ASC 842: Lessee’s Financial Statement Presentation of Leases

FREE ACCOUNT

FASB Accounting Standards Codification (FASB ASC) 842, Leases, is effective for all entities other than a public business entity, a not-for-profit entity that has issued or is a conduit bond obligor for securities that are traded, listed, or quoted on an exchange or an over-the-counter market, or an employee benefit plan that files or furnishes financial statements with or to the U.S. Securities and Exchange Commission for annual reporting periods beginning after December 15, 2021 (i.e., calendar year 2022 for

Download the CPEA report: FASB ASC 842: Lessee’s Financial Statement Presentation of Leases

File name: cpea-report-fasb-asc-842-lessees-financial-statement-presentation-of-leases.pdf

Already a member?

Log in with your account, not a member, mentioned in this article, related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

Home » Resources » FASB Topic 842: Presentation and Disclosure

FASB Topic 842: Presentation and Disclosure

June 13, 2019

Introduction

In February 2016, the Financial Accounting Standards Board (“FASB” or “the Board”) issued its highly-anticipated leasing standard in ASU 2016-02 (“ASC 842” or “the new standard”) for both lessees and lessors. Under its core principle, a lessee will recognize right-of-use (“ROU”) assets and related lease liabilities on the balance sheet for all arrangements with terms longer than 12 months. The pattern of expense recognition in the income statement will depend on a lease’s classification.

During deliberations for the standard, many users indicated that the existing disclosure requirements did not provide sufficient information to understand an entity’s leasing activities. As a result, the new standard also introduces an overall disclosure objective together with significantly enhanced presentation and disclosure requirements for leases.

Disclosure Objective

FASB Accounting Standards Codification (ASC) 842-20-50-1 and 842-30-50-1 provide that “the objective of the disclosure requirements is to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.” The standard further indicates that “a lessee [lessor] shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the various requirements. A lessee [lessor] shall aggregate or disaggregate disclosures so that useful information is not obscured by either the inclusion of a large amount of insignificant detail or by aggregating items that have different characteristics.”[1]

With that objective in mind, significant judgment will be required to determine the level of disclosures necessary for an entity. However, as a guiding principle, the basis for conclusions indicates “if leasing is a significant part of an entity’s business activities, the disclosures would be more comprehensive than for an entity whose leasing activities are less significant….”[2] For example, although the new standard does not provide specific quantitative or qualitative disaggregation requirements such as those required under ASC 606, for entities for which leasing is a significant portion of their business, such disaggregation might be appropriate.

Entities must make appropriate disclosures for each annual reporting period for which a statement of comprehensive income (statement of activities) is presented and in each year-end statement of financial position. Entities are not required to repeat disclosures if the information is already presented in the financial statements as required by other accounting standards.

Although the majority of the disclosures required by ASC 842 only affect an entity’s annual financial statements, the new standard requires that lessors provide a table disclosing lease income for each interim and annual reporting period[3]. Additionally, in the year of adoption, the Securities and Exchange Commission (SEC) requires public companies to include all required annual disclosures in any interim financial statements that are prepared until the next annual financial statements are filed – even if the disclosure requirements are only applicable for annual periods.

Presentation

Lessee A lessee is required to present ROU assets resulting from finance leases separately from ROU assets resulting from operating leases and separately from other assets, either on the face of the balance sheet or in the footnotes. Similarly, lease liabilities for finance leases are required to be presented separately from lease liabilities from operating leases and from other liabilities. In addition, ROU assets are presented as noncurrent in the lessee’s balance sheet, consistent with how other amortizing assets such as PP&E are presented. However, the related lease liabilities are subject to current and long-term presentation requirements in a classified balance sheet, consistent with the way other financial liabilities are presented.

If the lessee chooses to report ROU assets and liabilities within other line items on the balance sheet rather than in separate captions, the lessee is prohibited from reporting finance lease ROU assets or finance lease liabilities in the same caption as operating lease ROU assets and operating lease liabilities. Additionally, disclosure of which line items in the statement of financial position include the ROU assets and lease liabilities would be required.

For finance leases, a lessee should present the interest expense on the lease liability and amortization of the ROU asset in a manner consistent with how the lessee reports other interest expense and depreciation or amortization expense in the income statement. For operating leases, the lessee must present both components together as lease expense within income from continuing operations, consistent with the presentation of other operating expenses. Lease expense should be classified within cost of sales; selling, general, and administrative expense; or another expense line item depending on the nature of the lease.

The new standard does not provide specific guidance on the presentation of variable lease payments (for either finance or operating leases). Paragraph BC271 in the basis of conclusions for ASU 2016-02 indicates that amount recognized in the income statement should be presented within income from continuing operations. We believe that presentation as either lease expense or interest expense may be appropriate, depending on the nature of the lease. In making this determination, lessees should assess whether the payments are more akin to lease payments or interest.

The cash flow classification of payments related to finance leases should be consistent with the classification of payments associated with other financial liabilities. Payments of principal should be presented as financing activities, while payments of interest would typically result in operating cash flow presentation. Payments related to operating leases, leases to which the lessee has applied the practical expedient for short term leases, and any variable lease payments for either operating or finance leases should all be classified as operating cash outflows (unless the payment represents a cost of bringing another asset to the condition and location necessary for its intended use, in which case it should be classified within investing activities). Additionally, the establishment of ROU assets and lease liabilities at inception of a lease (or that change as a result of lease modifications or reassessment events) should be disclosed as noncash investing and financing activities.

Lessor A lessor is required to present lease assets (i.e., net investment in leases) resulting from sales-type and direct financing leases separately from other assets in the balance sheet. Lease assets are financial assets that are subject to current and long-term presentation requirements in a classified balance sheet.

For operating leases, the assets underlying the leases and related depreciation are presented in accordance with other accounting guidance (e.g., ASC 360). Assets subject to lease under operating leases should be presented separately from owned assets that are held and used by the lessor as they are subject to different risks. Any rent receivable, deferred rent revenue (i.e., that results from requirement to recognize rents on a straight-line basis), or prepaid initial direct costs would be subject to current and long-term presentation requirements.

Income arising from leases should be presented separately in the income statement or in the footnotes. If presented in the footnotes, a lessor must also disclose which line items include lease income. Revenue and cost of goods sold related to profit or loss on leases recognized at the commencement date should be presented on a gross basis if the lessor uses leases as an alternative means of realizing value from goods that it would otherwise sell. If the lessor uses leasing as a means of providing finance, profit or loss should be presented on a net basis (i.e., as a single line item).

The new standard does not provide specific guidance on the presentation of variable lease payments received for direct financing or sales type leases. We believe that presentation as either lease income or interest income may be appropriate, depending on the nature of the lease. In making this determination, Lessors should assess whether the payments are more akin to lease payments or interest.

Lessors must classify all cash receipts from leases as operating activities in the statement of cash flows.

As noted previously, the objective of the disclosure requirements in the new leasing standard is to enable users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. To help entities achieve this objective, the leasing standard prescribes quantitative and qualitative disclosures that are required for all entities.[4]

The following table summarizes the disclosure requirements of the leasing standard:

| Lessees – Annual Disclosures | Lessors – Annual Disclosures | ||

|---|---|---|---|

| Statement of Financial Position ASC 842-20-45-1 through 45-3 | Present, or disclose in the notes, separately from each other and from other assets and liabilities: | Sales-Type and Direct Financing Leases | Statement of Financial Position ASC 842-30-45-1 through 45-2 and 842-30-45-6 |

| Statement of Comprehensive Income ASC 842-20-45-4 | For finance leases, present interest expense on the lease liability and amortization of the right-of-use asset in a manner consistent with how the entity presents other interest expense and depreciation and amortization of similar assets, respectively. For operating leases, lease expense should be included in income from continuing operations | Sales-Type and Direct Financing Leases Present, or disclose in the notes, income arising from leases. Disclose which line items in the statement of comprehensive income include lease income Present profit or loss on the lease recognized at the commencement date in a manner that best reflects the lessor’s business model, for example: | Statement of Comprehensive Income ASC 842-30-45-3 through 45-4 |

| Statement of Cash Flows ASC 842-20-45-5 | Classify repayments of the principal portion of the lease liability arising from finance leases within financing activities Classify interest on the lease liability arising from finance leases in accordance with requirements relating to interest paid in ASC 230 on cash flows Classify payments arising from operating leases within operating activities, except to the extent that those payments represent costs to bring another asset to the condition and location necessary for its intended use, which should be classified within investing activities Classify variable lease payments and short-term lease payments not included in the lease liability within operating activities | Classify cash receipts from leases within operating activities[6] | Statement of Cash Flows ASC 842-30-45-5 and 842-30-45-7 |

| Qualitative Information ASC 842-20-50-3(a) through 50-3(b) and 842-20-50-4 | Information about the nature of its leases, including | Information about the nature of its leases, including | Qualitative Information ASC 842-30-50-3(a), 842-30-50-4, and 842-30-50-7 |

| Significant Judgments ASC 842-20-50-3(c) | Information about significant assumptions and judgments made, including: | Information about significant assumptions and judgments made, including: | Significant Judgments ASC 842-30-50-3(b) |

| Quantitative Disclosures ASC 842-20-50-4 and 50-6 | For each period presented, disclose amounts related to a lessee’s total lease cost (including both amounts recognized in income and capitalized) and the cash flows arising from lease transactions Finance lease cost, segregated between: | For each period[7] presented, disclose in tabular format: Sales-type leases and direct financing leases | Quantitative Disclosures ASC 842-30-50-5 through 50-6 and 842-30-50-8 through 50-13 |

| Policy Elections and Practical Expedients ASC 842-20-50-8 through 50-9 | Disclose policy election for short-term leases, if elected | An entity that elects the practical expedient to not separate nonlease components from associated lease components (including an entity that accounts for the combined component entirely in ASC 606 on revenue from contracts with customers) shall disclose the following by class of underlying asset: Accounting policy election and the class or classes of underlying assets for which it has elected to apply the practical expedient The nature of | Policy Elections and Practical Expedients ASC 842-30-50-3A |

Sale and Leaseback

If a seller-lessee enters into a sale and leaseback transaction, it must provide the disclosures required for lessees. Similarly, a buyer-lessor must provide the disclosures for lessors. Additionally, a seller-lessee must disclose the main terms and conditions of the sale and leaseback transaction and must disclose any gains or losses arising from the transaction separately from gains or losses on disposal of other assets.

Leveraged Leases

Although ASC 842 removed leveraged lease accounting, leases that met the definition of a leveraged lease under ASC 840 that commenced before the effective date of ASC 842 are grandfathered in. As such, entities that continue to have leveraged leases must continue to provide disclosures as required by ASC 842-50, which carries forward existing guidance from ASC 840.

Other Disclosure Considerations

Transition The leasing standard requires an entity to provide the general disclosures required by ASC 250 Accounting Changes and Error Corrections. Entities are also required to provide an explanation to users of financial statements about which practical expedients were used in transition.

SAB 74 Disclosures In periods prior to adoption of the leasing standard, entities are required to make disclosures under the SEC’s Staff Accounting Bulletin No. 74 (codified in SAB Topic 11.M), Disclosure Of The Impact That Recently Issued Accounting Standards Will Have On The Financial Statements Of The Registrant When Adopted In A Future Period (“SAB 74”). SAB 74 requires that when a recently issued accounting standard has not yet been adopted, a registrant disclose the potential effects of the future adoption in its interim and annual SEC filings. SAB 74 disclosures should be both qualitative and quantitative. According to Center for Audit Quality Alert 2017-03, SAB Topic 11.M – A Focus on Disclosures for New Accounting Standards, the SEC staff expects that SAB 74 disclosures will become more robust and quantitative as the new accounting standard’s effective date approaches. As such, the following types of SAB 74 disclosures are expected in a registrant’s financial statements in the periods before new accounting standards are effective:

- A comparison of accounting policie s . Registrants should compare their current accounting policies to the expected accounting policies under the new accounting standard(s).

- Status of implementation. The status of the process should be disclosed, including significant implementation matters not yet addressed or if the process is lagging.

- Consideration of the effect of new footnote disclosure requirements in addition to the effect on the balance sheet and income statement. A new accounting standard may not be expected to materially affect the primary financial statements; however, it may require new significant disclosures that require significant judgments.

- Disclosure of the quantitative impact of the new accounting standard if it can be reasonably estimated.

- Disclosure that the expected financial statement impact of the new accounting standard cannot be reasonably estimated.

- Qualitative disclosures. When the expected financial statement impact is not yet known by a registrant, a qualitative description of the effect of the new accounting standard on the registrant’s accounting policies should be disclosed.

Selected Financial Data – 5 Year Table

Some SEC registrants have questioned whether they must recast all periods reflected in the 5 year Summary of Selected Financial Data in accordance with the new leasing standard? In short, the answer is “no”. Registrants are only required to adjust the periods in the financial data table that correspond to the periods adjusted in the registrant’s financial statements. For example, an entity that elects to adopt the new standard as of the effective date (i.e., without restating prior comparative periods), the four prior years in the selected financial data table would not be adjusted. Companies will be required to provide the disclosures required by Instruction 2 to S-K Item 301 regarding comparability of the data presented.

Appendix A – Disclosure Example – LESSEE

Background For purposes of this example, we have assumed that Susie’s Stitch-n-Sew (“Susie’s”) is a national retailer of fabrics and other craft materials which primarily leases its retail locations. We have not presented a statement of financial position, but have assumed that Susie’s has presented the following captions:

- Operating lease ROU assets

- Fixed assets, net

- Current portion of operating lease liabilities

- Long-term operating lease liabilities

- Current portion of long-term debt

- Long-term debt

We have also not presented a statement of comprehensive income, but have assumed that Susie’s has presented Cost of sales, SG&A expense, Depreciation and amortization expense, and Interest expense. This example assumes that the guidance in ASC 842 has been in effect for all periods presented, and that all amounts are in millions.

Note X. Leases Susie’s has historically entered into a number of lease arrangements under which we are the lessee. Specifically, of our 250 retail locations, 240 are subject to operating leases and 5 are subject to finance leases. In addition, we lease our corporate headquarters facility, as well as various warehouses and regional offices. We are also a party to an additional 12 leases in which we previously operated a retail location, but which are now subleased to third parties. In addition, we have elected the short-term lease practical expedient related to leases of various equipment used in our retail locations.

As of December 31, 20X9, we have entered into eight leases for additional retail locations and one lease for an additional warehouse which have not yet commenced. Although certain of the retail locations are currently under construction, we do not control the building during construction, and are thus not deemed to be the owner during construction.

All of our retail leases include multiple optional renewal periods. Upon opening a new retail location, we typically installs brand-specific leasehold improvements with a useful life of eight years. To the extent that the initial lease term of the related lease is less than the useful life of the leasehold improvements, we conclude that it is reasonably certain that a renewal option will be exercised, and thus that renewal period is included in the lease term, and the related payments are reflected in the ROU asset and lease liability. Generally, we do not consider any additional renewal periods to be reasonably certain of being exercised, as comparable locations could generally be identified within the same trade areas for comparable lease rates.

All of our leases include fixed rental payments, but many of our leases also include variable rental payments. Specifically, a number of our leases in certain markets require rent payments that are calculated as a percentage of sales in that location. In addition, we also commonly enter into leases under which the lease payments increase at pre-determined dates based on the change in the consumer price index. While the majority of our leases are gross leases, we also have a number of leases in which we make separate payments to the lessor based on the lessor’s property and casualty insurance costs and the property taxes assessed on the property, as well as a portion of the common area maintenance associated with the property. We have elected the practical expedient not to separate lease and nonlease components for all of our building leases.

During 20X9, 20×8 and 20×7, we recognized rent expense associated with our leases as follows:

| 20x9 | 20x8 | 20x7 | |

|---|---|---|---|

| Operating lease cost: | |||

| Fixed rent expense | $23.7 | $22.6 | $20.5 |

| Variable rent expense | 3.8 | 3.6 | 3.4 |

| Finance lease cost: | |||

| Amortization of ROU assets | 2.5 | 2.4 | 2.2 |

| Interest expense | 2.0 | 2.1 | 2.0 |

| Short-term lease cost | 0.2 | 0.2 | 0.3 |

| Sublease income | |||

| Net lease cost | |||

| Lease cost – Cost of sales | |||

| Lease cost – SG&A | |||

| Lease cost – Depreciation and amortization | |||

| Lease cost – Interest expense | |||

| Net lease cost |

Amounts recognized as right-of-use assets related to finance leases are included in Fixed assets, net in the accompanying statement of financial position, while related lease liabilities are included in Current portion of long-term debt and Long-term debt. As of December 31, 20×9 and 20×8, right-of-use assets and lease liabilities related to finance leases were as follows:

| 20x9 | 20x8 | |

|---|---|---|

| Finance lease ROU assets | $17.6 | $17.0 |

| Finance lease liabilities: | ||

| Current portion of long-term debt | 2.2 | 2.2 |

| Long-term debt | 15.3 | 15.1 |

During the years ended December 31, 20×9, 20×8 and 20×7, we had the following cash and non-cash activities associated with our leases:

| 20x9 | 20x8 | 20x7 | |

|---|---|---|---|

| Cash paid for amounts included in the measurement of lease liabilities: | |||

| Operating cash flows from operating leases | $26.0 | $25.7 | $24.8 |

| Operating cash flows from finance leases | 2.0 | 2.1 | 2.0 |

| Financing cash flows from finance leases | 2.0 | 1.9 | 1.9 |

| Non-cash investing and financing activities: | |||

| Additions to ROU assets obtained from: | |||

| New operating lease liabilities | $18.7 | $20.3 | $16.2 |

| New finance lease liabilities | - | 3.4 | - |

The future payments due under operating and finance leases as of December 31, 20×9 is as follows:

| Operating | Finance | |

|---|---|---|

| Due in 20x0 | $ 22.6 | $ 2.2 |

| 20x1 | 23.9 | 3.8 |

| 20x2 | 24.7 | 3.6 |

| 20x3 | 22.4 | 3.2 |

| 20x4 and thereafter | ||

| 128.8 | 18.9 | |

| Less effects of discounting | ||

| Lease liabilities recognized |

As of December 31, 20×9 and 20×8, the weighted-average remaining lease term for all operating leases is 3.4 years and 3.5 years, respectively, while the weighted-average remaining lease term for all finance leases is 4.9 years and 5.6 years, respectively.

Because we generally do not have access to the rate implicit in the lease, we utilize our incremental borrowing rate as the discount rate. The weighted average discount rate associated with operating leases as of December 31, 20×9 and 20×8 is 4.2% and 4.0%, respectively, while the weighted-average discount rate associated with finance leases is 3.9% and 3.8%, respectively.

For questions regarding FASB Topic 842 please contact Sean Spitzer or another member of Smith and Howard’s Assurance Services Group by completing the contact form below at calling 404-874-6244.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

Want to get insights right to your inbox?

Subscribe to our newsletters to get inside access to timely news, trends and insights from Smith + Howard.

Planning next year's budget? Check out our free Budget Hero Kit full of helpful resources

Operating Lease Accounting under ASC 842 Explained with a Full Example

by Kiley Arnold, CPA | Mar 12, 2023

1. Operating lease treatment under ASC 842 vs. ASC 840: What changed?

2. Operating lease vs. finance lease identification under ASC 842

- Transference of title/ownership to the lessee

- Purchase option

- Lease term for major part of the remaining economic life of the asset

- Present value represents “substantially all” of the fair value of the asset

- Asset specialization

3. Is lease capitalization required for all operating leases under 842?

4. Operating lease accounting example and journal entries

- Details on the example lease agreement

Step 1: Determine the lease term under ASC 840

Step 2: determine the total lease payments under gaap, step 3: prepare the straight-line amortization schedule under asc 840, step 4: on the asc 842 effective date, determine the total payments remaining, step 5: calculate the operating lease liability, step 6: calculate the right-of-use asset (with journal entry), operating lease treatment under asc 842 vs. asc 840: what changed.

Under ASC 840 , operating leases were considered off-balance sheet transactions . The rent expense associated with the arrangements was recognized in the income statement, but nothing was recorded on the balance sheet. This made it difficult to understand the total amount of commitments a company had. It could also make comparisons between companies difficult, depending on their different approaches to leased vs. capital assets.

To increase transparency, the FASB issued ASC 842, Leases . One of the main provisions of this new standard is that all leases must be recognized on a company’s balance sheet. For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement .

With the changes introduced under ASC 842, all leases are now presented on both the balance sheet and income statement whether they are operating or finance (capital) leases . The updated financial statement presentation requires issuers to show the operating ROU asset and operating lease liability separately from the finance (capital) ROU asset and lease liability both on the face of the financials and in the notes disclosures.

However, the effect of operating leases on the income statement is not changing. Companies will continue to recognize a straight-line expense for the lease payments made over the lease term as an operating expense on the statement of profit and loss.

Operating lease vs. finance lease identification under ASC 842

Operating vs. finance lease classification under ASC 842 is relatively similar to the operating lease vs. capital lease criteria under ASC 840, but certain “bright lines” for classification have been removed, consistent with the more “principles-based” approach of ASC 842. For a lease to be classified as a finance lease , it must meet one of the five criteria listed below. If the lease does not fall under any of these criteria, it is classified as an operating lease:

1. Transference of title/ownership to the lessee

Ownership of the underlying asset is transferred to the lessee by the end of the lease term.

2. Purchase option

The lease arrangement grants the lessee an option to purchase the asset , which is reasonably certain to be exercised. It is important to note, the purchase option must be reasonably certain to be exercised for this criteria to met.

3. Lease term for major part of the remaining economic life of the asset

The lease term spans a major part of the remaining economic life of the underlying asset.

Note: The FASB provided additional clarification that “major part” can be consistent with the 75% threshold used under ASC 840. Companies are allowed to determine how they will define the “major part” threshold . In practice, though, a large portion of organizations tend to lean towards using the 75% threshold previously seen in ASC 840.

4. Present value represents “substantially all” of the fair value of the asset

The present value of the sum of the remaining lease payments equals or exceeds substantially all of the underlying asset’s fair value. If applicable, any residual value guarantee by the lessee not already included in lease payments is also included in the present value calculation.

5. Asset specialization

The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Is lease capitalization required for all operating leases under 842?

An entity can establish an accounting policy to exclude operating leases with a lease term of 12 months or less at lease commencement (provided they also do not have a purchase option that is reasonably certain of exercise) from capitalization on the balance sheet . Further, while ASC 842 does not have an exclusion for low-value assets, some companies have established a capitalization threshold. Similar to a capitalization threshold for fixed assets , the company has determined that leases below this value are not material to the company and therefore, are not recognized on the balance sheet.

Operating lease accounting example and journal entries

The following is a full example of how to transition an operating lease initially recorded under ASC 840 to ASC 842 accounting treatment.

Details on the example lease agreement:

First, assume a tenant signs a lease document with the following terms:

The lease begins on April 1, 2016 (commencement date) and continues for 120 full calendar months. The tenant is granted access to the premises 60 days prior to the commencement date to install equipment and furnishings (the “early access period”). Such access is subject to all the terms and conditions of this lease, except that the commencement date and the payment of rent shall not be triggered thereby.

Tenant improvement allowance

The tenant received a tenant improvement allowance , or TIA , of $1.2 million from the landlord as an incentive to sign the lease . The landlord paid the contractor directly for the construction of the improvements, which were constructed prior to the early access period.

Moving expenses

The tenant also received a reimbursement of $30,000 for moving expenses from the landlord.

Per the lease document, the first rent payment is due three full calendar months after the tenant begins operating at the leased location. Base rent is $205,000/month paid in arrears; with annual 3% increases on the anniversary of rent commencement.

Assumptions

Assume the lease is classified as an operating lease and the fair value of the building is $300 million. Assume the tenant opened for business at the location on June 1, 2016. Assume the tenant is a private company with a calendar year-end and transitioned to ASC 842 on January 1, 2022. Assume the discount rate implicit in the lease is unknown and the tenant’s incremental borrowing rate is 6% on September 1, 2016, and 9% on January 1, 2022.

The lease term stated in the contract is 120 months. The document also grants the tenant an early access period, subject to all the terms and conditions in the lease. Assuming the early access period started on February 1, 2016 – 60 days before the April 1 commencement date – then under ASC 840 the lease is accounted for beginning on that date, and the lease term is 122 months: from February 1, 2016, through March 31, 2026.

Note: To understand the difference between the commencement date, execution date, possession dates, etc, read this article on when a lease starts .

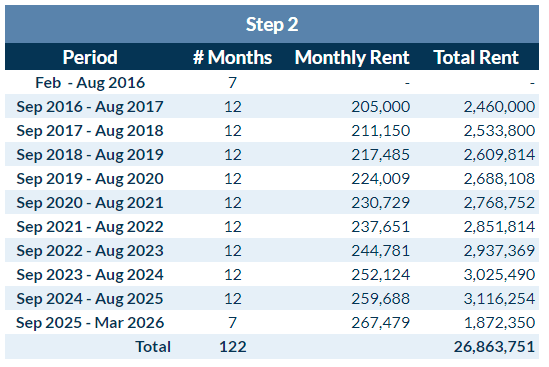

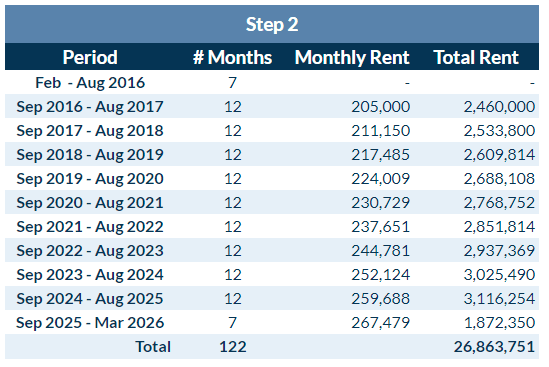

The tenant will begin paying rent on September 1, 2016 (3 months from the date the tenant opened for business). The total lease payments are $26,863,751, as illustrated in the payment schedule below.

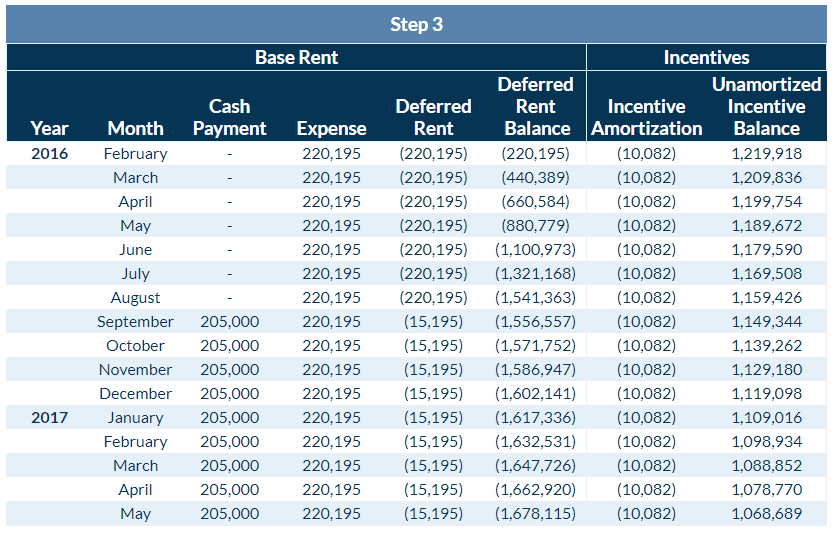

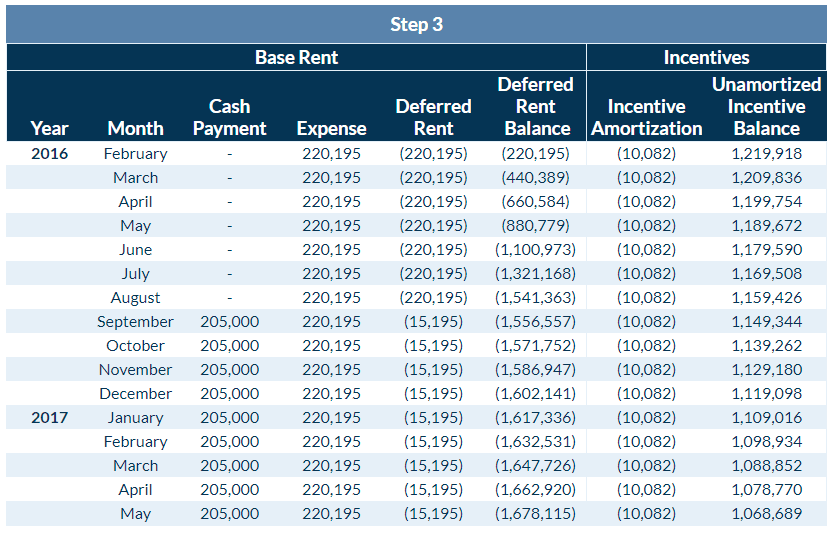

Under ASC 840, the lease term is 122 months (from step 1) and total rent is $26,863,751 (from step 2). Straight-line monthly rent expense calculated from base rent is therefore $220,195 ($26,863,751 divided by 122 months).

The tenant must also account for the total incentive of $1,230,000 ($1.2 million of tenant improvement allowances + $30,000 of moving expenses). Under ASC 840, the incentives are amortized over the lease term on a straight-line basis as well, resulting in a monthly credit to rent expense of $10,082 ($1,230,000 / 122 months). As a result of the incentive adjustment, periodic rent expense on the income statement is $210,113 ($220,195 – $10,082).

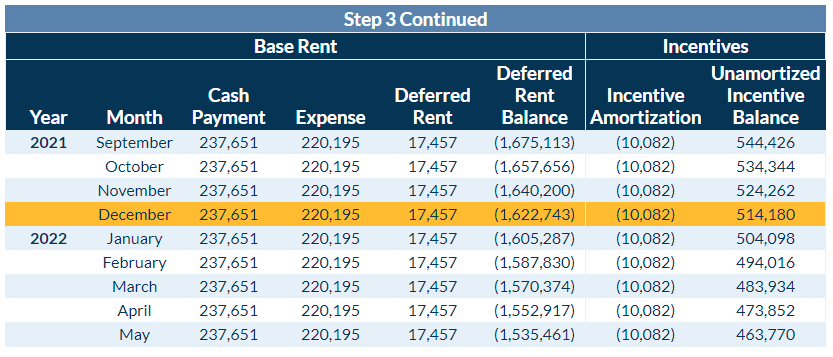

Below is the first 16 months’ straight-line amortization schedule under ASC 840, showing amortization of both rent and the incentives.

How is the rent-free period shown on the amortization schedule

The rent-free period is shown on the amortization table as seven months of no payment with the periodic straight-line expense accruing as deferred rent . Below is a summary of the columns in the amortization table impacted by the free rent:

- Cash Payment: This is the exact amount paid out each month.

- Expense: This is the periodic rent expense calculated from the total payment amount divided evenly over the number of months in the lease term, also known as straight-line rent expense.

- Deferred Rent: This is the difference between the expense incurred and the cash paid. In the first seven months, the company has free rent so the deferred rent amount is the total of the expense for the month.

- Deferred Rent Balance: This is the cumulative difference between the expense incurred and the cash paid. When the expense is greater than the payment the balance increases and when the expense is less than the payment the balance decreases until it is $0 at the end of the lease term.

For calendar-year private companies, the effective date of ASC 842 was January 1, 2022. The transition entry is recorded from either the start of the earliest comparative period presented or if companies utilize the practical expedient and do not present comparative financial statements, the transition date.

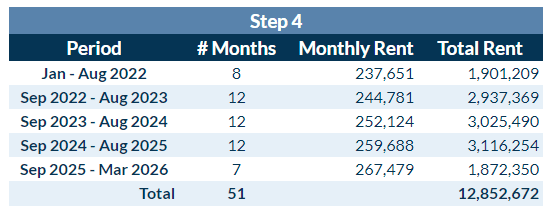

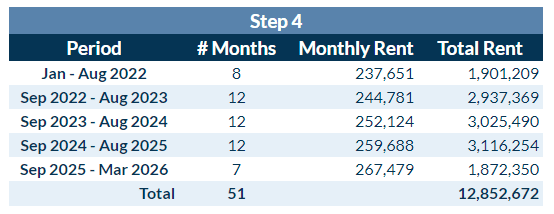

Most private companies will elect to use the practical expedient to not present comparative financial statements, so our example will as well. Therefore, the transition date for this company is January 1, 2022. The total remaining payments from January 1, 2022, through March 31, 2026, are $12,852,672, shown in the updated payment schedule below.

Since the company elected to not present comparative financials, they must calculate the present value of the remaining lease payments as of their transition date. ASC 842 requires private entities to use the rate inherent in the lease, unless that rate is not readily determinable. If the implicit rate is not determinable, the tenant has the option to use their incremental borrowing rate or a risk-free rate .

In this example, the tenant uses their January 2022 incremental borrowing rate of 9%, and payments are made at the end of the month. Using these facts and LeaseQuery’s present value calculator tool , the present value of the remaining lease payments is $10,604,260 . This is the lease liability as of January 1, 2022.

Note: The present value amount above ($10,604,260) is a simplified calculation based on Excel. The number you get should be lower than this, if you were using more accurate interest calculations, like those available in some lease accounting software solutions. Keep this in mind as you’re viewing demonstrations of lease accounting software from your choice of vendors.

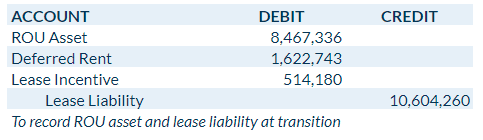

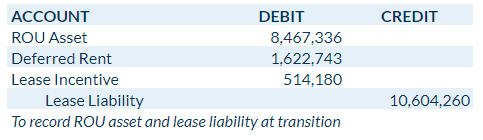

Per ASC 842, the ROU asset is the liability calculated in step 5 above, adjusted by deferred or prepaid rent and lease incentives . In this example, it is the liability of $10,604,260 plus the deferred rent balance as of December 2021, plus the unamortized incentive balance as of December 2021.

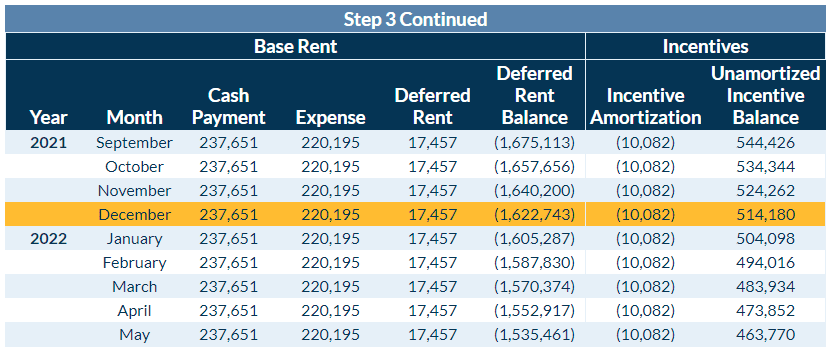

Below is a portion of the table from step 3 for the September 2021 through March 2022 periods to show how we arrive at the deferred rent balance and unamortized incentive balance as of December 31, 2021:

The formula for the ROU asset is the lease liability of $10,604,260 less $1,622,743 (accumulated deferred rent balance as of December 2021) less $514,180 (unamortized incentives as of December 2021). This gives us a total ROU asset of $8,467,336 . The journal entry to record the lease liability and ROU asset at transition clears the outstanding deferred rent and lease incentive amounts to the ROU asset and would look like this:

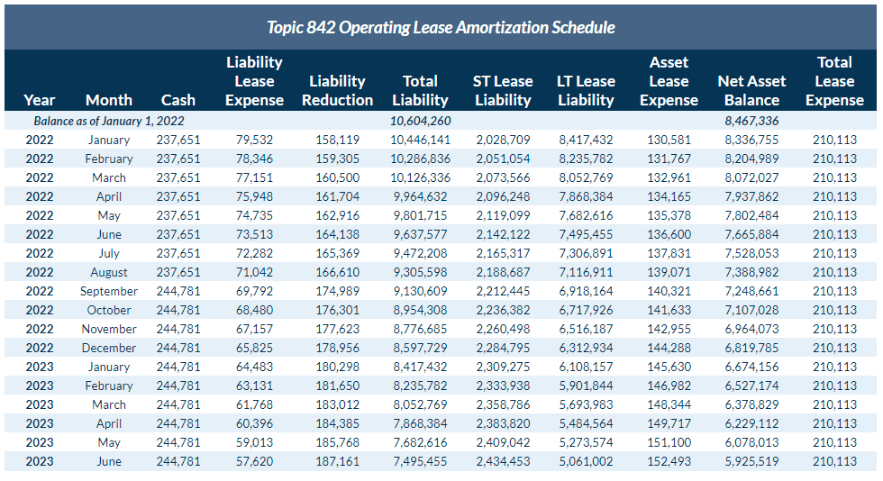

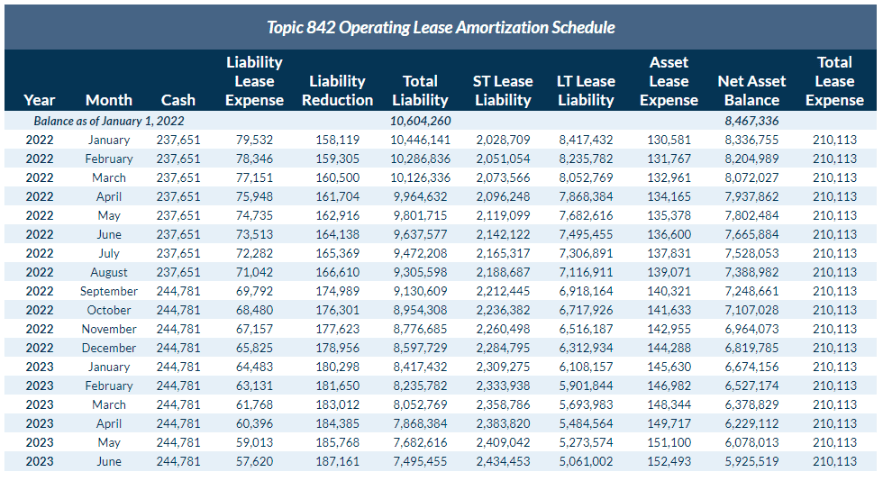

After recording the ROU asset and lease liability as of transition, the tenant would prepare an amortization table under ASC 842 to assist with the calculation of the periodic entries moving forward. Below is the amortization schedule for the lease in the example as of the transition date for a private company.

This concludes the example of how to transition an operating lease from ASC 840 to ASC 842.

Ultimate Lease Accounting Guide

For more examples of operating leases, finance leases, and more under ASC 842, download LeaseQuery’s Ultimate Lease Accounting Guide today.

ASC 842: The New Lease Accounting Standards Explained with Examples, Effective Dates, & More

Capital/Finance Lease vs. Operating Lease Explained: Differences, Accounting, & More

Lease Commencement Date and Start Date for US GAAP Accounting Explained

Right-of-Use Asset (ROU Asset) and Lease Liability for ASC 842, IFRS 16, and GASB 87 Explained with an Example

accounting made sense

Asc 842 lease footnote disclosure – 3 real-world examples.

- Updated: January 18, 2024

Table of Contents

The introduction of ASC 842 has significantly altered the landscape of lease accounting, which now requires more detailed disclosure of leases in financial statements, especially within the footnote section.

The authoritative guideline has listed very detailed requirements on what to disclose on the financial statement. Instead of going through every part of the guidance , let’s take a look at how large public companies have disclosed their leases in the footnote section of the annual report. By looking at real examples from these big companies, we’ll have a better understanding of how they follow the footnote disclosure requirement of ASC 842.

Recap on ASC 842 Leases – Financial Statements Impact

Before we dive into the examples, let’s quickly review the key terms of ASC 842 and the overall impact on the financial statements .

Lease Classification :

- Operating Leases : Typically follow a consistent expense recognition pattern throughout the lease term, generally utilizing a straight-line approach.

- Finance Leases (formerly ‘capital’ leases): Result in a front-loaded expense pattern, where higher expenses are recognized earlier in the lease term due to interest charges.

Balance Sheet Recognition : Unlike ASC 840, where only capital leases were recognized on the balance sheet, ASC 842 mandates recording both an ROU (Right-of-Use) asset and a corresponding lease liability for both lease types.

- Right-of-Use (ROU) Asset : Defines the lessee’s right to utilize the leased asset over the lease term. It’s normally classified as a long-lived asset .

- Lease Liability : Defines the obligation to fulfill remaining lease payments throughout the lease term.

Income Statement Impact : For the operating lease cost, companies typically record a single lease expense, often referred to as “rent expense” or “operating lease expense,” in the general ledger. On the other hand, finance leases are typically separated into interest expense and the amortization of ROU assets.

Cash Flow Statement Implications : Payments related to operating leases are generally recorded under operating activities , whereas finance leases affect both financing and operating activities; payments towards the principal portion of the lease liability are recorded under financing activities , and the payments towards the interest portion are recorded under operating activities .

Related Readings: ASC 842 Cash Flow Statement Example – a Quick Guide

The ASC 842 footnote disclosure relies on the principles of these financial statement impacts. Without further ado, let’s take a look at some examples.

Real-World Examples – ASC 842 Footnote Disclosure

10-K (Annual Report) for the FY ended June 30, 2023

Here are the components of Microsoft’s lease footnote disclosure:

- Nature of Leases & Remaining Lease Terms: Microsoft stated they have operating and finance leases for various facilities, with a remaining lease term between less than 1 year and 18 years. The renewal option was also mentioned.

- Lease Cost : Microsoft listed their cost for both operating and finance leases. There is a separate line for finance leases to disclose the amortization cost and interest expense.

- Cash Flow : Microsoft disclosed two kinds of cash flow information: 1) cash paid regarding the lease liabilities and 2) ROU assets obtained.

- Operating leases: 1) The ROU asset balance and 2) lease liabilities, bifurcated into current portion and non-current portion (presented as “operating lease liabilities”)

- Finance Leases: 1) The ROU asset balance is presented as the gross balance (Property and equipment, at cost) and the accumulated depreciation balance, leading to the net balance of “Property and equipment.” 2) Lease liabilities bifurcated into current and non-current portions.

- Weighted Average Remaining Lease Term

- Weighted Average Discount Rate

- Lease Payments for each of the subsequent five years and “thereafter” accompanied by imputed interest.

- Leases signed but not yet commenced . The balance was disclosed along with the timeline.

10-K (Annual Report) for the FY ended September 30, 2023

Here are the components of Apple’s lease footnote disclosure

- Nature of Leases & Remaining Lease Terms: Apple stated they have lease arrangements for various facilities and equipment, with a remaining lease term typically less than 10 years. The renewal option was also mentioned.

- Lease Cost : Apple disclosed the cost of their lease arrangements in a paragraph. The lease cost was grouped by types of payments (fixed vs variable).

- Cash Flow : Apple disclosed two kinds of cash flow information in a paragraph: 1) cash paid for their fixed and variable payment leases and 2) ROU assets obtained, the latter being a non-cash item.

- ROU assets: The table displays values for both operating and finance leases, including the specific line items on the financial statements or balance sheet where they are categorized.

- Lease liabilities: The table also has numbers for operating and finance leases. The numbers are further bifurcated into current and non-current portions and where they can be located on the balance sheet.

10-K (Annual Report) for the FY ended January 31, 2023

- Nature of Leases: Walmart stated they have leases for various functions such as retail locations, office spaces, land, and equipment both domestically and internationally. Walmart did not state the remaining lease term.

- Per ASC 842-20-25-5 , Variable Lease Cost represents payments made to the variable components of a lease arrangement outside of the lease liability. Typically, these costs do not depend on an index or a rate, such as real estate taxes, common area maintenance, and insurance premiums.

- Cash Flow : Walmart also disclosed two kinds of cash flow information in a paragraph: 1) cash paid for both operating leases and finance leases and 2) ROU assets obtained

Walmart did not disclose additional balance sheet information in the footnote section. However, that’s because they have already done so on the actual balance sheet – see below.

This level of disclosure already met the requirement listed in ASC 842-20-45-1 . Therefore, additional disclosure may not be necessary in the footnote section.

Walmart did not disclose information on leases that have not yet commenced. According to the requirement outlined in ASC 842-20-50-3 , it may not be applicable to Walmart.

We reviewed the footnote disclosure of ASC 842 Lease Accounting from three major public companies. Below are the components found in all of their footnote section.

- Nature of Leases

- Lease Costs

- Cash Flow (including cash payment on leases and the ROU asset acquisition, which is a non-cash item)

- Weighted Average Remaining Lease Term ( here is how to calculate it )

These components align with the typical quantitative requirements outlined in ASC 842-20-50-4 .

Apple and Microsoft also included supplemental balance sheet information in the footnote section. Walmart did not have additional disclosure as the information on the balance sheet is sufficient per guidance.

Apple and Microsoft also included information on leases that have not yet commenced. This type of disclosure is typically on an “as applicable” basis.

While the examples provided here offer a glimpse into how companies typically present their footnote disclosures under ASC 842, it’s essential for those directly involved in preparing financial statements and disclosures to conduct a thorough review of the authoritative guidance. This is important because there may be specific disclosure requirements unique to your business that are not commonly addressed elsewhere.

- Tags: ASC 842 , Finance Lease , Footnote Disclosure , Lease Accounting , Operating Lease , ROU Asset

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Information published on sadaccountant.com is for general informational purposes only. You are solely responsible for any reliance on this information. For complex matters, we suggest conducting thorough research or seeking professional advice. Click for full disclosure.

- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search..

- Topic Areas

- Reference Library

ASC 842 for lessees

KPMG Exeutive View | December 2021

Updated: An executive level overview of the new lease accounting standard from a lessee’s perspective.

Our executive summary highlights key accounting changes and organizational impacts for lessees applying ASC 842.

Applicability

- Lessees in the scope of ASC 842

Relevant dates

| Effective date | Public entities and certain other entities* | Public NFPs** | All other entities |

|---|---|---|---|

Annual periods – Fiscal years beginning after | Dec 15, 2018 | Dec 15, 2019 | Dec 15, 2021 |

Interim periods – In fiscal years beginning after | Dec 15, 2018 | Dec 15, 2019 | Dec 15, 2022 |

Early adoption allowed in fiscal years beginning after | N/A | Yes | Yes |

* Includes (1) public business entities; (2) not-for-profits that have issued, or are conduit bond obligors for, securities that are traded, listed or quoted on an exchange or an over-the-counter market (‘Public NFPs’); and (3) employee benefit plans that file financial statements with the SEC. ** That had not issued GAAP-compliant financial statements reflecting the adoption of ASC 842 before June 3, 2020. | |||

Key Impacts:

- Lessees will recognize all leases, including operating leases, with a term greater than 12 months on-balance sheet

- Key balance sheet measures and ratios may change, IT systems may need to be upgraded or modified, and accounting processes and/or internal controls will need to be revised

- Lessees can choose between two transition methods, with additional practical expedients available

- Sale-leaseback accounting is substantially changed

- Both qualitative and quantitative disclosures are expanded

Report contents

- In a snapshot

- Effective dates

- The transition approach

- Leases on-balance sheet

- Other key considerations

Download the document:

Executive Summary

Subscribe to stay informed

Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox.

Choose your subscription (select all that apply)

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Accounting Research Online

Access our accounting research website for additional resources for your financial reporting needs.

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

- Agribusiness Construction Dealerships Distribution Education Financial Institutions Financial Services Fintech Governments Healthcare Hospitality Accommodations Insurance Manufacturing Nonprofits Private Equity Real Estate Technology Tribal Gaming and Government

- Assurance Accounting services Audit and assurance Organizational performance Leadership development Strategy and operations Outsourcing Finance and accounting Human resources Technology Operations C-suite Private client services Estate and tax planning Business transition strategy Wealth management and investment advisory services Risk advisory ESG services Forensic advisory Fraud investigation and litigation support Governance risk and controls Internal controls Operational risk Regulatory and compliance Technology Tax Credits and incentives Individual tax International tax State and local tax services Transaction advisory Buy-side Sell-side Investment banking Valuation services Wipfli Digital Custom software & apps Cybersecurity Data & analytics Digital strategy E-commerce Enterprise solutions Managed services

- Business Intelligence Microsoft Power BI Microsoft Fabric Planful Qlik Snowflake CRM Microsoft D365 Sales Microsoft D365 Marketing Microsoft D365 Customer Insights Salesforce Wipfli Move ERP business software Complete Solution for Job Shops and Contract Manufacturers Microsoft Dynamics 365 Business Central Microsoft Dynamics 365 Project Service Automation Microsoft Dynamics GP Oracle NetSuite Sage Intacct Financial solutions Microsoft Dynamics 365 Business Central Microsoft Dynamics GP Microsoft Dynamics SL Oracle NetSuite Procore QuickBooks Sage Intacct iPaaS solutions Boomi MuleSoft Technology management Microsoft Azure Microsoft Office 365 Wipfli Marketplace Wipfli Connect Industry CRM Solutions Wipfli Connect for Banking Wipfli Connect for Contractors Wipfli Connect for Manufacturing Wipfli Connect for Nonprofits Wipfli Connect for Real Estate Integrated Products for Sage Intacct AssetEdge CFO Connect for Sage Intacct Concur Connectors for Sage Intacct EMRConnect for Sage Intacct HCMConnect LM-2 on Sage Intacct PositivePay for Sage Intacct Integrate invoice processing & AP automation with Concur Connectors Connectors for Dynamics 365 Business Central Connectors for Dynamics GP Connectors for Dynamics SL Connectors for Finance and Operations Connectors for NetSuite Connectors for Sage Intacct

- About us The Wipfli Way Living our values DEI Serving our communities The Wipfli Foundation Awards Corporate development Annual report Partners and associates Leadership team Window into Wipfli Media Logo and trademark

- RESOURCE HUB

- All openings Careers at Wipfli Diversity, equity and inclusion Experienced professionals How we invest in your growth Student opportunities

ASC 842 changes bring new lease accounting requirements

New lease accounting standards are in effect as of January 1, 2022. ASC 842 applies to nonpublic entities and retains a two-category approach: operating leases and finance leases, which replaces the legacy term “capital leases.”

As lessees, entities must be aware of some big changes in how they evaluate their leases, how those leases are presented on their financial statements and what information is required to be disclosed.

This Q&A addresses important key changes and can help you in your communication with clients.

1. How will the new lease accounting standard impact my balance sheet?

Under the principles of ASC 842, a lessee will include on its balance sheet a right-of-use (ROU) asset and a lease liability associated with its right to use the underlying asset and its contractual obligations to make payments over the term of the agreement.

The lease liability represents the present value of all future remaining lease payments at the commencement date. The ROU asset is the amount of the initial measurement of the lease liability but adds any unamortized initial direct costs and any prepaid lease balances and then subtracts any lease incentives received.

The initial journal entry to record a lease under the new standard would be as follows:

Debit: ROU asset

Credit: Lease liability

The overall impact will significantly increase the total assets and liabilities reported on a lessee’s balance sheet. ROU assets are to be presented as a noncurrent asset, while the lease liability should be broken out between the current and noncurrent portions based on the maturity of future lease payments.

2. How does the new lease accounting standard impact my income statement?

Under ASC 842, the impact on a lessee’s income statement generally will be minimal. The way a lessee accounts for rent expense under the new standard is generally the same as before — straight-line over the term of the lease. Therefore, a lessee’s income statement is not likely to see any significant impacts.

3. How does the monthly accounting change under ASC 842?

Two transactions will need to be recorded every month (assuming the lease requires monthly payments):

- Rent payments

- Amortization of ROU asset and accretion of “interest” on the lease liability

Making the monthly lease payments will result in the following entry:

Debit: Lease liability Credit: Cash

This entry uses the actual cash outlay incurred for the period.

The amortization of the ROU asset account would occur at the end of each month to capture the monthly lease activity by making the following entry:

Debit: Lease expense

Credit: ROU asset

The amount recorded as lease expense is the straight-line rent expense over the term of the lease. The portion hitting the lease liability account represents the adjustment to reflect the new present value of the remaining payments to account for the passage of time. To calculate this amount, an entity would multiply the current balance of the lease liability account by the monthly interest rate (annual discount rate utilized in the present value calculation divided by 12).

The adjustment to the ROU asset is the difference between the straight-line expense amount and the “interest” accreted to the lease liability.

4. How do I determine the discount rate to calculate the present value of the lease liability?

The standard requires that the rate implicit in the lease, if one is known or readily determinable, be used as the discount rate. If the rate implicit in the lease is not readily determinable, an entity should use its incremental borrowing rate.

The incremental borrowing rate is the rate of interest that the lessee would have to pay to borrow on a collateralized basis over a similar term and amount equal to the lease payments in a similar economic environment.

However, for private companies, a practical expedient is available that allows an entity to use a risk-free rate as the discount rate. Like determining the incremental borrowing rate, an entity must use the risk-free rate for a comparable term to the lease term. This expedient is an alternative for entities that don’t know their incremental borrowing rate, or for which determining an incremental borrowing rate — or multiple incremental borrowing rates for numerous leases — is difficult, burdensome or otherwise too costly.

The risk-free rate is generally a lower rate than an incremental borrowing rate, which leads to a large (less discounted) lease liability and ROU asset, so entities should be sure to consider the impacts of electing expedients.

The risk-free rate is generally easier to obtain than the incremental borrowing rate since readily available and published daily by the U.S. Treasury. However, the risk-free rate is generally a lower rate than an incremental borrowing rate, which will result in a larger (less discounted) lease liability and ROU asset. Therefore, entities should be sure to consider the impacts of electing this and other expedients.

5. Does every lease need to be included in the ROU asset and lease liability?

An entity can consider adopting a capitalization threshold, similar to a capitalization policy for fixed assets, where certain leases could be excluded from the recognition requirements if those leases are immaterial.

It’s important to note that the impact of any such excluded leases needs to be immaterial both individually (for that single lease) as well as in the aggregate (the cumulative potential impact of all excluded leases).

Therefore, when determining and applying a capitalization threshold, an entity will need to quantify not just the amount of the periodic payment or the total annual lease expense but also quantify, among other things, the present value of all future lease payments as that would be more reflective of the balance sheet impact of the lease. Further, an entity should also consider whether excluding leases would be qualitatively material if information about those leases is omitted from the footnote disclosures.

The standard also provides a short-term lease exemption expedient, which allows an entity to not apply the recognition requirements to leases with a term of 12 months or less. The original lease term, including any renewal options reasonably certain to be exercised, must be 12 months or less. However, upon adoption an existing lease with less than 12 months remaining as of the adoption date, but which had an original lease term greater than 12 months, would not be subject to the short-term lease exemption.

6. When should renewal or termination options be included in the lease term?

The lease term is defined as the noncancellable period within the lease, including any periods covered by the option to extend or terminate the lease if the lessee is “reasonably certain” to do so.

Factors that may support “reasonably certain” exercise of a renewal option can include:

- Renewal option period payments are below market rates.

- The lessee made significant leasehold improvements that will still have economic value.

- The lessee would incur significant costs as a result of exercising an option to terminate the lease (i.e., negotiation costs, relocation costs, etc.).

- The leased asset is critical to the lessee’s operations and cannot be easily replaced.

- The location of the leased asset is of strategic importance to the lessee.

Factors that may not support “reasonably certain” exercise of a renewal option can include:

- Renewal option period payments above market rates or reset to fair market value.

- There is a significant period of time before the option can be exercised.

- Other similar types of leased assets are readily available in the marketplace.

- Leased asset does not have strategic value to the lessee.

7. What about month-to-month and annual recurring related party leases? Do these meet the short-term lease exemption?

The guidance remains a little cloudy in this area. The standard states that related party leases should be treated in the same was as any other lease. Most interpretations conclude that this likely means both month-to-month leases and annual recurring leases are not simply 30-day and one-year leases, respectively.

A month-to-month lease acts more as a 30-day lease with automatic renewal options, which would require an entity to determine whether they are reasonably certain to cancel the option or continue to lease the space, and for how long. Similarly, an annual recurring lease would need to be evaluated to determine whether it’s reasonably certain that the lease will renew for another year or more. Absent clarification from the standard setters, this approach is a reasonable interpretation.

It’s worth noting that the guidance on leasehold improvements remains largely unchanged. That is, leasehold improvements are to be amortized over the lesser of the lease term or the useful life. Therefore, if a lessee has concluded that a lease is short-term (either a true month-to-month lease or a single 12-month period), the leasehold improvements would need to be amortized over that short-term period (one month or one year in the examples, respectively).

As such, it is important for entities to carefully consider the language, terms and conditions in their lease agreements as well as the potential impacts when determining the appropriate lease term.

8. What are embedded leases and how are they accounted for?

Embedded leases are leases that exist within or as a part of another contract. For example, IT contracts, maintenance agreements, service contracts or other executory contracts may be or contain leases.

To identify whether an embedded lease exists, an entity should determine whether the four characteristics of a lease exist within the contract:

- Is there an identifiable asset?

- Does the entity have control of the asset?

- Does the contract span a period?

- Is there a component of consideration?

To determine whether the entity has control of the asset, consider 1) if the entity has the right to obtain substantially all of the economic benefit of the asset throughout the lease term and 2) if the entity has the right to direct use of the asset. If both apply, then the contract likely contains an embedded lease.

An example of an embedded lease might be a three-year maintenance agreement for a copier where the entity will purchase all paper, ink, toner and maintenance services from the supplier, and the supplier will provide a copier “free of charge” that will sit at the entity’s site. Even though the contract does not specify that the entity is paying to lease a copier, the copier represents an identifiable asset that the entity will control (it is at their site, and they can use it as they see fit and obtain the economic benefits from it), over a three-year period in exchange for cash payments.

Contracts that contain embedded leases should be bifurcated into lease and nonlease components. In this case, the copier is the lease component — the part of the contract that meets the characteristics of a lease — and the nonlease components are the paper, ink, toner and maintenance services, which transfer a good or service but do not otherwise meet the definition of a lease.

The total contract value should be allocated to the lease and nonlease components based on the relative standalone value of each, with the lease component recognized and accounted for under the new lease standard and the nonlease components recognized and accounted for under other applicable GAAP.

A practical expedient exists that allows a lessee to not separate lease and nonlease components. However, it would require that the entire contract be accounted for as a lease under the new standard. While it simplifies the process by not requiring allocation of the contract value to the various components, it would result in a larger ROU asset and lease liability balance since the entire payment amount is allocated entirely to the lease component.

9. What are the transition options?

Entities have the option of two approaches when transitioning from ASC 840 to ASC 842.

Under the first approach, the entity would apply the recognition requirements as of the date of adoption. This would mean, in comparative financial statements, the presentation and disclosure of the prior year financial information will remain under ASC 840 and the entity will apply the presentation and disclosure requirements under ASC 842 in the year of implementation and going forward. This allows an entity to avoid restating prior reporting periods but may be confusing as the two years presented would not be directly comparable with respect to leases.

The second approach applies the principles of the new standard to both periods presented in comparative financial statements. The presentation and disclosure of the prior and current year information would be adjusted to ASC 842. This requires an entity to apply the recognition requirements as of the earliest date presented in the financial statements, typically the beginning of the prior year.

10. Are there any practical expedients and policy elections available to make the transition easier?

A few expedients can make the transition easier. The first is the package of three practical expedients, which are an all-or-nothing election (i.e., an entity either elects all three or none as part of the package). The package of three expedients include:

- The entity doesn’t need to reassess existing or expired contracts for lease classification (i.e., a lease that was classified as an operating lease under ASC 840 does not need to be reassessed for classification under ASC 842 and can carry forward the operating classification under the new standard).

- The entity doesn’t t need to reassess existing or expired contracts for the existence of embedded leases.

- Initial direct costs for existing leases don’t need to be reassessed under the new definition.

It’s important to note that the package of three expedients does not apply to errors made under the previous standard. That is, a lease that was improperly accounted for as an operating lease under ASC 840 cannot be grandfathered in as an operating lease. Similarly, if a contract was not evaluated for an embedded lease under ASC 840 or was determined to have an embedded lease but was not accounted for as such, it would still need to be reassessed.

The hindsight expedient allows the entity to use hindsight in assessing the lease term and other conditions upon transition. This expedient may be useful if an entity determined that it was reasonably certain that a renewal would be exercised in year one of a lease prior to the transition to ASC 842, but in year two, after the transition, it has obtained new information that indicates the entity is no longer reasonably certain that the renewal will be exercised.

The land easements expedient allows an entity to not reassess existing or expired land easements or rights-of-way for embedded leases. While some land easements may have been accounted for as a lease under ASC 840, others — such as indefinite easements — may have been accounted for as intangible assets.

Further, certain definite-lived easements may have been accounted for as prepaid assets. This allows the entity to effectively carry forward the prior year treatment, as long as the prior treatment was appropriate under the old guidance.

How Wipfli can help

Wipfli’s audit and accounting team can help you navigate the complexities of the new lease accounting standards. You want to be certain your organization is correctly applying the updated rules. Contact us to learn more or continue reading on:

- What is a lease under ASC 842?

- New lease accounting standards: Key differences between ASC 842 and GASB 87

- ASC 842 expedients you can use to make your transition easier

- The new leasing accounting standard (ASC 842) and how it may affect your valuation

Let's talk about how Wipfli can meet your needs.

Wipfli’s quick turnaround of All World Supply’s financial statement audit had a big impact.

Article Download

Please register, contact information.

* = required fields

First Name *

Last Name *

Phone number *

- Community & Foundation

- Diversity & Inclusion

- Advisory Services

- Forensic, Valuation, & Litigation Support

- Fractional CFO

- Transaction Advisory Services

- Assurance Services

- Employee Benefit Plans

- Lease Accounting

- Risk Assurance

- Talent Services

- Tax Services

- Estate Planning

- State & Local Taxes

- Technology Services

- Custom Software

- Wealth Management

- Collective Investment Funds

- Construction

- Financial Institutions

- Manufacturing & Distribution

- HoganTaylor News

- HoganTaylor Thought Leadership

- Wealth Thought Leadership

- "How That Happened" Podcast

- COVID-19 Resource Center

- Guide: A Comprehensive Guide to Business Valuations

Our Services

Operating Lease Accounting Under ASC 842 Explained With a Full Example

April 26, 2023 • HoganTaylor

Lease Accounting Publications

Operating lease treatment under ASC 842 vs. ASC 840: What changed?

Under ASC 840 , operating leases were considered off-balance sheet transactions . The rent expense associated with the arrangements was recognized in the income statement, but nothing was recorded on the balance sheet. This made it difficult to understand the total amount of commitments a company had. It could also make comparisons between companies difficult, depending on their different approaches to leased vs. capital assets.

To increase transparency, the FASB issued ASC 842, Leases . One of the main provisions of this new standard is that all leases must be recognized on a company’s balance sheet. For operating leases, ASC 842 requires recognition of a right-of-use asset and a corresponding lease liability upon lease commencement.

With the changes introduced under ASC 842, all leases are now presented on both the balance sheet and income statement whether they are operating or finance (capital) leases . The updated financial statement presentation requires issuers to show the operating ROU asset and operating lease liability separately from the finance (capital) ROU asset and lease liability both on the face of the financials and in the notes disclosures.

However, the effect of operating leases on the income statement is not changing. Companies will continue to recognize a straight-line expense for the lease payments made over the lease term as an operating expense on the statement of profit and loss.

Operating lease vs. finance lease identification under ASC 842

Operating vs. finance lease classification under ASC 842 is relatively similar to the operating lease vs. capital lease criteria under ASC 840, but certain “bright lines” for classification have been removed, consistent with the more “principles-based” approach of ASC 842. For a lease to be classified as a finance lease , it must meet one of the five criteria listed below. If the lease does not fall under any of these criteria, it is classified as an operating lease:

1. Transference of title/ownership to the lessee

Ownership of the underlying asset is transferred to the lessee by the end of the lease term.

2. Purchase option

The lease arrangement grants the lessee an option to purchase the asset , which is reasonably certain to be exercised. It is important to note, the purchase option must be reasonably certain to be exercised for this criteria to met.

3. Lease term for major part of the remaining economic life of the asset

The lease term spans a major part of the remaining economic life of the underlying asset.

Note: The FASB provided additional clarification that “major part” can be consistent with the 75% threshold used under ASC 840. Companies are allowed to determine how they will define the “major part” threshold . In practice, though, a large portion of organizations tend to lean towards using the 75% threshold previously seen in ASC 840.

4. Present value represents “substantially all” of the fair value of the asset

The present value of the sum of the remaining lease payments equals or exceeds substantially all of the underlying asset’s fair value. If applicable, any residual value guarantee by the lessee not already included in lease payments is also included in the present value calculation.

Note: The FASB provided some additional clarification that “substantially all” can be consistent with the 90% threshold used under ASC 840. Here also, companies are allowed to determine their own “substantially all” threshold, but in practice the majority of entities are continuing to use 90%.

5. Asset specialization

The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Is lease capitalization required for all operating leases under 842?