed costs only. To cover these fixed costs, the business needs to sell a certain number of units to reach this break-even point or cover the fixed costs.

High break-even points usually suggest that a business could benefit from economies of scale

A detailed break-even analysis can provide some insight regarding the economics of a certain project or the entire industry. Imagine you come across a business that has a high break-even point, since the business needs to sell a lot of products to become profitable (e.g., Intel). This scenario is usually due to large fixed costs (so-called asset-heavy industries) which need to be covered by high product sales. In such situations, economies of scale play a major role: The more units you sell, the more you cover the fixed costs. In addition, due to the experience/learning curve, you tend to have fewer variable costs and therefore more control over prices . Also, high fixed costs are a serious entry barrier for new competitors (see Porter's Five Forces for more details).

Apply the break-even analysis in weak profitability situations

For instance, your client is operating at increasing losses even though revenues have increased. You find that the issue is increased costs because of a newly opened factory . The additional fixed costs are still higher than the gain in revenues, leading to losses.

In this case, we can start by hypothesizing the need to increase revenues to fix profitability. In this scenario, it would make sense to check the break-even number of units sold before recommending increased marketing efforts. For a break-even analysis, you need to have information such as fixed costs, variable costs, and price.

Required data

- Yearly fixed costs: $50m

- Average variable cost/product: $1000

- Average price/product: $1500

Calculation

- Profit/product: $1,500 - $1,000 = $500

- $500 * x units = $50m

- x units = 100,000

As a result, the factory needs to produce and sell 100,000 units. Make sure to check its feasibility and if infeasible, your advice could be to divest the new factory .

Key takeaways

- At the break-even point, a business has no net gain/loss .

- To determine the break-even point, you will need a breakdown of the costs and revenues of the product.

Related Cases

Caribbean Island – MBB Final Round

Bain 1st Round Case – BlissOttica

Rally racing, universal tv.

Facilities in a restroom

- Select category

- General Feedback

- Case Interview Preparation

- Technical Problems

Hacking the Case Interview

A breakeven analysis is a common quantitative calculation you’ll perform in case interviews. You may need to conduct a breakeven analysis when you are determining whether a company should enter a new market, launch a new product , or acquire a company.

A breakeven analysis helps a company to determine whether or not they should make a particular business decision. All companies have a goal of being profitable from the decisions that they make.

By looking at the circumstances that need to be true in order for a company to recoup its investment costs, a company can see how likely it is that they will be profitable.

If the conditions for breaking even are favorable, a company may decide to pursue an investment. If the conditions for breaking even are unfavorable, the company may decide to pursue something else.

In this article, we’ll cover:

- The breakeven analysis formula for case interviews

- How to interpret breakeven in case interviews

- Breakeven analysis examples in case interviews

- Breakeven analysis case interview tips

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

Breakeven Analysis Formula for Case Interviews

By definition, breakeven occurs when a company earns as much money as it has spent. In other words, breakeven occurs when the revenue generated from operations has grown to the point that the company has recouped all of its costs.

To get the formula for breakeven, we set profit equal to zero. This is the same thing as setting revenue equal to costs.

Profit = Revenue – Costs

$0 = Revenue - Costs

Revenue = Costs

We can further breakdown revenue as the product of price and quantity of units sold. We can also breakdown costs into variable costs and fixed costs. Remember that variable costs is equal to the quantity of units sold times the variable cost per unit.

Quantity * Price = (Quantity * Variable Cost) + Fixed Costs

We can simplify this formula to get our formula for breakeven analysis.

Fixed Costs = (Price – Variable Cost) * Quantity

This is the only formula you need to know to solve any breakeven problem in a case interview. You should memorize this formula so that you will not need to derive it from scratch during a case interview.

However, if you understand the intuitive meaning behind this formula, as explained in the next section, you won’t even need to memorize it.

How to Interpret Breakeven in Case Interviews

To understand the breakeven formula better, let’s go through each of the terms.

Fixed costs are costs that the company has to incur regardless of how many units of product are produced. Fixed costs include:

Variable costs are costs that increase as the number of units produced increases. They are costs associated with directly producing a unit of product. Variable costs include:

- Raw materials

- Direct labor

Price is the amount the product is being sold for. In other words, it is the amount of money the company receives for each unit sold.

Finally, quantity is the number of units of product that are sold.

Here is how to understand the formula intuitively in your case interviews.

For each product sold, the company makes an amount of profit equal to the difference between the product’s price and variable cost. If you multiply this by the quantity of units sold, this is the total profit the company makes.

However, the company has fixed costs that it has paid for or needs to pay for. Therefore, the profit made from selling product has to at least equal fixed costs in order for the company to actually be profitable.

If you can understand the concept of breakeven from this perspective, you should be able to immediately recall the breakeven formula in any case interview situation.

Breakeven Analysis Examples in Case Interviews

The breakeven analysis formula has four different terms. When given a breakeven analysis problem in case interview, you’ll typically know three of these terms and be asked to solve for the fourth term that is unknown.

Therefore, there are four different types of questions you could be asked.

Breakeven Analysis Example #1

You operate a lemonade stand that sells a cup of lemonade for $4. The cost to produce a cup of lemonade is $1. To legally operate a lemonade stand, you had to purchase a permit for $600. How many cups of lemonade do you need to sell to break even?

$600 = ($4 - $1) * Quantity

$600 = $3 * Quantity

Quantity = 200

You will need to sell 200 cups of lemonade.

Breakeven Analysis Example #2

Your company produces and sells widgets. Each widget costs $500 to produce. You have $100,0000 in fixed costs and expect to be able to sell 1,000 widgets. What minimum price do you need to set for your widgets to break even?

$100,000 = (Price - $500) * 1,000

$100 = Price - $500

Price = $600

You need to price your widgets for at least $600.

Breakeven Analysis Example #3

A pharmaceutical company is considering investing money to research a new drug. They believe they can sell 10,000 units of this drug for $201 each over the course of the drug’s lifetime. The cost to produce each drug is $1. How much does the company need to keep research costs under in order to generate a profit?

Fixed Costs = ($201 - $1) * 10,000

Fixed Costs = $200 * 10,000

Fixed Costs = $2,000,000

The company needs to keep fixed costs under $2,000,000.

Breakeven Analysis Example #4

Your company is a roofing tile distributor. You purchase roofing tiles from suppliers and sell them to retailers for a profit. Your annual fixed costs are $100,000. Each tile that you sell is priced at $1 and you sell ten million tiles a year. What is the maximum price per tile that you can purchase tiles for and still break even?

$100,000 = ($1 – Variable Cost) * 10,000,000

$0.01 = $1 – Variable Cost

Variable Cost = $0.99

You can purchase the tiles for $0.99 each at most.

Breakeven Analysis Case Interview Tips

During your case interview, follow these tips to ensure that your breakeven analysis proceeds smoothly.

1. Make sure to include all costs

When doing breakeven analysis, it is important that you include all of the potential costs involved in managing and operating the business. Leaving out even a single cost element will change your answer.

2. Distinguish between variable costs and fixed costs

Whether a particular cost is a variable cost or a fixed cost can drastically change your answer. Therefore, ensure that you are correctly identifying each cost as either a variable cost or fixed cost.

The simplest way to assess this is to determine whether the cost element would increase if an additional unit is produced. If it does increase, then it is likely a variable cost. If it does not increase, then it is probably a fixed cost.

3. Check that price is greater than variable costs

It is impossible for a company to break even if its variable cost per unit is greater than the price that it charges for its product. Therefore, if you observe that price is less than variable costs, know that there is no way for the company to break even.

4. Talk the interviewer through each of your steps

Whenever you are doing math during a case interview, you want to make it as easy as possible for the interviewer to follow what you are doing. So, before you begin doing any calculations, walk the interviewer through your approach.

Start by explaining the breakeven formula that you are going to be using. Then, as you perform each calculation, talk through exactly what you are doing out loud.

This is beneficial for two reasons. One, you’ll be less likely to make math mistakes if you are talking through the calculations out loud. Two, it will be easier for the interviewer to give you hints or help you out if they know exactly what you are doing.

5. State the implications of your answer

Once you finish calculating your answer, don’t just stop there. Remember, the purpose of a breakeven analysis is to help a company determine whether it should make a particular investment.

Based on the answer that you calculated, do you think the company can realistically achieve the conditions to at least break even? If so, you could hypothesize that the company should make the investment. If not, you should consider what the company could do to increase the likelihood that it will be profitable.

Stating the implications of your breakeven analysis demonstrates that you are a proactive problem solver. This is a quality that separates outstanding case interview candidates from average candidates.

Land Your Dream Consulting Job

Here are the resources we recommend to land your dream consulting job:

For help landing consulting interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple consulting interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing consulting behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Quick Guide to Breakeven Analysis

It’s a simple calculation, but do you know how to use it?

In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You’ve probably heard of it. Maybe even used the term before, or said: “At what point do we break even?” But because you may not entirely understand the math — and because understanding the formula can only deepen your understanding of the concept — here’s a closer look at how the concept works in reality.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

Igniting Brilliance, Inspiring Success with Regenesys. Enrol Now --> Enrol Now

By submitting this form, you agree to our Terms & Conditions.

Case Study: Understanding Break-Even Analysis

Please rate this article

2.6 / 5. 28

Join Regenesys’s 25+ Years Legacy

Awaken Your Potential

Break Even Analysis allows you to evaluate if your business is making a profit or not, so is integral in not only running a business, but also in directing the future of the business.

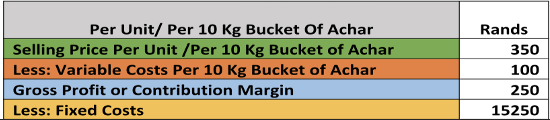

Break-Even Analysis Case Study: The Achar Company

The Achar Company is a small company started in 2020. They produce and distribute 10 kg buckets of achar. The Achar Company makes delicious affordable achar from the scratch using fresh and quality ingredient and delivering at a small fee according to orders across Gauteng.

The Selling Price per unit is R350 per 10 kg bucket of achar and the variable costs per bucket are R100, and that makes the gross profit to be R250 per bucket, but the fixed costs are R15250 per month.

In conclusion, we can see that this business is making enough profit only to cover the monthly fixed costs therefore the business is not making profit nor making a loss.

As the business owner, they can also identify other ideas in order to make profit. Such as:

- Increase the selling price per unit.

- Increase production units per month (make more Buckets of achar per months).

- Add another achar making machine,

- Rent a cheaper place

- Restructure or retrenchment

- Reduce salaries

- Review cheaper insurances etc.

DBA, MBL, MBA, BTech Academic Team Leader and Senior Lecturer Regenesys Business School

Related Posts

How The Two-Pot System Will Differ From Current Retirement Fund Rules: Part 1

Three Essential Tips to Boost your Savings Ratio

Very interesting subject , regards for putting up.

I just added this website to my feed reader, great stuff. Can’t get enough!

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

- Explore Courses

- Digital Programmes

- Digital Regenesys

What is Break-Even Analysis?

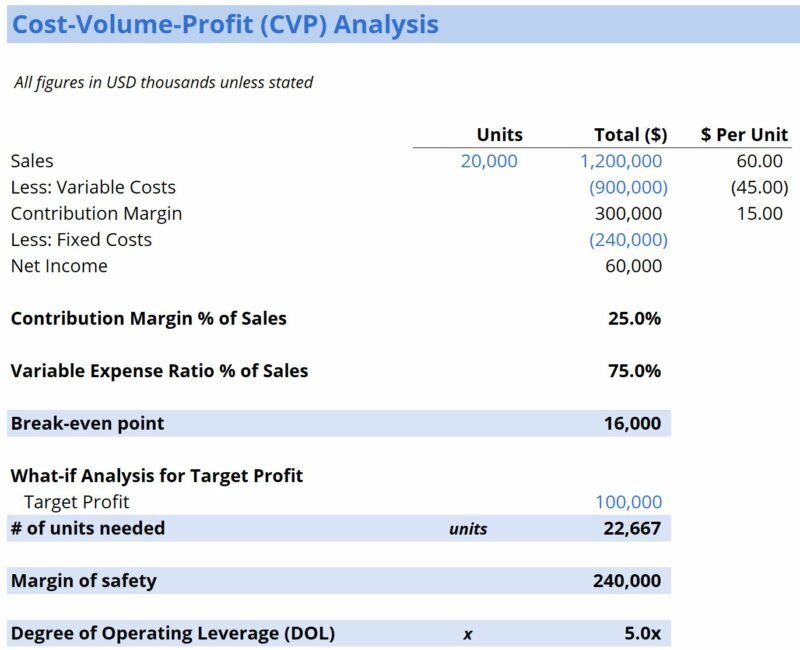

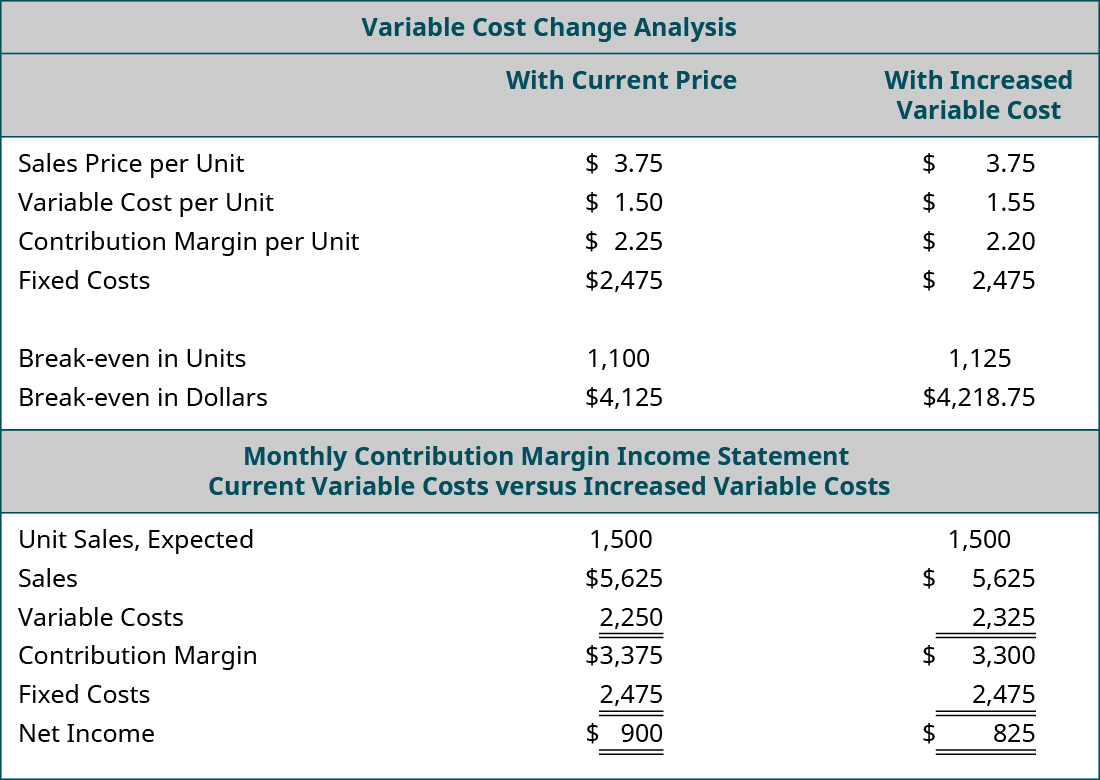

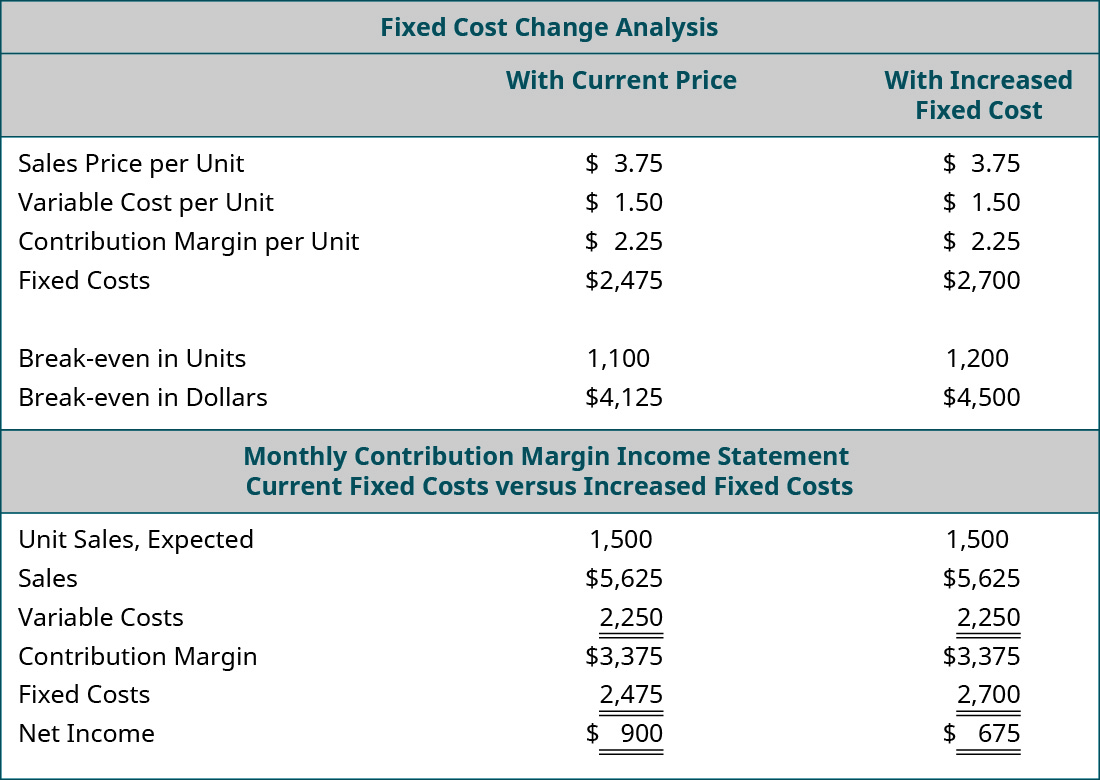

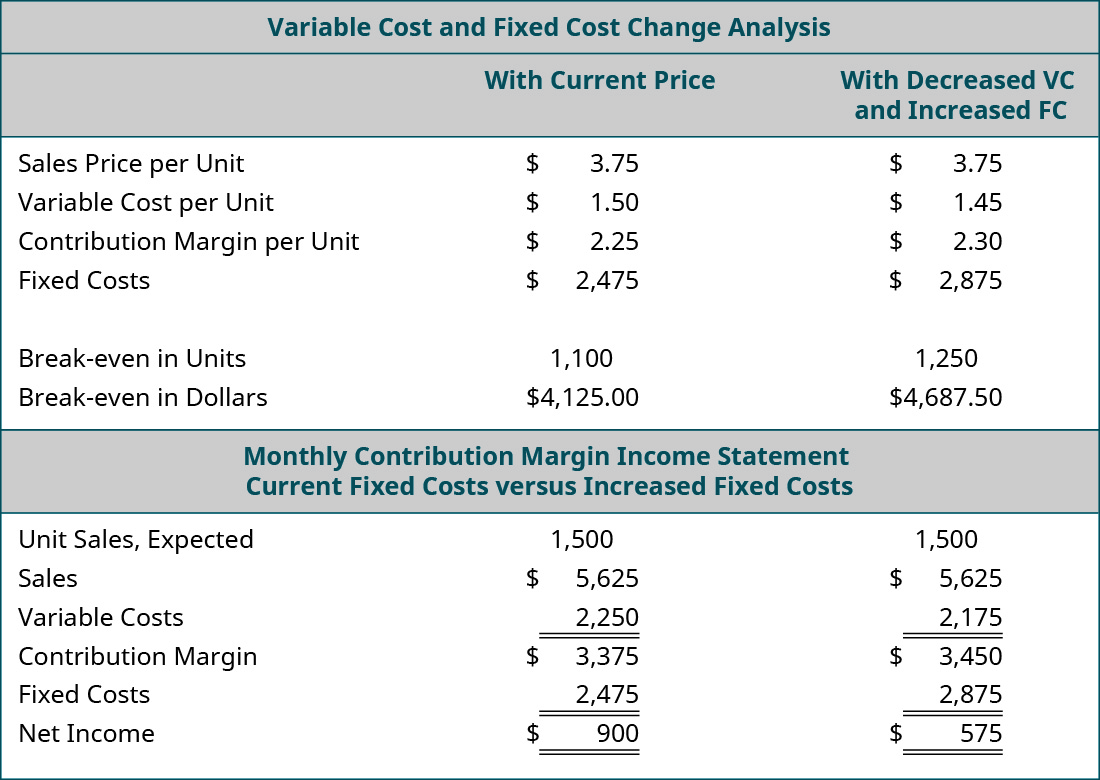

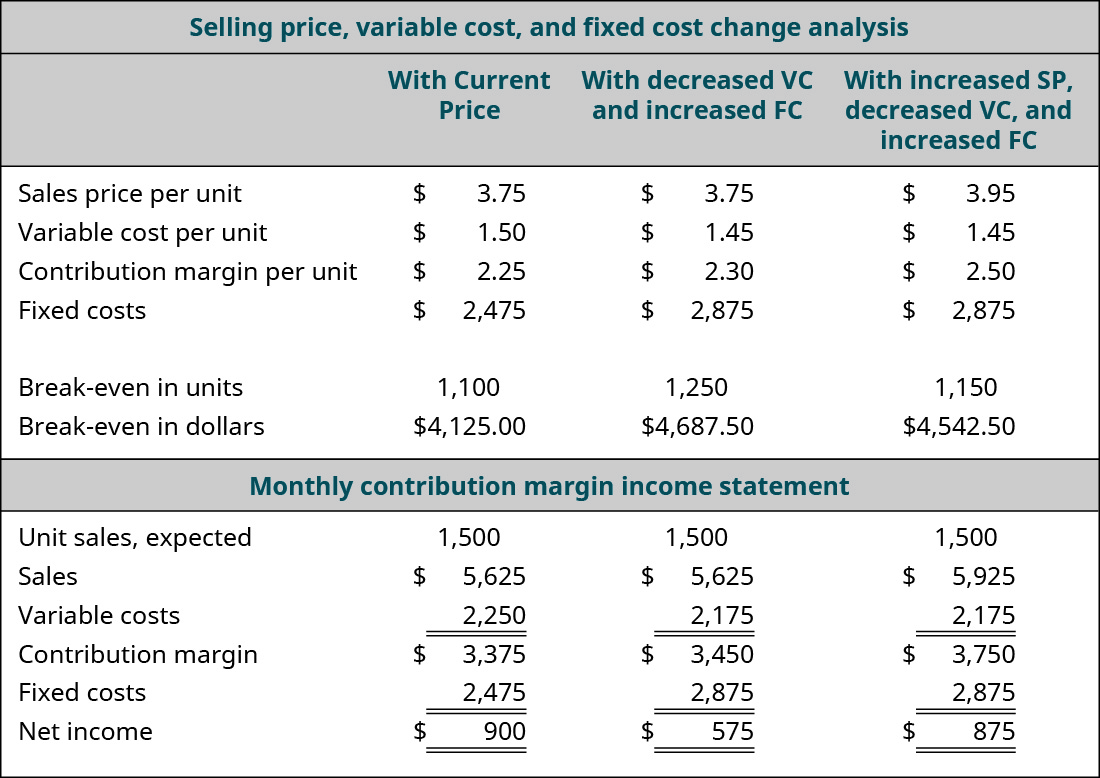

What is the break-even analysis formula, break-even analysis example, graphically representing the break-even point, free cost-volume-profit analysis template, download the free template, interpretation of break-even analysis, sensitivity analysis.

- Factors that Increase a Company’s Break-Even Point

How to reduce the break-even point

Additional resources, break even analysis.

The point in which total cost and total revenue are equal

Break-even analysis in economics, business, and cost accounting refers to the point at which total costs and total revenue are equal. A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs ( fixed and variable costs ).

Key Highlights

- Break-even analysis refers to the point at which total costs and total revenue are equal.

- A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs.

- Break-even analysis is important to business owners and managers in determining how many units (or revenues) are needed to cover fixed and variable expenses of the business.

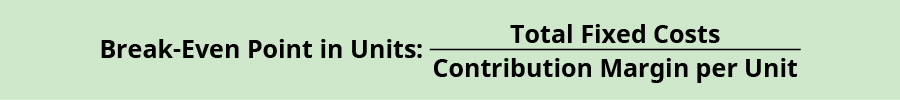

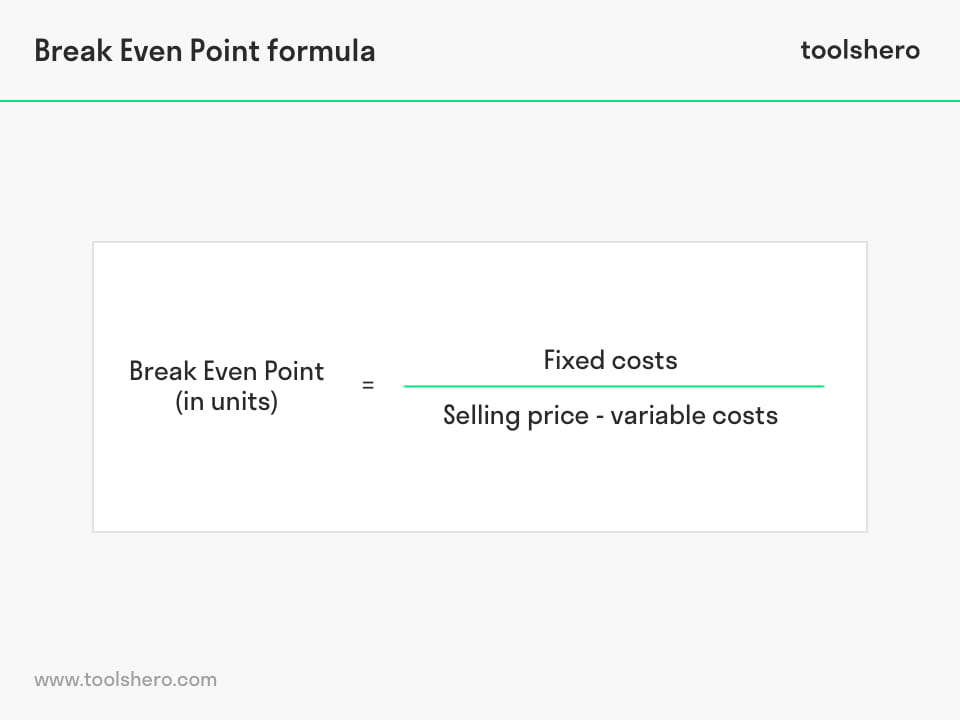

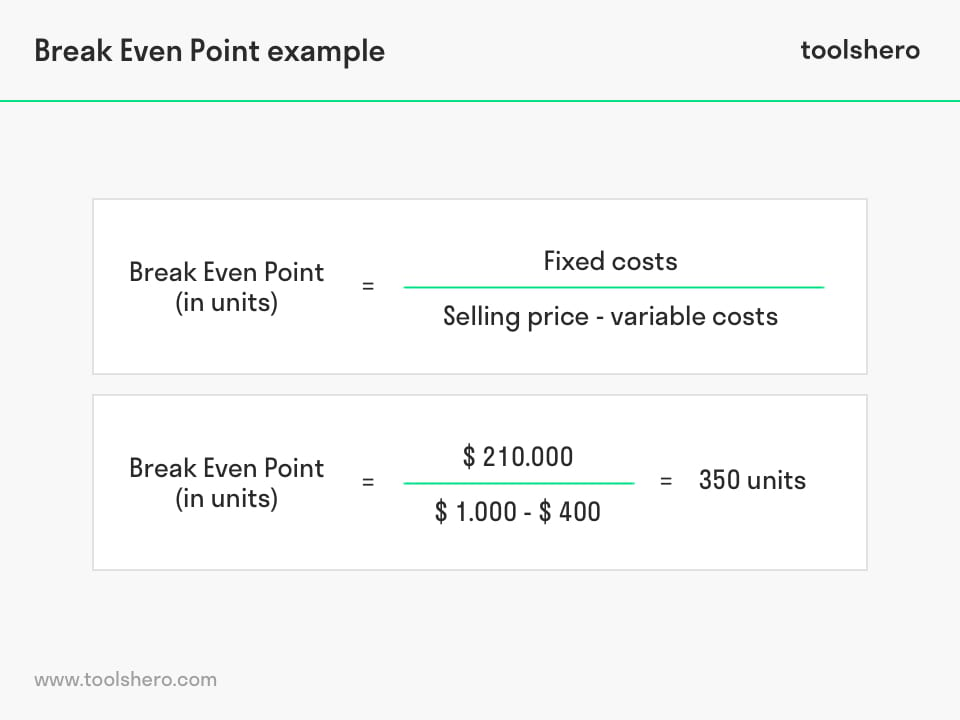

The formula for break-even analysis is as follows:

Break-Even Quantity = Fixed Costs / (Sales Price per Unit – Variable Cost Per Unit)

- Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery)

- Sales Price per Unit is the selling price per unit

- Variable Cost per Unit is the variable cost incurred to create a unit

It is also helpful to note that the sales price per unit minus variable cost per unit is the contribution margin per unit. For example, if a book’s selling price is $100 and its variable costs are $5 to make the book, $95 is the contribution margin per unit and contributes to offsetting the fixed costs.

Colin is the managerial accountant in charge of Company A, which sells water bottles. He previously determined that the fixed costs of Company A consist of property taxes, a lease, and executive salaries, which add up to $100,000. The variable cost associated with producing one water bottle is $2 per unit. The water bottle is sold at a premium price of $12. To determine the break-even point of Company A’s premium water bottle:

Break Even Quantity = $100,000 / ($12 – $2) = 10,000

Therefore, given the fixed costs, variable costs, and selling price of the water bottles, Company A would need to sell 10,000 units of water bottles to break even.

For more information about variable costs, check out the following video:

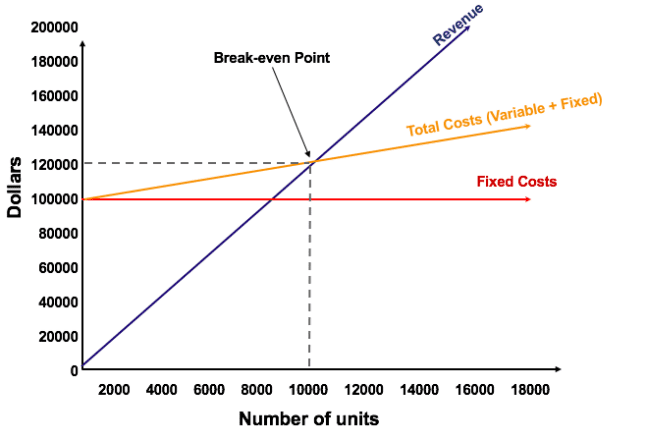

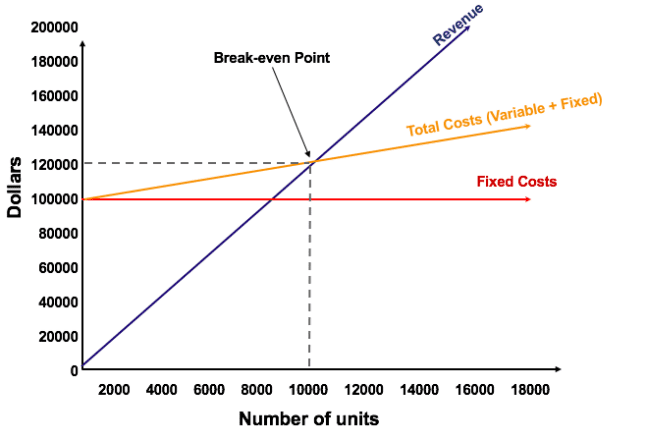

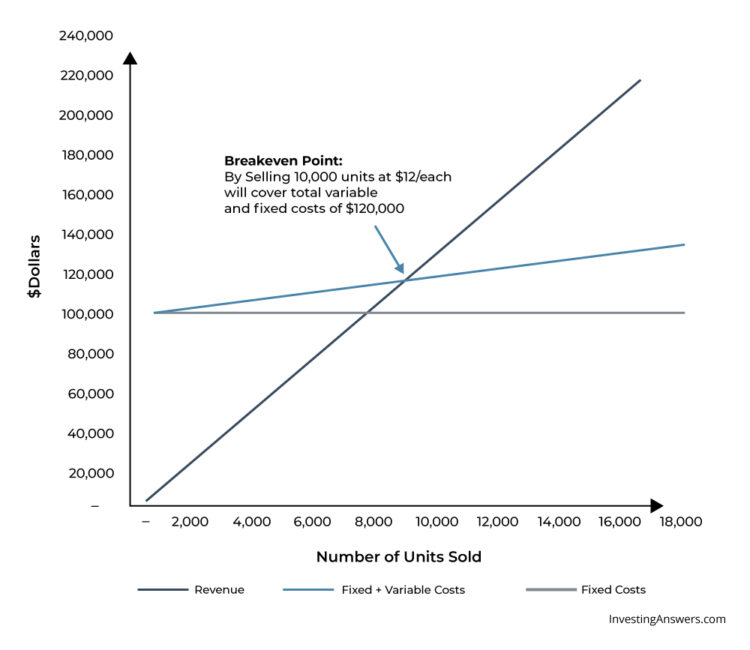

The graphical representation of unit sales and dollar sales needed to break even is referred to as the break-even chart or cost-volume-profit (CVP) graph. Below is the CVP graph of the example above:

Explanation:

- The number of units is on the X-axis (horizontal) and the dollar amount is on the Y-axis (vertical).

- The red line represents the total fixed costs of $100,000.

- The blue line represents revenue per unit sold. For example, selling 10,000 units would generate 10,000 x $12 = $120,000 in revenue.

- The yellow line represents total costs (fixed and variable costs). For example, if the company sells 0 units, then the company would incur $0 in variable costs but $100,000 in fixed costs for total costs of $100,000. If the company sells 10,000 units, the company would incur 10,000 x $2 = $20,000 in variable costs and $100,000 in fixed costs for total costs of $120,000.

- The break even point is at 10,000 units. At this point, revenue would be 10,000 x $12 = $120,000 and costs would be 10,000 x 2 = $20,000 in variable costs and $100,000 in fixed costs.

- When the number of units exceeds 10,000, the company would be making a profit on the units sold. Note that the blue revenue line is greater than the yellow total costs line after 10,000 units are produced. Likewise, if the number of units is below 10,000, the company would be incurring a loss. From 0-9,999 units, the total costs line is above the revenue line.

Enter your name and email in the form below and download the free template now!

As illustrated in the graph above, the point at which total fixed and variable costs are equal to total revenues is known as the break-even point. At the break-even point, a business does not make a profit or loss. Therefore, the break-even point is often referred to as the “no-profit” or “no-loss point.”

The break-even analysis is important to business owners and managers in determining how many units (or revenues) are needed to cover fixed and variable expenses of the business.

Therefore, the concept of break-even point is as follows:

- Profit when Revenue > Total Variable Cost + Total Fixed Cost

- Break-even point when Revenue = Total Variable Cost + Total Fixed Cost

- Loss when Revenue < Total Variable Cost + Total Fixed Cost

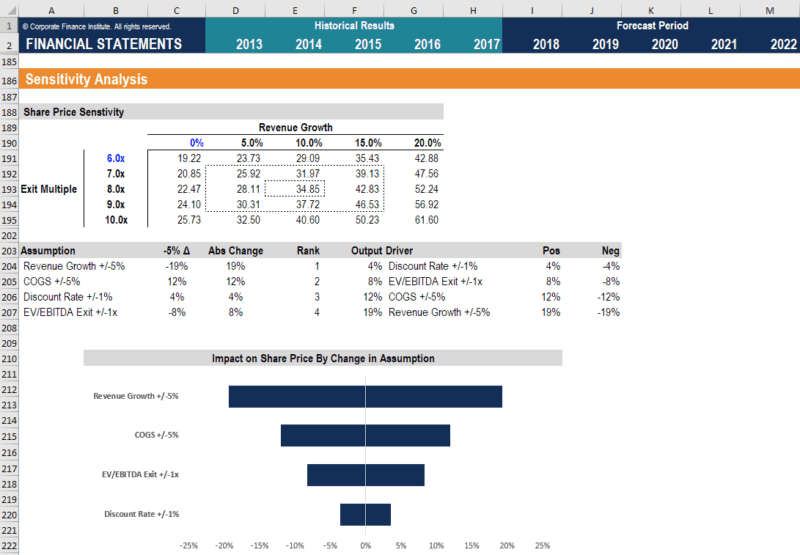

Break-even analysis is often a component of sensitivity analysis and scenario analysis performed in financial modeling . Using Goal Seek in Excel, an analyst can backsolve how many units need to be sold, at what price, and at what cost to break even.

Factors that Increase a Company’s Break-Even Point

It is important to calculate a company’s break-even point in order to know the minimum target to cover production expenses. However, there are times when the break-even point increases or decreases, depending on certain of the following factors:

1. Increase in customer sales

When there is an increase in customer sales, it means that there is higher demand. A company then needs to produce more of its products to meet this new demand which, in turn, raises the break-even point in order to cover the extra expenses.

2. Increase in production costs

The hard part of running a business is when customer sales or product demand remains the same while the price of variable costs increases, such as the price of raw materials. When that happens, the break-even point also goes up because of the additional expense. Aside from production costs, other costs that may increase include rent for a warehouse, increases in salaries for employees, or higher utility rates.

3. Equipment repair

In cases where the production line falters, or a part of the assembly line breaks down, the break-even point increases since the target number of units is not produced within the desired time frame. Equipment failures also mean higher operational costs and, therefore, a higher break-even.

In order for a business to generate higher profits, the break-even point must be lowered. Here are common ways of reducing it:

1. Raise product prices

This is something that not all business owners want to do without hesitation, fearful that it may make them lose some customers.

2. Outsourcing

Profitability may be increased when a business opts for outsourcing , which can help reduce manufacturing costs when production volume increases.

Every company is in business to make some type of profit. However, understanding the break-even number of units is critical because it enables a company to determine the number of units it needs to sell to cover all of the expenses it’s accrued during the process of creating and selling goods or services.

Once the break-even number of units is determined, the company then knows what sales target it needs to set in order to generate profit and reach the company’s financial goals.

How the 3 Financial Statements are Linked

Cost Behavior Analysis

Analysis of Financial Statements

Shutdown Point

See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

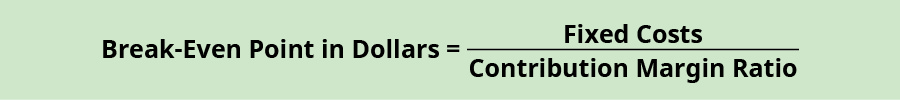

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

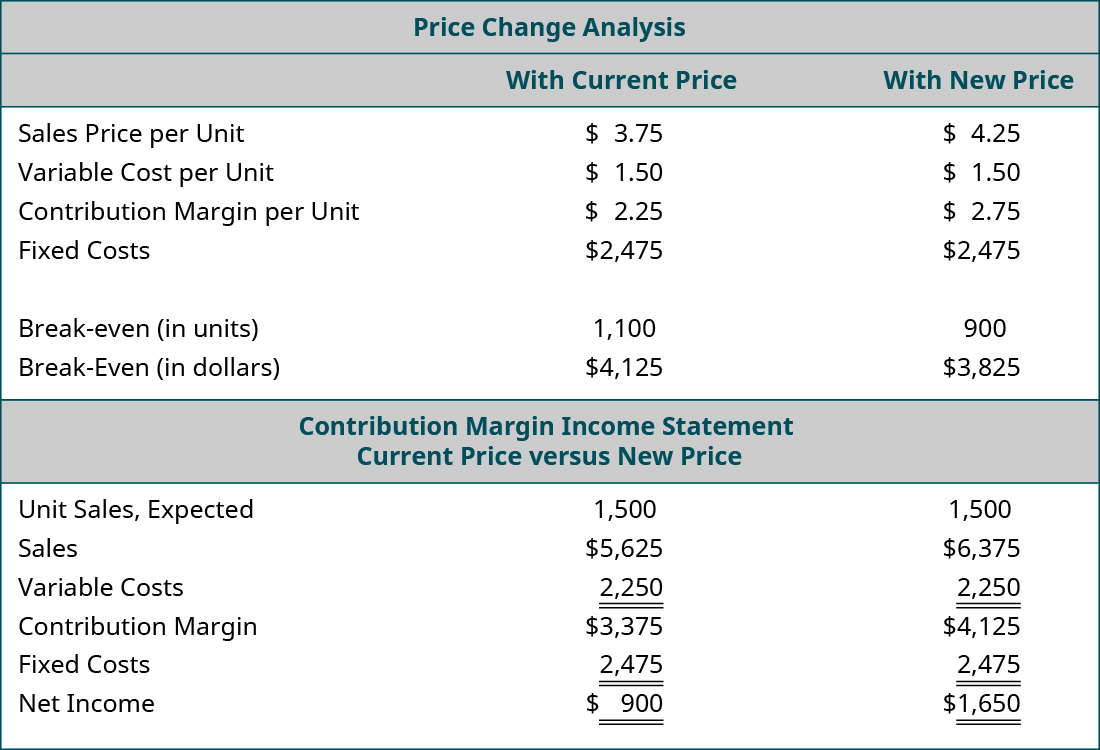

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

- Search for:

- Top 10: Best Credit Cards

- What is A Credit Card?

- Overview: Investment Strategies

- Shopping & Luxury

- Society & Lifestyle

- Tax Overview

- List: Investment Strategies

Break-Even Analysis: Definition and How to Calculate and Use It

Table of Contents

Introduction

When it comes to running a business, understanding your break-even point is crucial. It is the point at which your revenue equals your expenses, and you start making a profit. Break-even analysis is a powerful tool that helps business owners make informed decisions about pricing, costs, and profitability. In this article, we will define break-even analysis, explain how to calculate it, and explore its practical applications.

What is Break-Even Analysis?

Break-even analysis is a financial tool that allows businesses to determine the point at which their total revenue equals their total costs. It helps answer the fundamental question: “How much do I need to sell to cover all my expenses?” By understanding the break-even point, businesses can set realistic sales targets, make pricing decisions, and assess the financial viability of their operations.

Calculating the Break-Even Point

To calculate the break-even point, you need to consider two main components: fixed costs and variable costs.

Fixed Costs

Fixed costs are expenses that do not change regardless of the level of production or sales. These costs include rent, salaries, insurance, and utilities. To calculate the break-even point, you need to determine the total fixed costs for a specific period, such as a month or a year.

Variable Costs

Variable costs, on the other hand, are expenses that vary with the level of production or sales. Examples of variable costs include raw materials, direct labor, and sales commissions. To calculate the break-even point, you need to determine the variable cost per unit and the total number of units sold.

Break-Even Point Formula

The break-even point can be calculated using the following formula:

Break-Even Point (in units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

For example, let's say a company has fixed costs of $10,000 per month, a selling price per unit of $20, and a variable cost per unit of $10. Using the formula, the break-even point would be:

Break-Even Point (in units) = $10,000 / ($20 – $10) = 1,000 units

This means that the company needs to sell 1,000 units to cover all its costs and reach the break-even point.

Using Break-Even Analysis

Break-even analysis provides valuable insights into a business's financial health and helps guide decision-making. Here are some practical applications of break-even analysis:

Pricing Decisions

Break-even analysis can help businesses determine the optimal pricing strategy. By understanding the break-even point, businesses can calculate the minimum price they need to charge to cover costs and make a profit. It also allows them to assess the impact of price changes on profitability. For example, if a business lowers its price, it can calculate how many additional units it needs to sell to maintain the same profit margin.

Cost Control

Break-even analysis helps businesses identify areas where they can reduce costs to reach the break-even point faster. By analyzing their fixed and variable costs, businesses can identify opportunities for cost savings. For example, they may find that renegotiating a lease agreement or finding a more cost-effective supplier can significantly impact their break-even point.

Investment Decisions

Break-even analysis is also useful when making investment decisions. It helps businesses assess the financial viability of a new project or expansion. By calculating the break-even point for the new venture, businesses can determine whether the potential revenue will cover the additional costs. This analysis provides a clear picture of the risks and rewards associated with the investment.

Scenario Planning

Break-even analysis allows businesses to conduct scenario planning and assess the impact of different variables on their profitability. By adjusting the selling price, variable costs, or fixed costs, businesses can simulate different scenarios and evaluate their financial implications. This helps them make informed decisions and develop contingency plans.

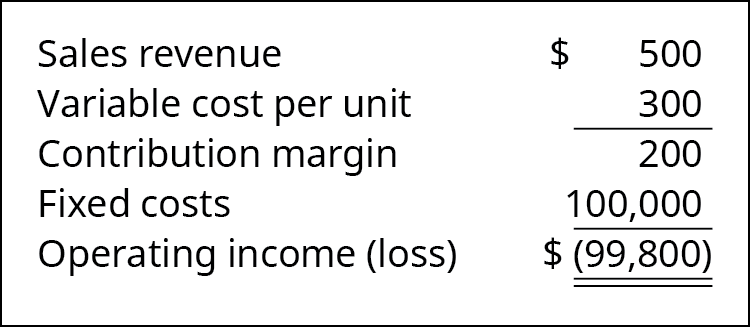

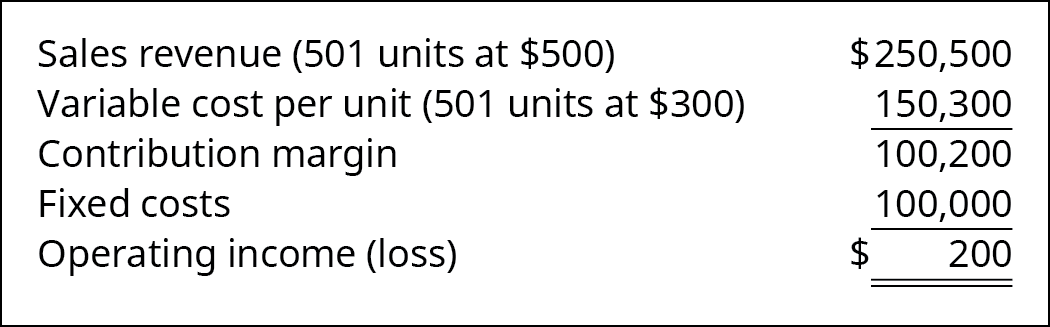

Case Study: Break-Even Analysis in Action

Let's consider a case study to illustrate the practical application of break-even analysis. ABC Electronics is a company that manufactures and sells smartphones. They have fixed costs of $100,000 per month, a selling price per unit of $500, and a variable cost per unit of $300.

Using the break-even formula, we can calculate the break-even point:

Break-Even Point (in units) = $100,000 / ($500 – $300) = 500 units

This means that ABC Electronics needs to sell 500 units to cover all its costs and reach the break-even point.

Now, let's assume ABC Electronics sells 800 units in a month. By subtracting the break-even point from the actual units sold, we can calculate the company's profit:

Profit = (Actual Units Sold – Break-Even Point) * (Selling Price per Unit – Variable Cost per Unit)

Profit = (800 – 500) * ($500 – $300) = 300 * $200 = $60,000

In this case, ABC Electronics would make a profit of $60,000.

Break-even analysis is a powerful tool that helps businesses determine the point at which their revenue equals their expenses. By calculating the break-even point, businesses can make informed decisions about pricing, costs, and profitability. It allows them to set realistic sales targets, make pricing decisions, control costs, and assess the financial viability of their operations. Break-even analysis is a valuable tool for businesses of all sizes and industries, providing insights that can drive success and growth.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Username or email address *

Password *

Remember me Log in

Lost your password?

- Search Search Please fill out this field.

What Is Break-Even Analysis?

- How It Works

Calculating Contribution Margin and BEPs

Who calculates beps, why break-even analysis matters.

- Break-Even Analysis FAQs

The Bottom Line

- Investing Basics

Break-Even Analysis: Formula and Calculation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Break-even analysis compares income from sales to the fixed costs of doing business. The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP).

When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars.

Key Takeaways:

- Using the break-even point formula, businesses can determine how many units or dollars of sales cover the fixed and variable production costs.

- The break-even point (BEP) is considered a measure of the margin of safety.

- Break-even analysis is used for different reasons, from stock and options trading to corporate budgeting for various projects.

- Once a company meets the break-even point, subsequent sales will exceed expenses and profits can be generated.

Investopedia / Paige McLaughlin

Understanding Break-Even Analysis

Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold.

A firm with lower fixed costs will have a lower break-even point of sale and $0 of fixed costs will automatically have broken even with the sale of the first product, assuming variable costs do not exceed sales revenue.

Fixed costs remain the same regardless of how many units are sold. Examples of fixed and variable costs include:

| Rent | Raw materials |

| Taxes | Production supplies |

| Insurance | Utilities |

| Wages or salaries | Packaging |

Break-Even Point Formula

Break-even analysis involves a calculation of the break-even point (BEP) . The break-even point formula divides the total fixed production costs by the price per individual unit less the variable cost per unit.

BEP = Total Fixed Costs / (Price Per Unit - Variable Cost Per Unit)

Contribution Margin

A product's contribution margin is the difference between the selling price of the product and its variable costs. So, relative to the BEP formula above, you could also say that the BEP = Total Fixed Costs / Contribution Margin.

Contribution Margin = Item Price - Variable Cost Per Unit

For example, if an item sells for $100, with fixed costs of $25 per unit, and variable costs of $60 per unit, the contribution margin is:

$40 = ($100 - $60)

This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

Break-Even Point in Units

To find the total units required to break even, divide the total fixed costs by the unit contribution margin.

BEP (Units) = Total Fixed Costs / Contribution Margin

Assume total fixed costs are $20,000. With a contribution margin of $40 (shown above), the break-even point is:

500 units = $20,000 divided by $40.

Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0.

Break-Even Point in Dollars

To calculate the break-even point in sales dollars, you'll need to divide the total fixed costs by the contribution margin ratio. So, first, you must determine the ratio:

Contribution Margin Ratio = Contribution Margin Per Unit / Item Price

Continuing with the example above, the contribution margin ratio is:

40% = ($40 / $100) x 100 to convert to a percentage

Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio.

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

$50,000 = $20,000 / 40%

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

- Entrepreneurs

- Financial Analysts

- Stock and Option Traders

- Government Agencies

Although investors may not be interested in an individual company's break-even analysis of production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

- Pricing : With a clear understanding of their cost structure and a break-even numbers, companies can set prices for their products that cover their fixed and variable costs and provide a reasonable profit margin.

- Decision-Making : When it comes to new products and services, operational expansion, or increased production, businesses can chart their profit to sales volume and use break-even analysis to help them make informed decisions about those activities.

- Cost Reduction : Break-even analysis helps businesses to pinpoint areas where they can reduce costs to increase profitability.

- Performance Metric: Break-even analysis is a financial performance tool that helps businesses ascertain where they stand in achieving their goals.

What Are Some Limitations of Break-Even Analysis?

Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

What Are the Components of Break-Even Analysis?

There are five components of break-even analysis: fixed costs, variable costs, revenue, contribution margin, and the break-even point (BEP).

Why Is the Contribution Margin Important in Break-Even Analysis?

The contribution margin represents the revenue required to cover a business' fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take.

Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even. Beyond the break-even point, it's all profit. That is, sales will exceed expenses.

Break-even analysis helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

U.S. Small Business Administration. " Break-Even Point ."

Professor Rosemary Nurre, College of San Mateo. " Accounting 131: Chapter 6, Cost-Volume-Profit Relationships ."

:max_bytes(150000):strip_icc():format(webp)/BreakevenPoint-b6ed6dc69b2742358a937e280a3fc103.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

In Pursuit of Profit: Applications and Uses of a Break-Even Analysis

A break-even analysis is an essential element of financial planning. Here’s how to apply it to your business.

Table of Contents

Every entrepreneur should use a break-even analysis in their financial planning. It helps you understand your business’s revenue, expenses and cash flow so you can keep your doors open and your business profitable.

Read on to learn more about a break-even analysis and how this essential form of financial planning helps business owners make informed decisions.

What is a break-even analysis?

A break-even analysis is a financial tool that helps determine when your company, service or product will be profitable. This calculation determines the number of products or services a company must sell to cover its expenses, especially fixed costs.

Here’s an example of the elements that go into a break-even analysis:

- Fixed costs: Fixed costs, also called overhead costs , are the expenses that stay the same no matter how much the business sells. They include utilities, bills, salaries and wages, rent and insurance.

- Variable costs: Variable costs are based on a business’s sales. They can include additional labor from independent contractors, materials and payment processing fees.

- Average price: This is the average amount you charge for your products and services.

Editor’s note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs.

What is the break-even-point formula?

Taken together, these elements create a formula known as the break-even-point formula. This relatively simple calculation is essential for planning for profitability.

Fixed Costs / (Average Price – Variable Cost) = Break-Even Point

The term “break-even” refers to a situation in which you are neither making nor losing money but all of your costs have been covered. With a break-even analysis, you can determine when your company will generate enough revenue to cover its expenses and earn a profit. The same holds true for a particular product or service. This data is often used for financial projections.

Examples of break-even analysis

Here are two examples of the break-even-point formula.

The price of one of your products is $100. Your fixed costs are $10,000 per month, and the variable cost is $50 per product. The formula to calculate how many products you must sell to break even would look like this:

$10,000 / ($100 – $50) = 200

Based on the formula, you must sell 200 products to cover your costs, effectively breaking even. To be profitable, you would have to sell at least 201 products.

If a company has $20,000 in fixed costs and a gross margin of 35 percent, the business would need to make $57,143 to break even.

$20,000 / 0.35 = $57,143

If revenue greater than $57,143 is achieved, the company can pay for its fixed and variable costs and make a profit.

Why is a break-even analysis important?

A break-even analysis informs you of the bare minimum performance your business must meet to avoid losing money. It also helps you understand at which point you’ll generate profits so you can set production goals accordingly.

You can use this information when your business is in the planning stages to determine whether your idea is feasible. Then, once your business is established, you can use a break-even analysis to develop direct cost structures and to identify opportunities for promotions and discounts.

Although there are many reasons to conduct a break-even analysis, let’s focus on the three most common uses.

It helps you identify the point of profitability.

A business that doesn’t turn a profit could take a turn for the worse at any time. This is why every company needs to focus on its point of profitability. Ask yourself these questions:

- How much revenue do I need to generate to cover all of my expenses?

- Which products or services generate a profit?

- Which products or services are sold at a loss?

A company’s goal is to become profitable as soon as possible. To ensure you’re on the right track, you need to focus on your numbers upfront. If you don’t calculate the break-even points for your products or services, you risk not generating a profit (or generating a smaller one than you expected).

It ensures that you price products and services correctly.

When most people think about pricing, they primarily consider how much their product costs to create, and they fail to take into account overhead costs. This leads businesses to underprice their products. Finding your break-even point will help you price your products correctly. You will know where to set your margins to generate the right revenue to break even and begin turning a profit.

Determining your break-even point is simple if you offer only a couple of products or services. It becomes more challenging as your service offerings and production increase.

Image via Business Tool Pro

As you determine your break-even point for a product or service, ask yourself the following questions:

- What is the total cost?

- What are the fixed costs?

- What are the variable costs?

- What is the total variable cost?

- What are the costs of any raw materials?

- What is the cost of labor?

It gives you the information you need to implement the best strategy.

Using your break-even analysis, you can create a strategy for the future. Suppose your business’s profitability is determined by the success of one or more products. In that case, the break-even point for each product provides a timeline for the company, which can help you implement a better overall financial strategy that fits the projected costs and profits.

This analysis can also help you determine ways to reach your company’s break-even point sooner, such as reducing your overall fixed costs, lowering the variable costs per unit, improving the sales mix by selling more of the products that have larger contribution margins, and increasing the prices (as long as it doesn’t cause the number of units sold to decline significantly).

When should I use a break-even analysis?

There are many situations where a break-even analysis comes in handy. According to Rick Vazza, owner of Driven Franchising, you should use a break-even analysis to answer the following questions about your business:

- How much of my product or service do I need to sell per month?

- How much volume do I expect to sell?

- What price makes those figures match my break-even calculation?

- What price allows me to generate a reasonable profit?

Your goal is to get an accurate look at your profit, net cash flow and finances.

“It’s much easier for people to decide whether they can beat that minimum than guessing how many sales they may make,” said Rob Stephens, founder of CFO Perspective.

Here are three times you should consider performing a break-even analysis.

You are expanding your business.

Stephens suggested using a break-even analysis to assess how long it will take for any planned investments or changes in your business to become profitable.

“These investments might be a new product or location,” Stephens said. “I’ve done break-even calculations many times for modeling the minimum sales needed to cover the costs of a new location.”

You need to lower your pricing.

This analysis is also helpful when you’re lowering your prices to beat a competitor . “You can also use break-even analysis to determine how many more units you need to sell to offset a price decrease,” Stephens said. “The most common use of break-even analysis in my career has been modeling price changes.”

You want to narrow down your options.

When making changes to your business, you may be bombarded with various scenarios and possibilities, which can be overwhelming when you’re trying to make a decision. Stephens suggested using a break-even analysis to narrow down your choices to scenarios with straightforward yes-or-no questions. For example, “Can we do better than the minimum needed for success?”

What are the limitations of a break-even analysis?

Although a break-even analysis is a classic tool for predicting business sustainability, it does have some limitations. You should always use multiple tools when analyzing business processes and profitability.

It assumes market conditions are consistent.

Once you open your business, it will quickly become apparent that every day, month and year can be completely different. You might have an increased customer demand, multiple competitors or a change in consumer spending.

It’s not sufficient for long-term planning.

A break-even analysis is most useful for short-term planning. For example, the analysis can accurately predict how many units must be sold for you to be profitable this month, but it cannot help you analyze business conditions over time, especially if you have busy and slow periods.

The analysis can quickly become obsolete.

Due to the short-term nature of a break-even analysis, it needs to be constantly updated to be accurate. If you fall behind on importing new data, the analysis can quickly become obsolete, leading to uninformed business decisions.

It’s not detailed enough.

If you have only one price point, a break-even analysis can be beneficial. However, most businesses have multiple price levels to encourage and engage a wide variety of consumers.

With multiple product tiers, your costs can fluctuate from supplies, inventory demand and shipping. With all of these factors to consider, you’ll need to use additional tools beyond a break-even analysis to accurately portray the financial health of your business.

It doesn’t account for competition.

Because there is no formula for a fluctuating marketplace, a break-even analysis can’t account for competition. You will need to monitor your competitors separately so you can accurately account for supply and demand, product price changes and promotional offers.

Julie Thompson and Julianna Lopez contributed to this article. Source interviews were conducted for a previous version of this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Break-Even Analysis

What Is Break Even Analysis?

Break even analysis is a calculation of the quantity sold which generates enough revenues to equal expenses. In securities trading, the meaning of break even analysis is the point at which gains are equal to losses.

Another definition of break even analysis is the examination and calculation of the margin of safety that’s based on a company’s revenue – as well as the related costs of running the organization.

How Is Break Even Analysis Used?

A break-even analysis helps business owners determine when they'll begin to turn a profit, which can help them better price their products. Usually, management uses this metric to help guide strategic decisions to grow/maintain the business.

Break-Even Analysis vs. Break-Even Point

Break-even analysis uses a calculation called the break even point (BEP) which provides a dynamic overview of the relationships among revenues, costs, and profits. More specifically, it looks at a company’s fixed costs in relation to profits that are earned from each unit sold.

Break Even Analysis Varies Among Industries

Typical variable and fixed costs differ widely among industries. This is why comparison of break-even points is generally most meaningful among companies within the same industry. The definition of a 'high' or 'low' break-even point should be made within this context.

Break Even Analysis Formula

Fixed Costs

Fixed costs do not change with the quantity of output. In other words, they’re not affected by sales. Examples include rent and insurance premiums, as well as fees paid for marketing or loan payments.

Variable Costs

Variable costs change depending on the amount of output. Examples include raw materials and labor that are directly involved in a company's manufacturing process.

Contribution Margin

The contribution margin is the amount remaining (i.e. the excess) after total variable costs are deducted from a product’s selling price.

Say that an item sells for $5,000 and your total variable costs are $3,000 per unit. Your contribution margin would be $2,000 (after subtracting $3,000 from $5,000). This is the revenue that’ll be used to cover your fixed costs – which isn’t considered when calculating the contribution margin.

Earned Profit

Earned profit is the amount a business earns after taking into account all expenses. You can calculate this number by subtracting the costs that go into your company’s operations from your sales.

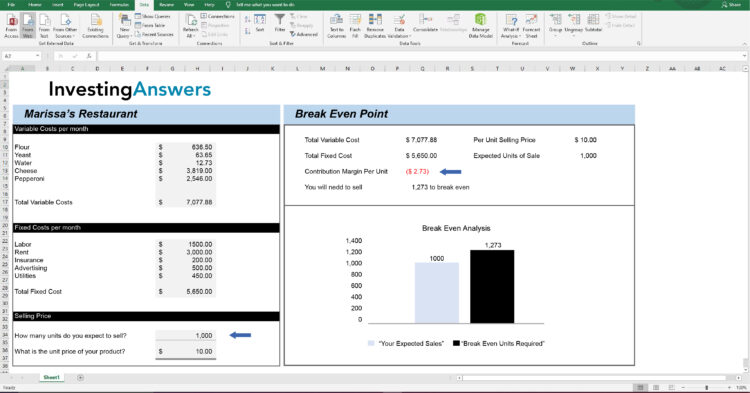

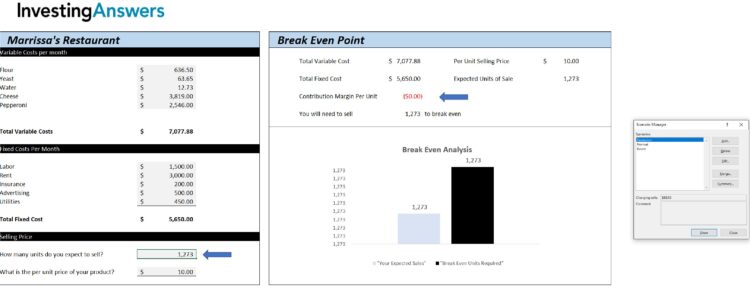

Example of Break Even Analysis

In this break even analysis sample, Restaurant ABC only sells pepperoni pizza. Its variable expenses for each pizza include:

Flour: $0.50

Yeast: $0.05

Water: $0.01

Cheese: $3.00

Pepperoni: $2.00

Adding all of these costs together, we determine that it has $5.56 in variable costs per pizza. Based on the total variable expenses per pizza, Restaurant ABC must price its pizzas at $5.56 or higher to cover those costs.

The fixed expenses per month include:

Labor: $1,500

Rent: $3,000

Insurance: $200

Advertising: $500

Utilities: $450

In total, Restaurant ABC's fixed costs are $5,650.

Let’s say that each pizza is sold for $10.00. Therefore the contribution margin is $4.44 ($10.00 - $5.56).

To determine the number of pizzas (or units) Restaurant ABC needs to sell, take its fixed costs and divide them by the contribution margin:

$5,650 ÷ $4.44 = 1,272.5

This means the restaurant needs to sell at least 1,272.53 pizzas (rounded up to 1,273 whole pizzas), to cover its monthly fixed costs. Or, the restaurant needs to have at least $12,730 in sales (1,272.5 x $10) to reach the break-even point.

Note: If your product must be sold as whole units, you should always round up to find the break-even point.

Remember: Fixed Costs Can Increase

Some fixed costs increase after a certain level of revenue is reached. For example, if Restaurant ABC begins selling 5,000 pizzas per month – rather than 2,000 – it might need to hire a second manager, thus increasing labor costs.

Break-Even Analysis Benefits

Break-even analysis is a great way to determine a business’ profitability. It can show business owners and management how many units need to be sold in order to cover both fixed and variable expenses. It also provides a specific benchmark or goal so businesses not only survive but also remain profitable.

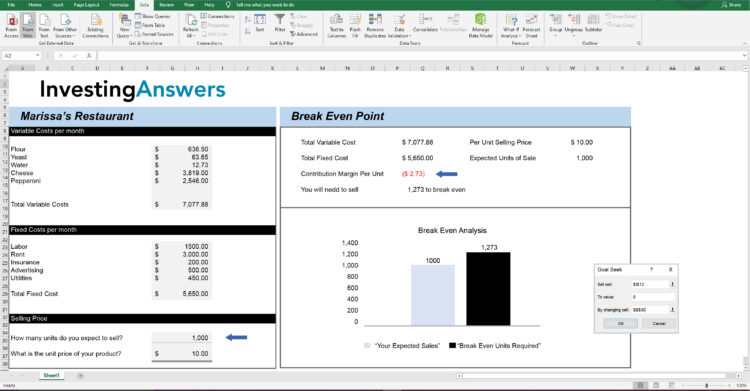

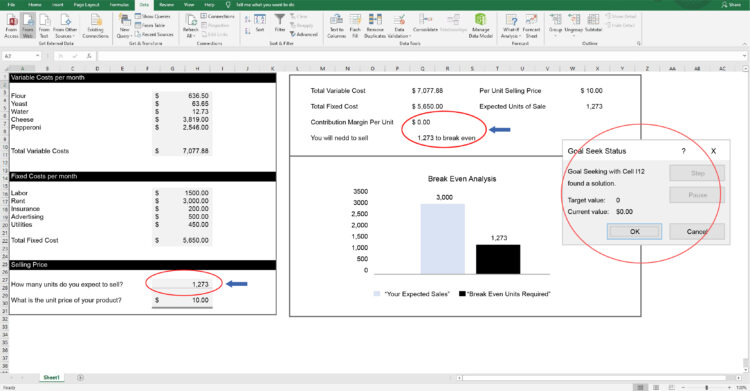

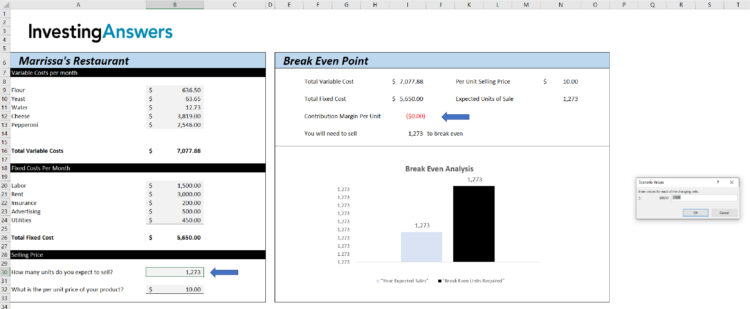

Calculating Break Even Analysis in Excel

Excel users can utilize Goal Seek (a tool that’s built into the program) to calculate a break-even rate. To do this, you’ll need to have an Excel break-even calculator set up:

Step 1: Find Goal Seek

Step 2: Enter Your Numbers Into the Break Even Point

In the inputs, enter:

Set Cell = Contribution Margin Per Unit($I$12);

To Value = 0;

By Changing Sells = $B$30 i.e. How many units do you want to sell (see blue arrows).

Step 3: Review the Number of Units Required to Break Even

Excel will automatically populate the required number of units to ensure that Contribution Margin is $0.

Optional: Create A Scenario Simulator for Multiple Units of Sale

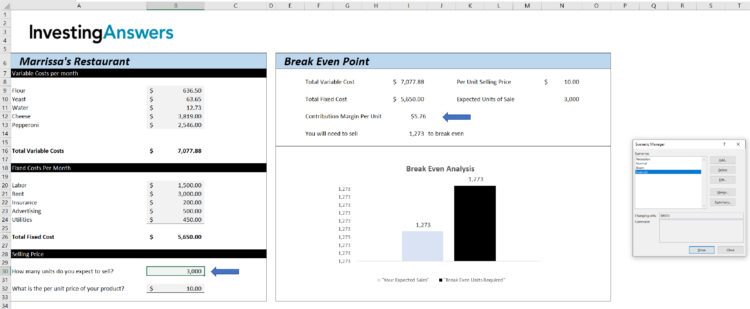

If you want to see profitability based on many sales figures, then a scenario simulator may be helpful.

To do this, In Excel, go to: DATA → What-if Scenario → Scenario Manager. Here, you can input multiple scenarios with different sales units.

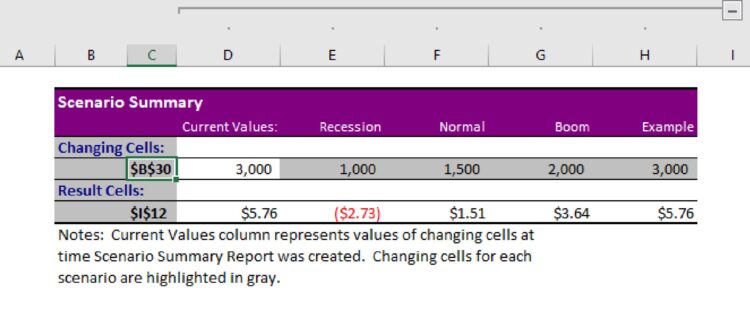

IA has recreated 3 scenarios as a starting point(Recession = 1000 Units; Normal = 1500 Units; Boom= 2000 Units)

Excel will then ask you to enter how many units you want this scenario to contain. In this instance, it is 3000 units. Click “Ok.”

If you click on a scenario and click “SHOW,” Excel will automatically update the expected sales figure and calculate the contribution margin. In the following screenshot, the chosen Example scenario has 3000 units:

To view all your scenarios simultaneously, click on “Summary.” Excel will ask you which resulting cell you want to see. In order to see “Contribution Margin Per Unit,” our example set that to cell $I$12 and Excel inserted a new tab which shows the scenarios ($B$30 is our units of expected sale) plus the associated Contribution Margin Per Unit ($I1$12).

Related Articles

How Did Warren Buffett Get Rich? 4 Key Stocks to Follow

5 Money Moves That Made Warren Buffett Rich Warren Buffett is perhaps the most famous investor in the world, amassing a fortune of over $80 billion during his lifetime. His ...

How Sean Quinn Went from Billionaire to Bankruptcy

Sean Quinn was once the richest man in Ireland. In 2008, Forbes estimated Quinn's riches reached $6 billion. Today, however, he owes Anglo Irish Bank $2.7 billion and in ...

After A Huge Sell-Off, Here's Where The Market's Heading

A nearly 2% pullback for the S&P 500 shouldn’t be of much concern. The fact that index had risen for five straight months prior to the pullback suggests a bit of ...

- How to Profit from Real Estate Without Becoming a Landlord

- Robo Advisors - Here's Why 15+ Million People Have Already Opened Up Accounts

- Personal Capital - Our #1 Choice for Free Financial Planning Tools

- Fundrise - 23% Returns Last Year from Real Estate - Get Started with Just $10

- CrowdStreet - 18.5% Average IRR from Real Estate (Accredited Investors Only)

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

7.2 Breakeven Analysis

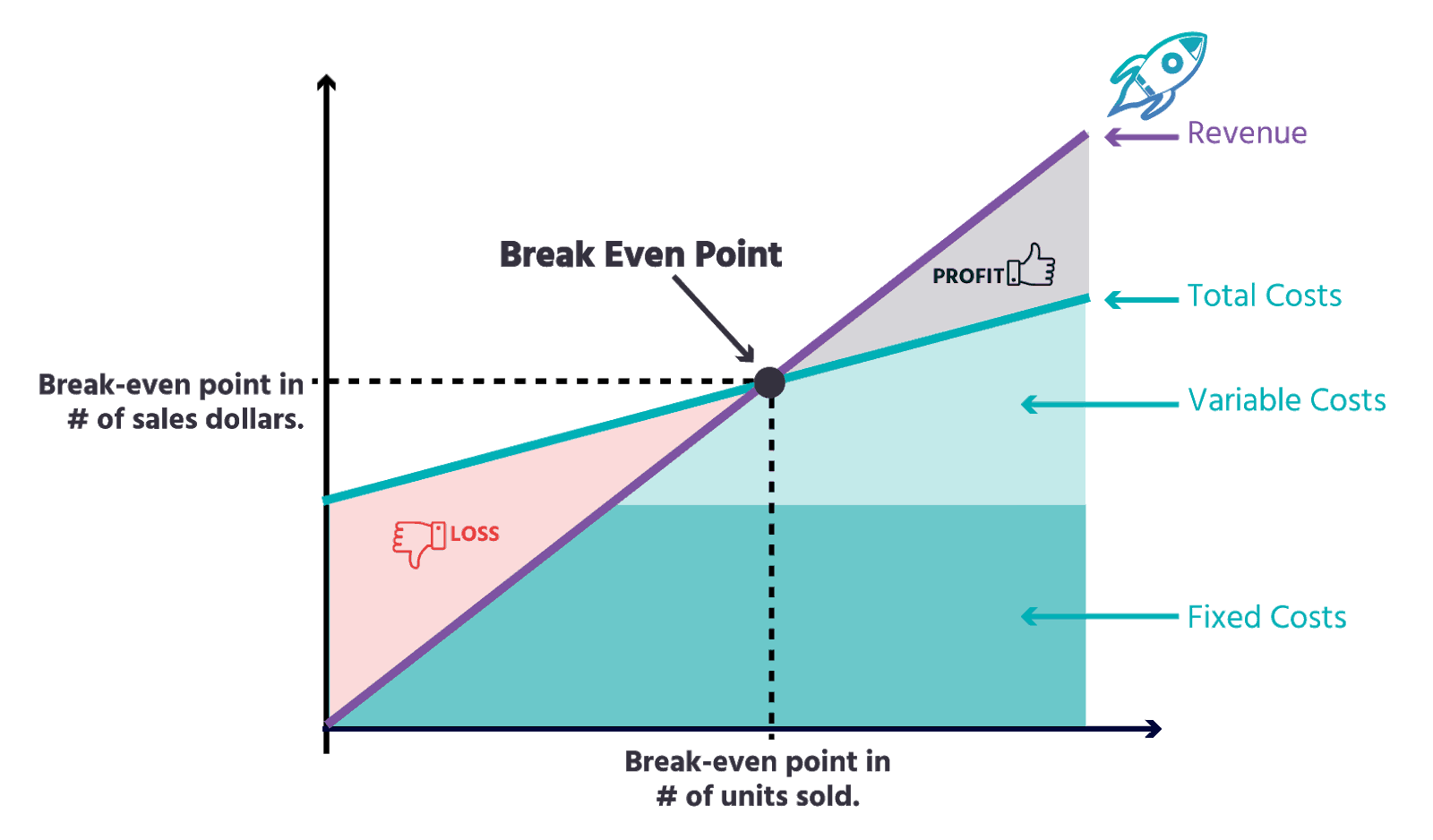

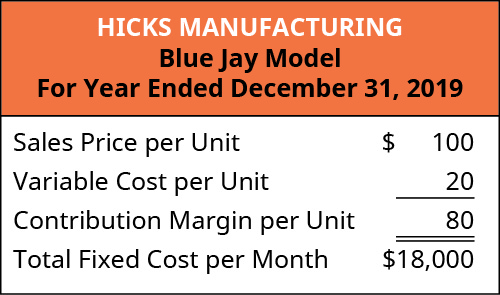

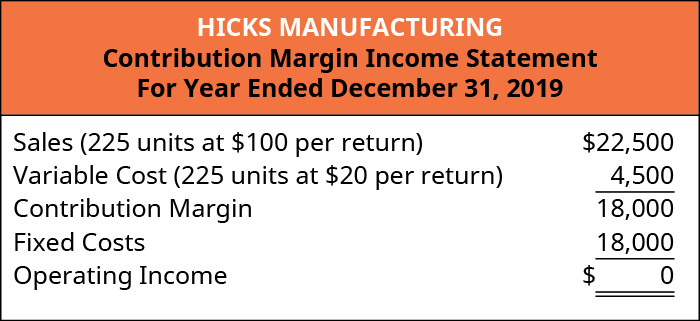

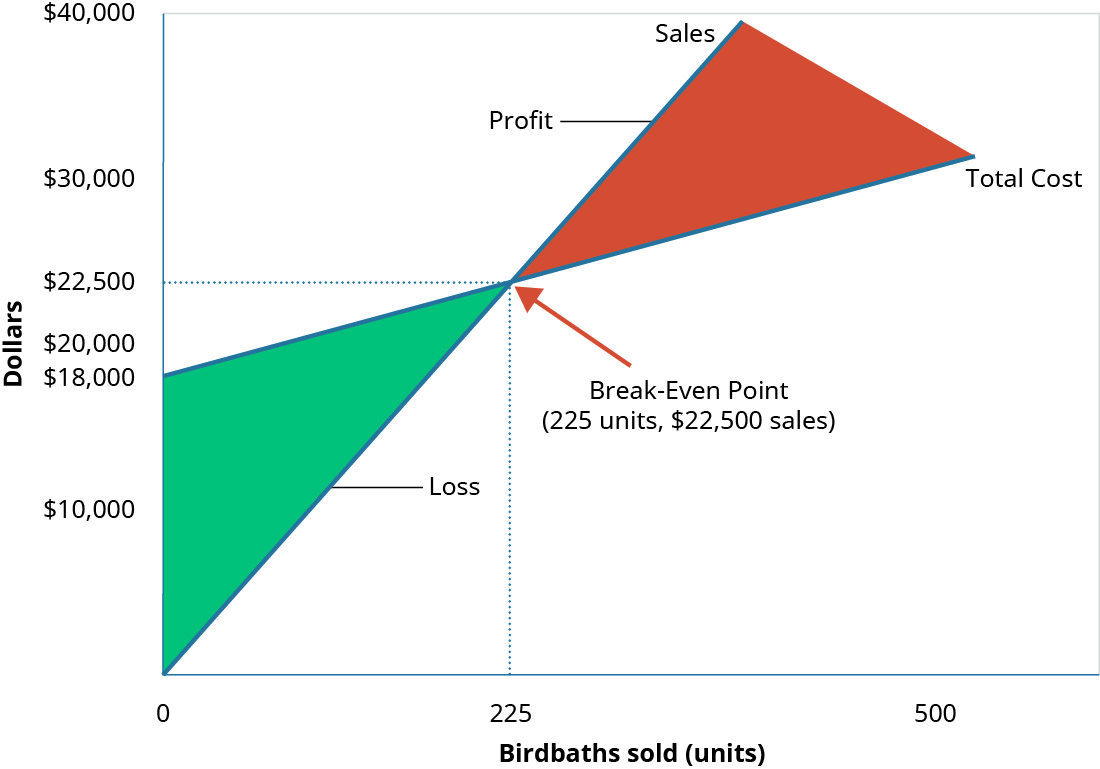

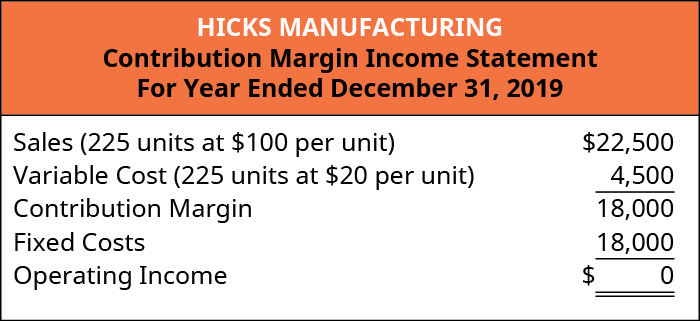

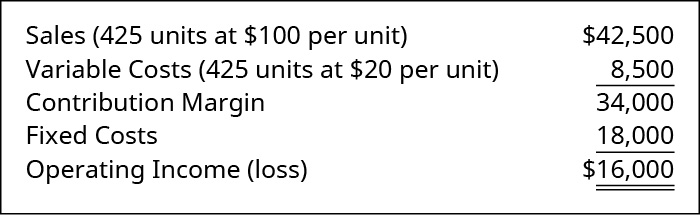

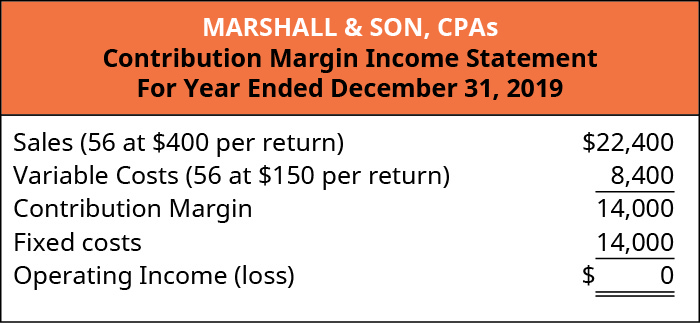

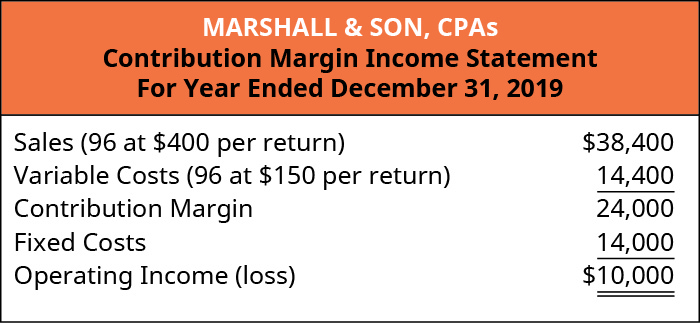

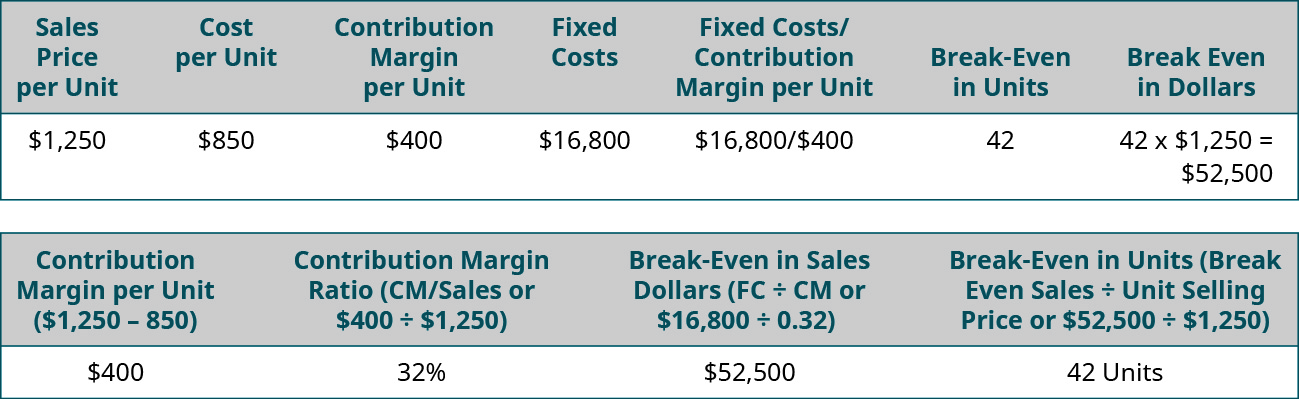

The break-even point is the dollar amount (total sales dollars) or production level (total units produced) at which the company has recovered all variable and fixed costs. In other words, no profit or loss occurs at break-even because Total Cost = Total Revenue. Figure 7.15 illustrates the components of the break-even point:

The basic theory illustrated in Figure 7.15 is that, because of the existence of fixed costs in most production processes, in the first stages of production and subsequent sale of the products, the company will realize a loss. For example, assume that in an extreme case the company has fixed costs of $20,000, a sales price of $400 per unit and variable costs of $250 per unit, and it sells no units. It would realize a loss of $20,000 (the fixed costs) since it recognized no revenue or variable costs. This loss explains why the company’s cost graph recognized costs (in this example, $20,000) even though there were no sales. If it subsequently sells units, the loss would be reduced by $150 (the contribution margin) for each unit sold. This relationship will be continued until we reach the break-even point, where total revenue equals total costs. Once we reach the break-even point for each unit sold the company will realize an increase in profits of $150.