Advertisement

Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy Process

- Original Paper

- Published: 03 January 2020

- Volume 14 , pages 54–70, ( 2019 )

Cite this article

- Sushil ORCID: orcid.org/0000-0002-3118-5461 1 &

- Shamita Garg ORCID: orcid.org/0000-0001-8952-0309 1

7872 Accesses

8 Citations

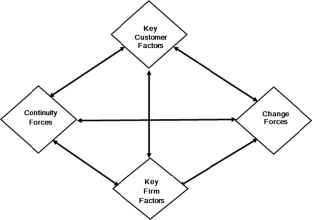

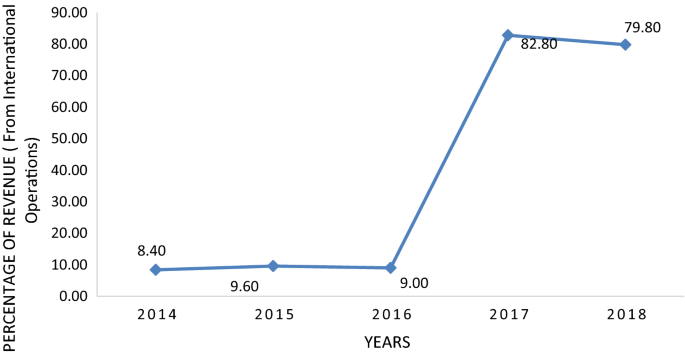

Explore all metrics

In the past few years, Tata Motors succeeded by exploiting international opportunities. Its percentage of revenue from international operations has increased from 9% in 2016 to 79.80% in 2018. Hence its strategy is worthy of study. ‘Flexible Strategy Framework’ is used to analyse the strategy of Tata Motors which evolved to gain its international presence in the automotive manufacturing industry. This framework is an attempt to manage change, along with the consideration of continuity forces in the organization. The ability of the firm to integrate continuity and change forces effectively has made the firm competitive in the international market. The organization is continually doing innovations to keep itself ahead of the competition. This study is a novel attempt to explore linkages between internationalization and competitiveness using the framework of flowing stream strategy.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Internationalisation Process of Indian Auto Giants

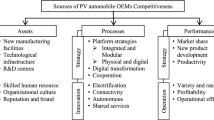

Strategic Options for Automobile OEMs of Indian Origin to have Sustained Competitive Advantage: A Case of Tata Motors

Explore related subjects

- Artificial Intelligence

Barnett, W. P., & Carroll, G. R. (1995). Modeling internal organizational change. Annual Review of Sociology, 21 (1), 217–236.

Article Google Scholar

Becker-Ritterspach, F., & Bruche, G. (2012). Capability creation and internationalization with business group embeddedness—The case of Tata Motors in passenger cars. European Management Journal, 30 (3), 232–247.

Bhat, J. S. A., Sushil, & Jain, P. K. (2011). Innovation by harmonizing continuity and change. Journal of Business Strategy, 32 (2), 38–49.

Bruche, G. (2010). Tata Motor’s transformational resource acquisition path: A case study of latecomer catch-up in a business group context (No. 55). Working Papers of the Institute of Management Berlin at the Berlin School of Economics and Law (HWR Berlin).

Buckley, P. J., Pass, C. L., & Prescott, K. (1988). Measures of international competitiveness: A critical survey. Journal of Marketing Management, 4 (2), 175–200.

Chatzoglou, P., & Chatzoudes, D. (2018). The role of innovation in building competitive advantages: An empirical investigation. European Journal of Innovation Management, 21 (1), 44–69.

Collins, J. R., & Porras, J. I. (1994). Built to last . New York: Harper Collins.

Google Scholar

Dua, K., & Dua, S. (2013). A study of customer satisfaction with reference to Tata Motor passenger vehicles. International Journal of Advanced Research in Management and Social Sciences, 2 (4), 68–83.

Goldstein, A. (2008). Emerging economies transnational corporations: The case of Tata. Transnational Corporations, 17 (3), 85.

IBEF. (2019). https://www.ibef.org/industry/india-automobiles.aspx . Retrieved 5 Sep 2019.

Industry Outlook. (2019). https://industryoutlook.cmie.com . Retrieved 19 Sep 2019.

Jahanshahi, A. A., Gashti, M. A. H., Mirdamadi, S. A., Nawaser, K., & Khaksar, S. M. S. (2011). Study the effects of customer service and product quality on customer satisfaction and loyalty. International Journal of Humanities and Social Science, 1 (7), 253–260.

Kale, D. (2017). Sources of innovation and technology capability development in the Indian automobile industry. Institutions and Economies, 4, 121–150.

Kim, W. C., & Mauborgne, R. (2005). Blue ocean strategy: How to create uncontested market space and make the competition irrelevant . Boston: HBS Press.

Kumar, R. S., & Balasubrhmanya, M. B. (2010). Influence of subcontracting on innovation and economic performance of SMEs in Indian automobile industry. Technovation , 30 (1/2), 558–569.

Kumar, A., Motwani, J., Douglas, C., & Das, N. (1999). A qualitty competitiveness index for benchmarking. Benchmarking: An International Journal, 6 (1), 12–21.

Lall, S. (2001). Competitiveness, technology and skills . Eldward Elgar Publishing, Number 2298.

Lessard, D. R., Lucea, R., & Vives, L. (2013). Building your company’s capabilities through global expansion . New York: MIT.

Mahapatra, S. N., Kumar, J., & Chauhan, A. (2010). Consumer satisfaction, dissatisfaction, and post-purchase evaluation: An empirical study on small size passenger cars in India. International Journal of Business & Society, 11 (2), 97–108.

Meckling, J., & Nahm, J. (2019). The politics of technology bans: Industrial policy competition and green goals for the auto industry. Energy Policy, 126, 470–479.

Mintzberg, H., Ahlstrand, B., & Lampel, J. (1998). Strategy safari: The complete guide, through the wilds of strategic management . Singapore: Pearson Education.

Mitra, R. (2011). Framing the corporate responsibility-reputation linkage: The case of Tata Motors in India. Public Relations Review, 37 (4), 392–398.

Narayanan, K. (2001). Liberalisation and the differential conduct and performance of firms: A study of the Indian automobile sector. http://hdl.handle.net/10086/13838 .

Nauhria, Y., Kulkarni, M. S., & Pandey, S. (2018). Development of strategic value chain framework for Indian car manufacturing industry. Global Journal of Flexible Systems Management, 19 (1), 21–40.

Nelson, L. (2003). A case study in organisational change: implications for theory. The Learning Organization, 10 (1), 18–30.

Okhmatovskiy, I. (2010). Performance implications of ties to the government and SOEs: A political embeddedness perspective. Journal of Management Studies, 47 (6), 1020–1047.

Palepu, K. G., & Srinivasan, V. (2008). Tata motors: The Tata Ace . Boston: Harvard Business School.

Porter, M. E. (1990). The competitive advantage of nations (p. 564). New York: The Free Press.

Book Google Scholar

Prowess CMIE. (2019). https://prowessdx.cmie.com/kommon/bin/sr.php?kall=wdispreq&reqid=37914&msg=2 . Retrieved 19 Sep 2019.

Sagar, A. D., & Chandra, P. (2004). Technological change in the Indian passenger car industry . Cambridge: Energy Technology Innovation Project, Kennedy School of Government, Harvard University.

Sahoo, T., Banwet, D. K., & Momaya, K. (2011). Strategic technology management in the auto component industry in India: A case study of select organizations. Journal of Advances in Management Research, 8 (1), 9–29.

Sarwade, W. K. (2015). Evolution and growth of Indian auto industry. Journal of Management Research and Analysis, 2 (2), 136–141.

Senthil Kumar, V. (2012). A study on the effects of customer service and product quality on customer satisfaction and loyalty. Namex International Journal of Management Research, 2 (2), 123–129.

Shalender, K., & Yadav, R. K. (2019). Strategic flexibility, manager personality, and firm performance: The case of Indian Automobile Industry. Global Journal of Flexible Systems Management, 20 (1), 77–90.

SIAMINDIA. (2019). http://www.siam.in/cpage.aspx?mpgid=42&pgidtrail=87#AutomotiveMissionPlan20062016 . Retrieved 5 Sep 2019.

SIAMINDIA. (2019). http://www.siamindia.com/statistics.aspx?mpgid=8&pgidtrail=9 . Retrieved 6 Sep 2019.

Sturdy, A., & Grey, C. (2003). Beneath and beyond organizational change management: Exploring alternatives. Organization, 10, 651–662.

Sushil, (2005). Flexible strategy framework for managing continuity and change. International Journal of Global Business and Competitiveness, 1 (1), 22–32.

Sushil, (2012). Making flowing stream strategy work. Global Journal of Flexible Systems Management, 13 (1), 25–40.

Sushil, (2013). Flowing stream strategy: Leveraging strategic change with continuity . New Delhi: Springer.

Tambade, H., Singh, R. K., & Modgil, S. (2019). Identification and evaluation of determinants of competitiveness in the Indian auto-component industry. Benchmarking: An International Journal, 26 (3), 922–950.

Tata Motors, annual report. (2018). https://www.tatamotors.com/wp-content/uploads/2018/07/12115930/Annual-Report-2017-2018.pdf . Retrieved 9 Aug 2019.

Tata Motors, annual report. (2019). https://www.tatamotors.com/investors/annual-reports/ . Retrieved 16 Aug 2019.

Upadhyayula, V. K., Parvatker, A. G., Baroth, A., & Shanmugam, K. (2019). Lightweighting and electrification strategies for improving environmental performance of passenger cars in India by 2030: A critical perspective based on life cycle assessment. Journal of Cleaner Production, 209, 1604–1613.

Van de Ven, A. H., & Poole, M. S. (1995). Explaining development and change in organizations. Academy of Management Review, 20 (3), 510–540.

Van den Waeyenberg, S., & Hens, L. (2008). Crossing the bridge to poverty, with low-cost cars. Journal of Consumer Marketing, 25 (7), 439–445.

Volberda, H. W. (1998). Building the flexible firm: How to remain competitive. Corporate Reputation Review, 2 (1), 94–96.

Weick, K. E., & Quinn, R. E. (1999). Organizational change and development. Annual Review of Psychology, 50 (1), 361–386.

Download references

Acknowledgements

The authors acknowledge all those who have contributed in improving the quality of the paper, including the anonymous reviewers and editors. The authors acknowledge the value-addition by the Editor-in-Chief.

Author information

Authors and affiliations.

Indian Institute of Technology Delhi, New Delhi, India

Sushil & Shamita Garg

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Shamita Garg .

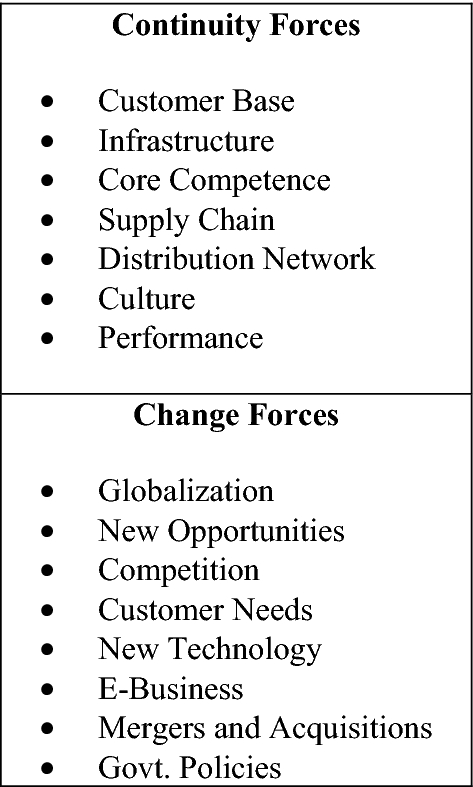

See Figs. 10 and 11 .

(source: developed based on data collected from annual reports of Tata Motors)

Percentage of revenue from (international operations)

Continuity and change forces

Appendix B: Continuity and Change Forces for Tata Motors Over Time

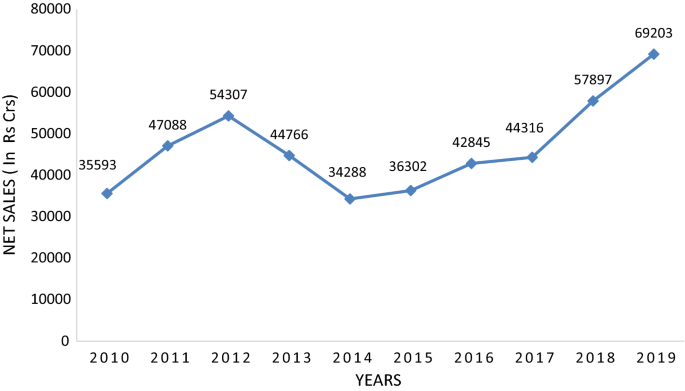

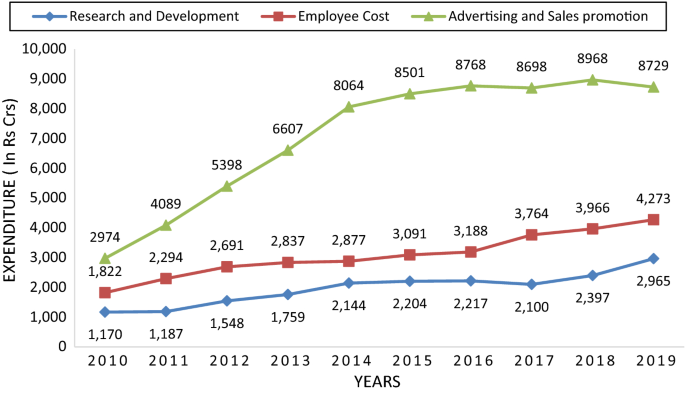

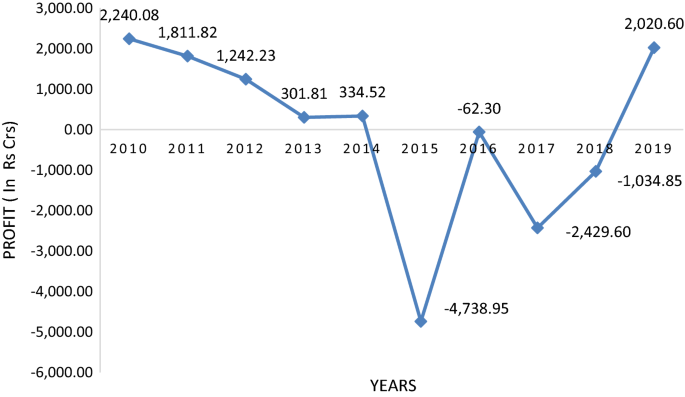

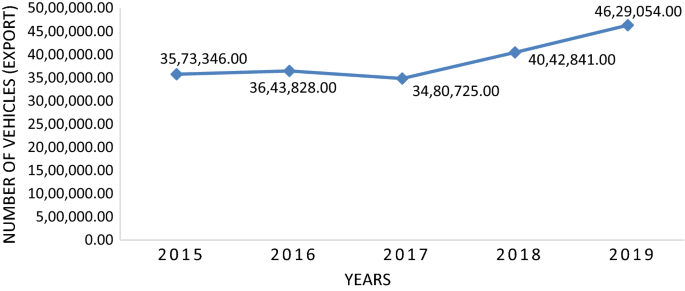

See Figs. 12 , 13 , 14 , 15 , 16 and 17 .

(source: developed based on data searched on ACE equity)

Revenue from net sales (in Rs crores)

source: developed based on data searched on ACE equity)

Expenditure (in Rs crores) (

Profit and loss incurred (in Rs crores)

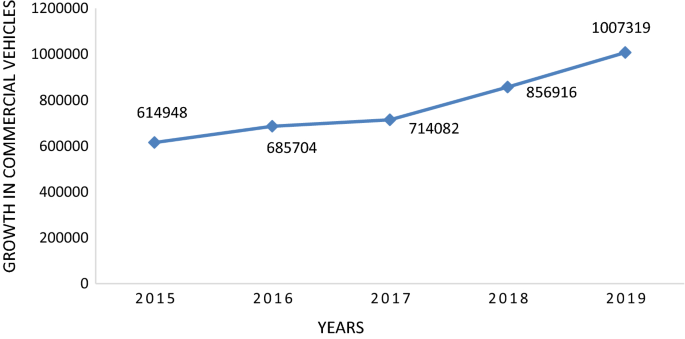

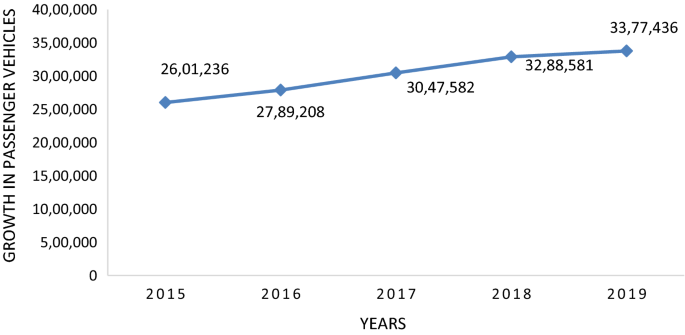

source: developed based on data searched on SIAM)

Number of vehicles (export)

(source: developed based on data searched on SIAM)

Growth in commercial vehicles

Growth in passenger vehicles (

Rights and permissions

Reprints and permissions

About this article

Sushil, Garg, S. Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy Process. JGBC 14 , 54–70 (2019). https://doi.org/10.1007/s42943-019-00006-z

Download citation

Received : 14 October 2019

Accepted : 15 November 2019

Published : 03 January 2020

Issue Date : December 2019

DOI : https://doi.org/10.1007/s42943-019-00006-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Competitiveness

- Flowing stream strategy

- Internationalization

- Tata Motors

- Find a journal

- Publish with us

- Track your research

A Comparative Study on Financial Performance of Tata Motors and Toyota Motor Corporation Cars

8 Pages Posted: 15 Aug 2022

Abdul Rahman

Mangalore University - Department of Commerce

Parameshwar Acharya

Mangalore University

Date Written: April 6, 2020

The Indian automobile industry has a pivotal role in the automobile market in the world, because the automobile industry in India is world’s fourth largest and seventh largest manufacturer of commercial vehicles. Automobile industry is largest sector which contribute the 45% manufacturing Gross domestic product and 7.1% GDP to nation. Asper sources, the major automobile players in the Indian market are expected to make India a leader in the two-wheeler and four-wheeler market in the world by 2021.The of rise in income and increasing number of middle-income levels, the demand for cars is been increasing. Customer attraction, sales rise and profit are the main objective of all automobile industry. We have selected two automobile industry Tata Motors and Toyota Motor Corporation. We have attempted analyse the trend situation in sales and profit for five years working capital is also been used in finding the trend. The main focus has been laid on financial performance of Tata Motors and Toyota Motor Corporation Car Company for the five years from 2015-2019 and to analyze whether the improper working capital management can affect the company profitability of automobile sector or not, when it comes to working capital performance, size remains an important.

Keywords: Automobile Industry and Financial Performance, Tata Motors and Toyota Motor Corporation

Suggested Citation: Suggested Citation

Abdul Rahman (Contact Author)

Mangalore university - department of commerce ( email ), mangalore university ( email ).

DEPARTMENT OF COMMERCE MANGALORE UNIVERSITY MANGALORE India

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, finance education ejournal.

Subscribe to this fee journal for more curated articles on this topic

- SECTOR : AUTOMOBILES & AUTO COMPONENTS

- INDUSTRY : CARS & UTILITY VEHICLES

- TATA MOTORS LTD.

Tata Motors Ltd.

NSE: TATAMOTORS | BSE: 500570

1111.35 -10.30 ( -0.92 %)

85.52% Gain from 52W Low

18.2M NSE+BSE Volume

NSE 30 Aug, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

1 active buys

Broker 1Year sells

1 active sells

Broker 1Year neutral

5 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

Tata Motors Ltd. share price target

Tata motors ltd. has an average target of 1107.57. the consensus estimate represents a downside of -0.34% from the last price of 1111.35. view 25 reports from 8 analysts offering long-term price targets for tata motors ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

| Summary | Date | Stock | Author | LTP | Target | Price at reco (Change since reco%) | Upside(%) | Type | Report | Discuss | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31 Aug 2024 | 1111.35 | 1170.97 | - | 5.36 | pdf Detailed Estimates | ||||||

| 12 Aug 2024 | Target | 1111.35 | 1156.00 | 1076.15 (3.27%) | 4.02 | Accumulate | pdf post cache | Broker Report pdf --> Alert | |||

| 07 Aug 2024 | Target | 1111.35 | 1098.00 | 1025.30 (8.39%) | Target met | Hold | pdf post cache | Broker Report pdf --> Alert | |||

| 04 Aug 2024 | Reco | 1111.35 | 1200.00 | 1096.65 (1.34%) | 7.98 | Hold | pdf post cache | Broker Report pdf --> Alert | |||

| 02 Aug 2024 | Target | 1111.35 | 1025.00 | 1096.65 (1.34%) | Target met | Neutral | pdf post cache | Broker Report pdf --> Alert | |||

| 25 Jun 2024 | Reco Target | 1111.35 | 1200.00 | 955.00 (16.37%) | 7.98 | Buy | pdf post cache | Broker Report pdf --> Alert | |||

| 12 Jun 2024 | 1111.35 | 955.00 | 988.70 (12.41%) | Target met | Neutral | pdf post cache | Broker Report pdf --> Alert | ||||

| 12 Jun 2024 | Target | 1111.35 | 1089.00 | 988.70 (12.41%) | Target met | Accumulate | pdf post cache | Broker Report pdf --> Alert | |||

| 12 Jun 2024 | 1111.35 | 1235.00 | 988.70 (12.41%) | 11.13 | Buy | pdf post cache | Broker Report pdf --> Alert | ||||

| 21 May 2024 | Reco Target | 1111.35 | 1043.00 | 951.30 (16.82%) | Target met | Accumulate | pdf post cache | Broker Report pdf --> Alert | |||

| 15 May 2024 | Reco Target | 1111.35 | 1049.00 | 947.30 (17.32%) | Target met | Hold | pdf post cache | Broker Report pdf --> Alert | |||

| 13 May 2024 | 1111.35 | 959.75 (15.80%) | Results Update | pdf post cache | Broker Report pdf --> Alert | ||||||

| 13 May 2024 | Target | 1111.35 | 1120.00 | 959.75 (15.80%) | Target met | Hold | pdf post cache | Broker Report pdf --> Alert | |||

| 12 May 2024 | Reco Target | 1111.35 | 955.00 | 1046.65 (6.18%) | Target met | Neutral | pdf post cache | Broker Report pdf --> Alert | |||

| 11 May 2024 | Reco Target | 1111.35 | 950.00 | 1046.65 (6.18%) | Target met | Sell | pdf post cache | Broker Report pdf --> Alert | |||

| 10 May 2024 | Target | 1111.35 | 1235.00 | 936.40 (18.68%) | 11.13 | Buy | pdf post cache | Broker Report pdf --> Alert | |||

| 28 Mar 2024 | Reco Target | 1111.35 | 1075.00 | 992.80 (11.94%) | Target met | Accumulate | pdf post cache | Broker Report pdf --> Alert | |||

| 05 Mar 2024 | Target | 1111.35 | 1178.00 | 1021.90 (8.75%) | Target met | Buy | pdf post cache | Broker Report pdf --> Alert | |||

| 05 Mar 2024 | Target | 1111.35 | 1085.00 | 1021.90 (8.75%) | Target met | Hold | pdf post cache | Broker Report pdf --> Alert | |||

| 05 Mar 2024 | Target | 1111.35 | 1188.00 | 1017.65 (9.21%) | 6.90 | Buy | pdf post cache | Broker Report pdf --> Alert | |||

| 12 Feb 2024 | Target | 1111.35 | 1060.00 | 911.60 (21.91%) | Target met | Buy | pdf post cache | Broker Report pdf --> 2 Alert | |||

| more | |||||||||||

TATA Motors Limited: A Revolution in Electric Cars - A Case Study

Chat with Paper

The role of instrumental, hedonic and symbolic attributes in the intention to adopt electric vehicles

The remarkable environmental rebound effect of electric cars: a microeconomic approach., company analysis – the beginning step for scholarly research, quantitative abcd analysis of iedra model of placement determination, overcoming barriers to entry in an established industry: : tesla motors, related papers (5), swot analysis and five competitive forces of chery automobile company, analisis strategi pemasaran pada pt. central international education, can marketing resources contribute to company performance, prospects of russian automobile industry development, swot analysis as a determinant of marketing strategy case, trending questions (1).

- Tata Motors has a huge customer base in the Indian market. - Tata Motors is the market leader in the EV sector.

IMAGES

VIDEO

COMMENTS

The total sales figures for all EVs increased by 20% when compared to 2018-2019. In 2019-. 2020, there were approximately 3400 sales of elec tric cars. Th is paper explains in detail how Tat a ...

The. percentage of revenue from international operations has. increased from 9% in 2016 to 79.80% in 2018. Till 2016, Tata motors used to earn international revenue only through. exports. After ...

PDF | On Dec 5, 2023, Sudip Basu published TATA MOTORS: OVERCOMING CHALLENGES THROUGH STRATEGIC TRANSFORMATION - CASE STUDY | Find, read and cite all the research you need on ResearchGate

In the past few years, Tata Motors succeeded by exploiting international opportunities. Its percentage of revenue from international operations has increased from 9% in 2016 to 79.80% in 2018. Hence its strategy is worthy of study. 'Flexible Strategy Framework' is used to analyse the strategy of Tata Motors which evolved to gain its international presence in the automotive manufacturing ...

2) To study customer satisfaction throughout the globe towards Tata motors 3) To understand the market share of products 4) To sustain in the global market REVIEW OF LITERATURE 1. SM Das, BM Dash PC Pandya Journal of Business Management and Social Sciences Research paper 1 (1), 82-87, 2013

This research paper examined Tata Motors as a case study of the Indian car industry and its sustainable supply chain management practices. The availability of sustainable materials and technology, as well as the regulatory framework for environmental and social concerns, were emphasised in the industry research as obstacles and ...

The objective of this research paper is to know and analyze various CSR initiatives taken by Tata Motors in many years. The study also focuses on several other initiatives by the Tata Group. ... Tata Motors, through its initiatives in education, has always tried to ensure access of quality education to all for the well being of future ...

This paper is an attempt to analyze the financial source of Tata motors limited for the purpose of reveals the strength and weakness of the firm with the help of profitability ratio analysis. Key words: Automobile, Tata Motors, electric and hybrid vehicles. Introduction Tata motors Limited is India's largest automobile company. It is the largest

mestic auto market, before it started staging a rapid recovery. Tata Motors is currently India's third-largest automaker, enjoying a market share of well over 9 percent in the world's fourth-largest auto market, up from a. eagre market share of 4.6 percent in 2016 and 4.8 percent in 2020. The company sold 222,025 passenger autom.

According to the case study, the company, TATA Motors wants to have a multiband approach to. competing in the global car industry. Based on the case study, I analyzed the company as a. whole in the global car industry and based on my findings figured out their SWOT (strengths, weaknesses, opportunities and threats).

ective of this study is to evaluate the performance of Tata Motors during t. e last decade. The reference period taken for study is 5 years starting from 2016 to 2020. Five Ratios were calculated to serve the purpose of assessing the financial performance of the company that includes net profit ma. gin, return on capital employed, inventory ...

A financial statement is an official record of a person's, a company's, or another entity's financial transactions and standing. It is laid down in a clear and structured format for ease of understanding. In the preparation of the final accounts of a firm, the financial statements display the net results for the given year.

Financial Statement Analyses of Tata Motors Limited. Shaikh Salman Masood. Abu Dhabi University, Email: [email protected]. Supervised by. Professor Haitham Nobanee. ABSTRACT. The purpose ...

The main focus has been laid on financial performance of Tata Motors and Toyota Motor Corporation Car Company for the five years from 2015-2019 and to analyze whether the improper working capital management can affect the company profitability of automobile sector or not, when it comes to working capital performance, size remains an important.

(2010 Tata Motors) The establishment ultimately went large in 2008 and joined the exclusive request of motorcars. Tata Motors bought Ford Motor for a total consideration of$2.5 billion from the Jaguar Land Rover enterprises. Tata Motors unveiled the most unique and their topmost stopgap of the People's Vehicle, Tata Nano, unchanged

Tata motors will need to capitalize on both the young population in India through new product designs as well as the low discretionary income in third world companies through a new introduction of the Nano. 2. External Analysis 2.1 Global Competition Tata Motors competes in the global market. As a result, they are fighting with the

are dissatisfied. TATA Motors have to improve its customer care and decrese the price of their spare part and make available in all part of the country Key word: TELCO (TATA Engineering and Locomotive Company), R&D (Research and Development) Sandesh Kumar Sharma et al, Int.J.Buss.Mgt.Eco.Res., Vol 2(4),2011,250-257 250

1.2 INDUSTRY PROFILE. Tata Motors Limited is India's greatest automobiles organization with incomes of Rs. 20,483 crores ( USD 4.7 Billion) in 2004-05 it is the chief with the aid of for in ...

formance of Tata Motors Limited.Scope of the studyThe study was carried out at Tata Motors Ltd in order to determine the efficacy of the company's financial performance during the last five years, from 2016-2017 to 2020-2021, in order to have a clear and cor. ect outline of the company's financial performance. Using a variety of analysis me.

Tata Motors Ltd. share price target. Tata Motors Ltd. has an average target of 1107.57. The consensus estimate represents a downside of -1.26% from the last price of 1121.65. View 25 reports from 8 analysts offering long-term price targets for Tata Motors Ltd.. Reco - This broker has downgraded this stock from it's previous report.

International Journal of Research Publication and Reviews. Journal homepage: www.ijrpr.com ISSN 2582-7421. Financial Analysis and Performance of Tata Motors Pvt Ltd. Ms. C. Nisha1, Sudharsan M2. 1M.COM, Assistant Professor, Department of Commerce, Sri Krishna Adithya College of Arts and Science, Coimbatore.

Tata Motors buys Nissan facility in South Africa. Tata Motors has got a prestigious order from the Delhi Transport Corporation (DTC) for 500 non-ac, CNG-propelled buses. Tata motors Ltd has appointed Mr. P M Telegang as Executive Director (Commercial Vehicles). OBJECTIVE OF THE STUDY The study of the Inventory Management is done in TATA MOTORS LTD.

A survey was used by the author to carry out this study. The effect of has been the focus of the study. Secondary data are gathered for the study from a variety of sources, including TATA motors Ltd. websites, research papers, newspaper articles, and journals. Findings/Result: This paper has studied a SWOT analysis of Tata Motors Limited.