Can You Assign a Promissory Note

“Can you assign a promissory note?” is a request you need to make to someone who promises to pay you a certain amount of money at a later date. 3 min read

“Can you assign a promissory note?” is a request you need to make to someone who promises to pay you a certain amount of money at a later date. While it is not as formal as a contract, a promissory note is legally binding, meaning that the promisee is entitled to take legal action if the promisor fails to make the specified payment.

What Is a Promissory Note?

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it. A promissory note is a legally binding note that is often used between parties who know each other personally, and it is totally customizable.

Using a Promissory Note to Pledge Collateral

Collateral refers to property pledged to ensure that a loan will be repaid. Take the following measures when collateral is pledged with a promissory note:

- If you are the lender, make sure the borrower upholds the terms stated in the promissory note. Also, the interest specified in the note must be legal.

- If you are the borrower, issue the promissory note to the institution or individual that needs it to obtain a loan for you. This should be done with an addendum stating the assignment of your rights or the completion of the assignment paperwork required by the lender.

Theoretically, a lender will only be willing to accept a promissory note as a form of collateral if you have satisfied at least part of the promise stated in the note. This means that you must have already paid back some money in accordance with the terms of your promissory note.

Using an Assignment of Deed of Trust

The purpose of a trust deed investment is to generate a greater return on your money on top of the amount you will otherwise receive from a certificate of deposit or savings account. If you are planning to make these types of investment, it is essential that you know how to use an assignment of deed of trust .

In California and many other states, the repayment of a promissory note is secured with a deed of trust against real property. Essentially, a trust deed investment involves the purchase of a promissory note, which is required to be secured by a deed of trust as part of the transaction.

When you obtain a loan to buy real estate, you will have to use a promissory note. The terms for repaying the loan, including the interest rate and monthly payment amount, will be stated in the promissory note. A deed of trust will be used to ensure that the promissory note will be repaid when it is recorded against the property purchased with the loan.

A lender may sell a promissory note. This usually happens between banks, but it can be done by any person who wishes to buy the promissory note as a form of investment. When a lender sells a promissory note, the deed of trust that secures the note will also be sold with it.

Difference Between Mortgage Assignment and Note Endorsement

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement. The new owner will have the right to receive payments and foreclose if you fail to make payments.

In casual conversations, people often use the word “mortgage” to refer to a home loan. A mortgage or a deed of trust is an essential document included as part of the process of securing a home loan. It is a form of security instrument. A promissory note , on the other hand, specifies the details and terms of the loan and obligates the borrower to repay the loan.

If you want to know whether or not you can assign a promissory note, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Cancel Promissory Note

- Default On Promissory Note

- Promissory Note

- Promissory Note Collection Demand Letter

- Unsecured Promissory Note

- Do Promissory Notes Hold up in Court?

- Demand Note vs Promissory Note

- How Long is a Promissory Note Good For?

- Understanding the Basics of Promissory Notes

- Promissory Note Payable on Demand

Choose Your Legal Category:

- Online Law Library

- Bankruptcy Law

- Business Law

- Civil Law

- Criminal Law

- Employment Law

- Family Law

- Finance Law

- Government Law

- Immigration Law

- Insurance Law

- Intellectual Property Law

- Personal Injury Law

- Products & Services Law

- Real Estate Law

- Wills, Trusts & Estates Law

- Attorney Referral Services

- Top 10 Most Popular Articles

- Legal Dictionary

- How It Works - Clients

- Legal Center

- About LegalMatch

- Consumer Satisfaction

- Editorial Policy

- Attorneys Market Your Law Practice Attorney Login Schedule a Demo Now Did LegalMatch Call You Recently? How It Works - Attorneys Attorney Resources Attorney Success Stories Attorney Success Story Videos Compare Legal Marketing Services Cases Heatmap View Cases

- Find a Lawyer

- Legal Topics

- Real Estate Law

Mortgage Assignment Laws and Definition

(This may not be the same place you live)

What is a Mortgage Assignment?

A mortgage is a legal agreement. Under this agreement, a bank or other lending institution provides a loan to an individual seeking to finance a home purchase. The lender is referred to as a creditor. The person who finances the home owes money to the bank, and is referred to as the debtor.

To make money, the bank charges interest on the loan. To ensure the debtor pays the loan, the bank takes a security interest in what the loan is financing — the home itself. If the buyer fails to pay the loan, the bank can take the property through a foreclosure proceeding.

There are two main documents involved in a mortgage agreement. The document setting the financial terms and conditions of repayment is known as the mortgage note. The bank is the owner of the note. The note is secured by the mortgage. This means if the debtor does not make payment on the note, the bank may foreclose on the home.

The document describing the mortgaged property is called the mortgage agreement. In the mortgage agreement, the debtor agrees to make payments under the note, and agrees that if payment is not made, the bank may institute foreclosure proceedings and take the home as collateral .

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party. That party is referred to as the assignee, and receives the right to enforce the agreement’s terms against the assignor, or debtor (also called the “mortgagor”).

What are the Requirements for Executing a Mortgage Assignment?

What are some of the benefits and drawbacks of mortgage assignments, are there any defenses to mortgage assignments, do i need to hire an attorney for help with a mortgage assignment.

For a mortgage to be validly assigned, the assignment document (the document formally assigning ownership from one person to another) must contain:

- The current assignor name.

- The name of the assignee.

- The current borrower or borrowers’ names.

- A description of the mortgage, including date of execution of the mortgage agreement, the amount of the loan that remains, and a reference to where the mortgage was initially recorded. A mortgage is recorded in the office of a county clerk, in an index, typically bearing a volume or page number. The reference to where the mortgage was recorded should include the date of recording, volume, page number, and county of recording.

- A description of the property. The description must be a legal description that unambiguously and completely describes the boundaries of the property.

There are several types of assignments of mortgage. These include a corrective assignment of mortgage, a corporate assignment of mortgage, and a mers assignment of mortgage. A corrective assignment corrects or amends a defect or mistake in the original assignment. A corporate assignment is an assignment of the mortgage from one corporation to another.

A mers assignment involves the Mortgage Electronic Registration System (MERS). Mortgages often designate MERS as a nominee (agent for) the lender. When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

An advantage of a mortgage assignment is that the assignment permits buyers interested in purchasing a home, to do so without having to obtain a loan from a financial institution. The buyer, through an assignment from the current homeowner, assumes the rights and responsibilities under the mortgage.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Failure to observe mortgage assignment procedure can be used as a defense by a homeowner in a foreclosure proceeding. Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note.

If the bank fails to “produce the note,” that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note. Therefore, it lacks legal standing to commence a foreclosure proceeding.

If you need help with preparing an assignment of mortgage, you should contact a mortgage lawyer . An experienced mortgage lawyer near you can assist you with preparing and recording the document.

Save Time and Money - Speak With a Lawyer Right Away

- Buy one 30-minute consultation call or subscribe for unlimited calls

- Subscription includes access to unlimited consultation calls at a reduced price

- Receive quick expert feedback or review your DIY legal documents

- Have peace of mind without a long wait or industry standard retainer

- Get the right guidance - Schedule a call with a lawyer today!

Need a Mortgage Lawyer in your Area?

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Daniel Lebovic

LegalMatch Legal Writer

Original Author

Prior to joining LegalMatch, Daniel worked as a legal editor for a large HR Compliance firm, focusing on employer compliance in numerous areas of the law including workplace safety law, health care law, wage and hour law, and cybersecurity. Prior to that, Daniel served as a litigator for several small law firms, handling a diverse caseload that included cases in Real Estate Law (property ownership rights, residential landlord/tenant disputes, foreclosures), Employment Law (minimum wage and overtime claims, discrimination, workers’ compensation, labor-management relations), Construction Law, and Commercial Law (consumer protection law and contracts). Daniel holds a J.D. from the Emory University School of Law and a B.S. in Biological Sciences from Cornell University. He is admitted to practice law in the State of New York and before the State Bar of Georgia. Daniel is also admitted to practice before the United States Courts of Appeals for both the 2nd and 11th Circuits. You can learn more about Daniel by checking out his Linkedin profile and his personal page. Read More

Jose Rivera, J.D.

Managing Editor

Preparing for Your Case

- What to Do to Have a Strong Mortgage Law Case

- Top 5 Types of Documents/Evidence to Gather for Your Mortgages Case

Related Articles

- Assumable Mortgages

- Loan Modification Laws

- Behind on Mortgage Payments Lawyers

- Home Improvement Loan Disputes

- Reverse Mortgages for Senior Citizens

- Mortgage Settlement Scams

- Short Sale Fraud Schemes

- Deed of Trust or a Mortgage, What's the Difference?

- Owner Carryback Mortgages

- Contract for Deed Lawyers Near Me

- Mortgage Subrogation

- Property Lien Waivers and Releases

- Different Types of Promissory Notes

- Repayment Schedules for Promissory Notes

- Ft. Lauderdale Condos and Special Approval Loans

- Special Approval Loans for Miami Condos

- Removing a Lien on Property

- Mortgage Loan Fraud

- Subprime Mortgage Lawsuits

- Property Flipping and Mortgage Loan Fraud

- Avoid Being a Victim of Mortgage Fraud

- Second Mortgage Lawyers

- Settlement Statement Lawyers

- Loan Approval / Commitment Lawyers

- Broker Agreement Lawyers

- Truth in Lending Disclosure Statement (TILA)

- Housing and Urban Development (HUD) Info Lawyers

- Good Faith Estimate Lawyers

- Mortgage Loan Documents

Discover the Trustworthy LegalMatch Advantage

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

How does LegalMatch work?

Law Library Disclaimer

16 people have successfully posted their cases

Assigning Loan Documents: Practical Reminders

The recent Supreme Court of Delaware case J.M. Shrewsbury v. The Bank of New York Mellon , CA No. N15L-03-108 (Del. 2017), provides a reminder of the importance of clearly documenting the assignment of loan documents. The Court’s holding requires that prior to the assignee of a mortgage loan filing suit on the note or mortgage, the assignee must have received both an allonge/assignment of the note and an assignment of the mortgage. The case is a reminder of the importance of maintaining a precise chain of title when assigning loan documents. The facts of the case as described below demonstrate the need to make sure that you “don’t leave the note behind.”

In 2007, J.M. Shrewsbury and Kathy Shrewsbury signed a promissory note in favor of Countrywide Home Loans, Inc. Concurrently, the Shrewburys were granted a mortgage to secure their obligations under the note, which mortgage encumbered real property in Delaware. In 2011, the mortgage was assigned to The Bank of New York Mellon (Bank). In 2013, the Shrewsburys requested and received a copy of the original note, which contained no indication that the note had been assigned. Neither party disputed the fact that the Shrewsburys stopped making mortgage payments in 2010.

The Bank commenced a mortgage foreclosure action in 2015 in the Superior Court of the State of Delaware, Bank of N.Y. Mellon v. Shrewsbury , C.A. No. N15L-03-108 CLS (Del. Super. Ct. Feb. 17, 2016). In holding in favor of the Bank, the Superior Court found that the Bank need only show that it had a valid assignment of the mortgage to enforce its rights. The Shrewsburys appealed the decision to the Court.

In reversing and remanding the decision of the Superior Court, the Court followed its reasoning in Iowa-Wisconsin Bridge Co. v. Phoenix Finance Corporation, Iowa-Wisconsin Bridge Co. v. Phoenix Finance Corporation , 25 A.2d 383, 389 (Del. 1942), stating that a debt is an essential requisite to a mortgage. While persuaded by wide-ranging case law and other respected authorities, the Court’s decision relied most heavily on the United States Supreme Court case Carpenter v. Longan, 83 U.S. 271 (1872), holding that the “note and mortgage are inseparable; the former as essential, the latter as an incident. An assignment of the note carries the mortgage with it, while an assignment of the latter alone is a nullity.”

Practical Reminders

While this case involved a residential transaction, important considerations can be applied in commercial mortgage transactions whether in connection with construction, bridge or permanent mortgage financing, a loan sale, a transfer of a loan to an affiliate of the original lender, or other assignment of the loan.

Practical reminders include:

- Make sure that the chain of title is precise when assigning the mortgage, the note and other collateral documents such as assignments of leases and rents, guarantees and UCC’s. Don’t leave the note “behind.”

- Assign and endorse the note by allonge so that the chain of title is complete. Firmly affix the allonge(s) to the underlying note.

- Keep good records of all documentation, including recorded ( i.e. the mortgage an assignment of mortgage) and unrecorded documents. Retain originals in a safe place (such as under the control of a custodian or servicer or in a vault) and copies of all loan documents including assignment documents.

- When the loan is assigned, always deliver the original note along with the original allonge.

Members of our Real Estate and Finance Groups regularly handle commercial real estate financing and sales transactions throughout the country. If you have questions or would like further information, please contact Tim Davis ( davist@whiteandwilliams.com ; 215.864.6829) or Pat Haggerty ( haggertyp@whiteandwilliams.com ; 215.864.6811).

PRACTICE AREAS

- Real Estate

KEY ATTORNEYS

- Cherry Hill

- Center Valley

- Philadelphia

By using this site, you agree to our updated Privacy Policy and our Terms of Use .

- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 14,480+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

Create, share, and e-sign documents in minutes using Jotform Sign.

- Integrations

- Legality Guide

- Signature Creator

- Real Estate

- See all solutions

Automatically create polished, designed documents

- PDF Templates

- Fillable PDF Forms

- Sign Up for Free

Assignment of Promissory Note

Generate an assignment of promissory note. Drag and drop to customize in seconds. Works great on any smartphone, tablet, or desktop. Converts to a PDF.

An Assignment of a Promissory note is a bilateral document that transfers the rights and obligations associated with a promissory note from one party (the assignor) to another party (the assignee). Jotform Sign ’s Assignment of Promissory Note shows the date the document was created, assignor information, assignee details, start and end dates of the promissory note, total amount due, interest rate percentage, and chosen payment method.

You can easily make changes to this Assignment of Promissory Note using our intuitive online builder. No coding or design experience is required — just drag and drop to add or edit form fields, update the wording of the document, include additional signature fields, change fonts and colors, and more. You can also set up an automated signing order to ensure signatures are received in a timely manner and in the correct order. Once signed, you’ll automatically receive a finalized version of the document for your records.

Letter of Authorization

A letter of authorization is an agreement between the person, known as the principal, authorizing another, known as an agent, to perform certain functions or powers in order to perform the duties of the principal. This letter also contains the period of effectivity of the contract of agency between the principal and the agent. Share Jotform’s free Letter of Authorization via email and securely collect electronic signatures from any device. Once signed, a finalized PDF document will be sent to your inbox — ready to download, print, and share with the appropriate parties.You can make changes to this Letter of Authorization in just a few easy clicks using Jotform’s intuitive form builder. Simply drag and drop to add or remove text fields, include additional signature fields, change fonts and colors, include your own branding and letterhead, and other design changes. Ditch messy paper forms and streamline your e-signature process with this free Letter of Authorization from Jotform. If you want to take your signing process online, create an e-sign document with Jotform Sign.

Professional Letter of Recommendation

A professional letter of recommendation is used by a prospective job applicant when applying for a position at a different company. Usually written by a previous supervisor, this letter highlights the skills, personality, and qualities of the applicant that is related to the job position they are applying for. Share this Professional Letter of Recommendation via email, which the respondent can then fill out and sign from any device. Once signed, a finalized PDF document will be automatically sent to your inbox and ready to present to the hiring manager.Make updates to this Professional Letter of Recommendation in seconds without any coding. Using Jotform’s drag-and-drop form builder, you can easily add or remove form fields, choose new fonts and colors, personalize automated emails, and much more. Land your next big job with Jotform’s free and fully customizable Professional Letter of Recommendation. If you want to take your signing process online, create an e-sign document with Jotform Sign.

Resignation Confirmation Letter

Need a quick and professional way to confirm your employees' resignations? No problem. With Jotform’s Resignation Confirmation Letter, you can build a confirmation letter to send to your employees who have recently resigned for both yours and their records. Oversee the signature process from start to finish in one centralized place. Share via email or embed in your internal management portal and start collecting resignation confirmation signatures today.Customizing your Resignation Confirmation Letter is easier than ever with Jotform’s drag-and-drop form builder. Update your business’ terms and conditions, add or remove form fields, change fonts and colors, and make other design changes — no coding required. Create your letter, send it straight to your former employees, and start collecting signatures seamlessly. To send and sign documents in seconds, customize this template and share it with Jotform Sign.

Job Confirmation Letter

Congratulate your new hires with Jotform’s Job Confirmation Letter template. Instead of drafting up individual letters for each new employee, Jotform Sign lets you save time by sending your letter template to be filled out and signed by your HR manager in a few quick clicks. You’ll receive a notification and a finalized version of the document once this has been completed.Want to make changes to this Job Confirmation Letter template? Drag and drop to add or remove text or signature fields, customize the letter’s message, and make other design changes. You can even add a signature field so your new employees can sign as well! Once each Job Confirmation Letter is filled out and completed, you can instantly download or print it for your records. Securely gather signatures anytime, anywhere with Jotform Sign.

Income Verification Letter Template

An income verification letter is a document an employer issues to confirm an individual’s income and employment status and provide evidence of the individual’s financial situation. If you need a standardized income verification letter for your property management company or landlord duties, Jotform has you covered. With our income verification letter template, you can quickly verify a potential renter’s income. Plus, you’ll be able to keep track of important applicant details — such as their salary, current occupation, and other renter-related information — that are saved in your Jotform account.Our drag-and-drop builder makes personalizing your income verification letter template easy too — you have the ability to change fonts and colors, add additional signature fields, edit policies, and much more. You can even set up an automated workflow either to approve or deny renters on the spot if they don’t meet your desired income requirements. Once everyone has signed your document, you can download it for your records or share with other stakeholders. If you’d like to save time by automating your workflow, do it with Jotform Sign, Jotform’s powerful e-sign solution.

Letter of Recommendation for Student

Create and collect recommendation letters from your managers and professors with this Letter of Recommendation for Student from Jotform Sign. It works for both students looking to collect letters and individuals who have been asked to give their letters of recommendation. Create and send your letter and receive a copy when all parties have filled it out — easily converted into a PDF document.Personalizing this Letter of Recommendation for Student is quick and easy with our intuitive online form builder. Drag and drop to add or remove form fields, include more signature fields, change fonts and colors, upload logos or personal branding, and create automated signing orders. Show your next employer or university that you have what it takes with the help of your professors or employers.

These templates are suggested forms only. If you're using a form as a contract, or to gather personal (or personal health) info, or for some other purpose with legal implications, we recommend that you do your homework to ensure you are complying with applicable laws and that you consult an attorney before relying on any particular form.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Written by Josh Sainsbury | Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.

Determine Assignability

Ensure that the contract is assignable. Some contracts, especially those involving personal services or unique skills, may not be assignable without the other party’s agreement.

Get Consent from the Other Party (if Required)

If the contract includes an anti-assignment clause or requires consent for assignment, seek written consent from the other party. This can often be done through a formal amendment to the contract.

Prepare an Assignment Agreement

Draft an assignment agreement that clearly outlines the transfer of rights and obligations from the assignor (the party assigning the contract) to the assignee (the party receiving the assignment). Include details such as the names of the parties, the effective date of the assignment, and the specific rights and obligations being transferred.

Include Original Contract Information

Attach a copy of the original contract or reference its key terms in the assignment agreement. This helps in clearly identifying the contract being assigned.

Execution of the Assignment Agreement

Both the assignor and assignee should sign the assignment agreement. Signatures should be notarized if required by the contract or local laws.

Notice to the Other Party

Provide notice of the assignment to the non-assigning party. This can be done formally through a letter or as specified in the contract.

File the Assignment

File the assignment agreement with the appropriate parties or entities as required. This may include filing with the original contracting party or relevant government authorities.

Communicate with Third Parties

Inform any relevant third parties, such as suppliers, customers, or service providers, about the assignment to ensure a smooth transition.

Keep Copies for Records

Keep copies of the assignment agreement, original contract, and any related communications for your records.

Here’s a list of steps on how to write an assignment agreement:

Step 1 – List the Assignor’s and Assignee’s Details

List all of the pertinent information regarding the parties involved in the transfer. This information includes their full names, addresses, phone numbers, and other relevant contact information.

This step clarifies who’s transferring the initial contract and who will take on its responsibilities.

Step 2 – Provide Original Contract Information

Describing and identifying the contract that is effectively being reassigned is essential. This step avoids any confusion after the transfer has been completed.

Step 3 – State the Consideration

Provide accurate information regarding the amount the assignee pays to assume the contract. This figure should include taxes and any relevant peripheral expenses. If the assignee will pay the consideration over a period, indicate the method and installments.

Step 4 – Provide Any Terms and Conditions

The terms and conditions of any agreement are crucial to a smooth transaction. You must cover issues such as dispute resolution, governing law, obligor approval, and any relevant clauses.

Step 5 – Obtain Signatures

Both parties must sign the agreement to ensure it is legally binding and that they have read and understood the contract. If a notary is required, wait to sign off in their presence.

Related Documents

- Sales and Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Contract : An agreement in which each party agrees to an exchange, typically involving money, goods, or services.

- Lease/Rental Agreement : A lease agreement is a written document that officially recognizes a legally binding relationship between two parties -- a landlord and a tenant.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Cookie Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

All Formats

Note Templates

Assignment of promissory note – 8+ free word, excel, pdf format download.

Working in a legal firm that generates legitimate documents for others can be quite difficult because a small mistake may ruin the entire business, firm, or concerned purpose of the customer. Many a time, you stay busy catering your business requirements and couldn’t get time to make promissory notes that can work as a legal documentation proof. The readymade Assignment of Promissory Note Template available over the web helps you to stay safe from monetary scams and frauds by mentioning every single thing in detail.

Note Template Bundle

- Google Docs

Types of Templates Available Under This Category

Assignment of promissory note to trust.

Assignment of Promissory Note Without Recourse

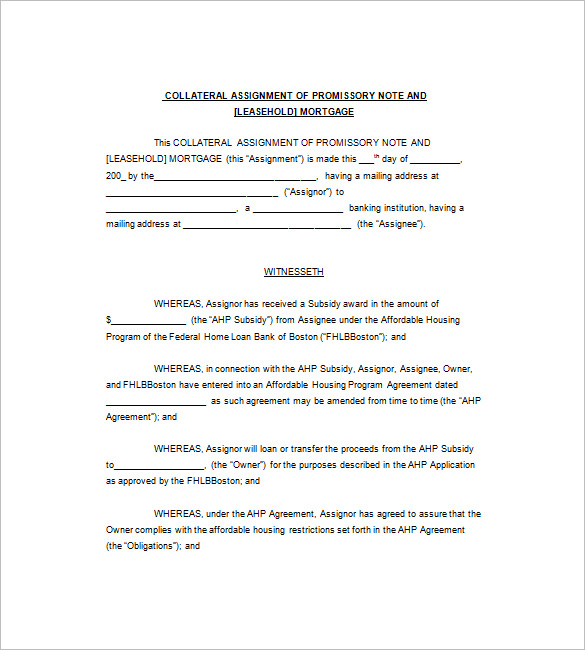

Collateral Assignment of Promissory Note

Assignment of Promissory Note to Living Trust

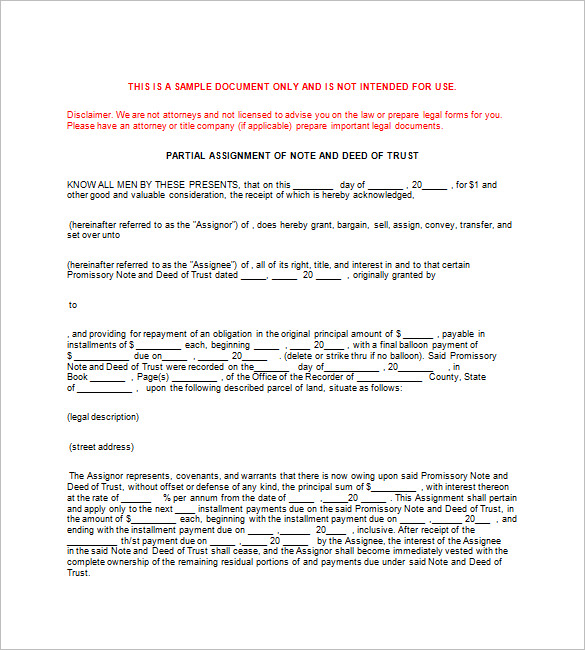

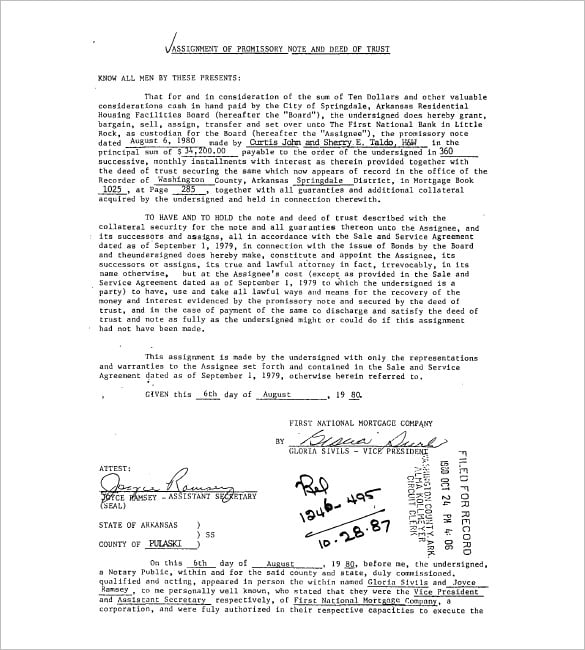

Assignment of Promissory Note and Deed of Trust

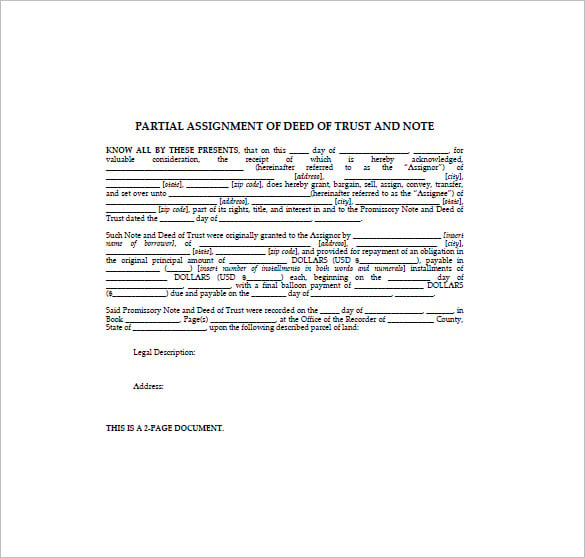

Partial Assignment of Promissory Note

Collateral Assignment of Promissory Note Sample

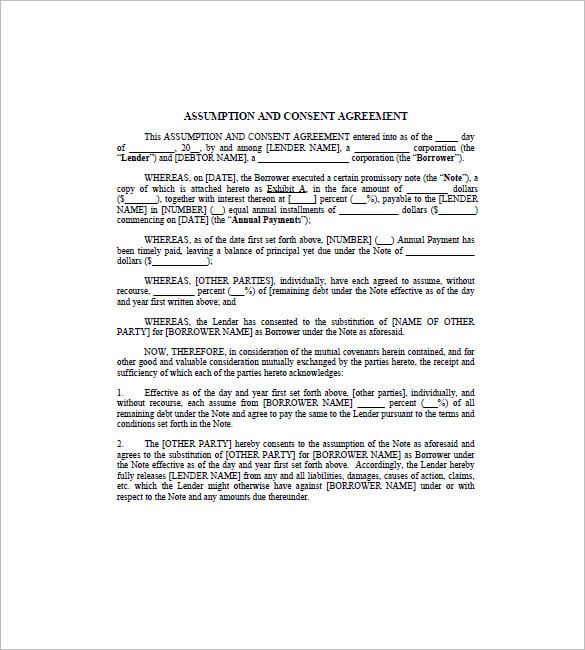

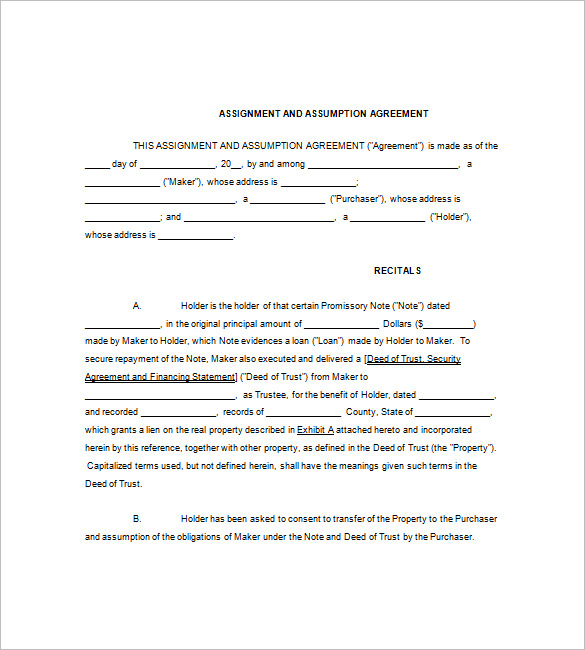

Assignment and Assumption Agreement

More in Note Templates

Google Classroom Assignment Tracker Template

Assignment to-do list template, college assignment template, professional assignment template, blank assignment template, sales lead assignment slip template, assignment planner template, interview and writing essay assignment template, assignment notebook template, case brief assignment template.

- 11+ Logistics Note Templates in PDF | MS Word

- 10+ Logistics Delivery Note Templates in MS Word | PDF

- 14+ Printable Doctor’s Note for Work Templates – PDF, Word

- 10+ Progress Note Templates – PDF, DOC

- 14+ Doctor Note Templates

- FREE 10+ Research Note Templates in PDF | MS Word

- 10+ Investment promissory Note Templates in PDF | DOC

- 11+ Credit Note Templates – Samples, Examples

- 6+ Audit Notes Templates in Doc | Excel | PDF

- 13+ School Absence Note Templates in PDF | Google Docs | Word | Pages

- 9+ Real Estate Promissory Note Templates in PDF

- 5+ Decision Note Templates in PDF | DOC

- 5+ Fit Note Templates in PDF | DOC

- 9+ Daily Note Templates in PDF | DOC

- 16+ Loan Note Templates in PDF

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

2.04 Interest Rates Assignment Downloadable (1)

- SI SWIMSUIT

- SI SPORTSBOOK

Breaking: Yu Darvish Returns to Padres; When Will He Pitch Next?

Valentina martinez | 3 hours ago.

- San Diego Padres

San Diego Padres right-handed pitcher Yu Darvish was officially reinstated from the restricted list on Friday. He's back — well, almost.

Darvish has been reinstrated from the restricted list and returned from the injured list. He will rejoin the team in San Diego on Friday.

Darvish hasn't thrown for the Padres since May 29 due to a number of groin and elbow injuries. At the beginning of July, he was placed on the restricted list because of a private family matter.

There was no timeline for the right-hander's return when he was first put on the restricted list. But Darvish was spotted throwing live batting practice at a local high school a couple weeks ago, which signaled his return was imminent.

The 38-year-old has a 4-3 record, a 3.20 ERA, and a 1.07 WHIP this season for San Diego. His return to the mound for the Padres is monumental. San Diego is on the hunt for the division lead in the National League West.

The Padres are 4.5 games behind the Los Angeles Dodgers, but a key starter like Darvish back in the pitching rotation could be huge.

“He’s dealing with a personal matter involving his family,” Padres manager Mike Shildt said in July. “Clearly we want to respect his privacy. He wants to make sure everybody knows he’s physically in a good spot. He’s still working on his craft. But he is going to step away for right now and deal with some things on a personal level.

“We’re going to love and support him. He’s part of the Padre family. But at the moment, he’s going to take a break from the team.”

Padres infielder Matthew Batten was designated for assignment in order to make room for the return of Darvish.

The Padres acquired reinforcements at the trade deadline in light of the right-hander's absence; however, a majority of the newcomers play a pivotal role in the bullpen.

Following the trade deadline, the Padres arguably had one of the best bullpens in baseball, but the starting rotation was still full of question marks.

Darvish provides a much-needed veteran presence on the mound. The success of the rotation is directly correlated to the Padres' two All-Stars, Darvish and Joe Musgrove.

As of now, the Padres would make the postseason as a Wild Card team, which would set them up for a best-of-three series. However, with Darvish back, the team will be gunning for the NL West win.

VALENTINA MARTINEZ

IMAGES

COMMENTS

A lender may sell a promissory note. This usually happens between banks, but it can be done by any person who wishes to buy the promissory note as a form of investment. When a lender sells a promissory note, the deed of trust that secures the note will also be sold with it. Difference Between Mortgage Assignment and Note Endorsement

Whether a written, recorded assignment is needed depends on state law. Endorsements of Promissory Notes. When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank, which makes it a bearer instrument under Article 3 of the Uniform Commercial Code.

©2010 Bridgeway Financial Corporation assumes no liability pertaining to the use of this form. If you doubt this form's fitness for your purpose, consult an attorney.

EXHIBIT 10.5. Assignment of Promissory Note as Collateral Security. THIS Assignment of Promissory Note as Collateral Security (the "Assignment") is entered into as of October 15, 2013 by and between WESSCO, LLC, a Delaware limited liability company, (the "Assignor") and THE BANK OF KENTUCKY, INC., a Kentucky banking corporation, (the ...

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

While a mortgage (or deed of trust) is a vital document in taking out a home loan, a promissory note defines the terms and details of the loan and creates the obligation for the homeowner to repay the loan. A mortgage, on the other hand, is a type of security instrument and is discussed in more detail below. When an investor purchases a loan ...

The Court's holding requires that prior to the assignee of a mortgage loan filing suit on the note or mortgage, the assignee must have received both an allonge/assignment of the note and an assignment of the mortgage. The case is a reminder of the importance of maintaining a precise chain of title when assigning loan documents.

Description Can You Assign A Promissory Note. This form is a Promissory Note Assignment and Notice of Assignment. In this agreement, the holder conveys all of his/her rights in and to the promissory note to the assignee. Also, the form contains a section which notifies the maker of the note that an assignment has taken place and instructs the ...

A mortgage assignment is the transfer of a mortgage from its initial lender to another party. Learn how this affects you! ... The note will be endorsed or signed over to the loan's new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner ...

Conclusion: An Assignment of Promissory Note Sample with Notary provides a legally binding way to transfer rights and benefits associated with a promissory note. Whether it's an absolute, conditional, or partial assignment, involving a notary ensures the authenticity and legality of the transaction.

This form is a Promissory Note Assignment and Notice of Assignment. In this agreement, the holder conveys all of his/her rights in and to the promissory note to the assignee. Also, the form contains a section which notifies the maker of the note that an assignment has taken place and instructs the maker to direct all future payments on the note ...

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan − aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time. The assignment of mortgage occurs because without a security ...

An Assignment of a Promissory note is a bilateral document that transfers the rights and obligations associated with a promissory note from one party (the assignor) to another party (the assignee). Jotform Sign 's Assignment of Promissory Note shows the date the document was created, assignor information, assignee details, start and end dates ...

ASSIGNMENT OF NOTE. THIS ASSIGNMENT is entered into effective this 18 th day of March, 2008 by and between Astraea Investment Management, LP., ("Assignor") and Global Casinos, Inc., a Utah corporation ("Assignee").. WITNESSETH. WHEREAS, Casinos U.S.A. Inc executed a Promissory Note originally payable to Assignee in the principal amount of Two Hundred Forty-Nine Thousand Four Hundred Eighteen ...

It endorses the promissory note (signs it over) to the new loan owner. The promissory note owner is the only party with the legal right (called "standing") to collect payment on the debt. Assignment. The seller also prepares an assignment of mortgage to the new entity and, usually, records the assignment in the county records.

Assignment: Provide details that identify the original contract being assigned. Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received. Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you ...

All these templates are available in various versions and formats including MS Word, Excel, PDF, and many others. These templates ensure higher transparency and easy mentioning of lending terms and conditions to ensure minimal chaos in near future. These readymade Assignment of Promissory Note templates signify that both the parties have agreed ...

ASSIGNMENT OF NOTE THE UNDERSIGNED hereby assigns all their right, title and beneficial interest in and to that certain Promissory Note dated in the original amount of executed in favor of to: Original note shall be endorsed to reflect the forgoing Assignment of beneficial interest. Dated this day of , ...

Examples of Assignment of Notes and Liens in a sentence. The Prior Loan Agreement and all Loan Documents and Security Instruments (as defined in the Prior Loan Agreement) referred to therein have, as of the Closing, been assigned from Bank One, Texas, N.A., as the sole lender under the Prior Loan Agreement, to Bank One, Texas, N.A., as Agent hereunder, for the benefit of the Banks and the LC ...

An Assignment transfers ownership of a contract, property, or asset from one party to another. Create your free, printable agreement now. ... Note: Your initial answers are saved automatically when you preview your document. This screen can be used to save additional copies of your answers.

Examples of Assignment of Promissory Note in a sentence. Service quality is particularly important for passengers trans- portation. The Maker agrees to abide by the terms of this Assignment of Promissory Note and honor all its obligations thereunder to the Assignee.. In addition, attendees would have the opportunity to read "Tigard memories" previously submitted by current and former residents ...

Assignment of Promissory Note with Acknowledgement of Assignment (CA) Summary. This template is an assignment of a promissory note to a revocable inter vivos trust in California. It can also be used to notify a debtor that a settlor/lender wishes to assign a promissory note to the settlor's revocable trust and to obtain the debtor's ...

1. Transfer and Assignment.As replacement security for certain Collateral being sold, but without limiting any rights Bank may have in the Collateral Documents (defined below) or under the Loan Documents, the Borrower hereby delivers to and deposits with Bank that certain Secured Promissory Note of even date from Danam Acquisition Corp. ("Maker") in the principal amount of $500,000 ...

Down Payment: $1,500 Interest Rate: 4% Loan Term: 60 months Monthly Payment: $433.85 7. Total paid after all 60 payments 433.85×60=433.85×60=$26,031.00 8. Total interest paid over the life of the loan Total Paid−Amount Financed=26,031.00−23,500=$2,531.00 Scenario 2 It is time to change things a little bit. Now we will assume that you did not have a down payment.

Padres infielder Matthew Batten was designated for assignment in order to make room for the return of Darvish. ... Padres Notes: Historic Sweep, Pitcher Designated for Assignment, Yu Darvish ...