- Search Search Please fill out this field.

- US & World Economies

- Fiscal Policy

U.S. National Debt by Year

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

How to Look at the National Debt by Year

Debt by year compared to nominal gdp and events.

The U.S. national debt grew to a record $34 trillion by the end of 2023, and it ballooned to nearly $35 trillion by the middle of 2024. It's grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it's greater than the annual economic output of the entire country, which is measured as the gross domestic product (GDP).

This chart of the national debt by year shows the figure's astonishing growth—from just $16 billion in 1930.

Key Takeaways

- The U.S. national debt climbed to $34 trillion for the first time in December 2023, up from about $31.42 trillion one year earlier.

- The debt-to-GDP ratio gives insight into whether the U.S. can cover all its debt.

- Recessions, defense budget growth, and tax cuts have all caused the national debt-to-GDP ratio to rise to record levels.

- The U.S. can't afford to default on its debt without major global economic consequences.

It's best to look at a country's national debt in context. Expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health during a recession. It can reduce the debt if it boosts enough growth. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. The cuts worsen the national debt without boosting growth enough to replace lost revenue if tax rates are lower.

Major events like wars and pandemics can increase the national debt.

The U.S. increases military spending during national threats. The U.S. debt grew after the Sept. 11, 2001 attacks as the country increased military spending to launch the War on Terror. These efforts cost $6.4 trillion, including increases to the Department of Defense and the Veterans Administration, between fiscal years 2001 and 2020.

The national debt by year should be compared to the size of the economy as measured by the gross domestic product (GDP). That gives you the debt-to-GDP ratio . This ratio is important because investors worry about default when it's greater than 77%. That's the tipping point, according to the World Bank.

The World Bank found that it slowed economic growth if the debt-to-GDP ratio exceeded 77% for an extended period. Every percentage point of debt above this level costs the country 0.017 percentage points in economic growth.

You can also use the debt-to-GDP ratio to compare the national debt to other countries. It gives you an idea of how likely the country is to pay back its debt.

The national debt is compared to GDP and influential events since 1929 in this table. The debt and GDP are given as of the end of the fourth quarter of each year unless otherwise noted. This coincides with the end of the fiscal year. That's the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

Debt and GDP are given at the end of the second quarter from 1947 through 1976 because the fiscal year ended on June 30 during that time. Debt is reported at the end of the second quarter for the years 1929 through 1946. GDP is reported annually because quarterly figures aren't available.

The national debt was about $34.8 trillion at the end of the second quarter of 2024. The debt-to-GDP ratio was about 122% in the first quarter of 2024.

| 1929 | $17 | 16% | Market crash |

| 1930 | $16 | 17% | Smoot-Hawley reduced trade |

| 1931 | $17 | 22% | Dust Bowl drought raged |

| 1932 | $20 | 34% | Hoover raised taxes |

| 1933 | $23 | 40% | New Deal increased GDP and debt |

| 1934 | $27 | 40% | |

| 1935 | $29 | 39% | Social Security |

| 1936 | $34 | 40% | Tax hikes renewed depression |

| 1937 | $36 | 39% | Third New Deal |

| 1938 | $37 | 42% | Dust Bowl ended |

| 1939 | $40 | 51% | Depression ended |

| 1940 | $43 | 49% | FDR increased spending and raised taxes |

| 1941 | $49 | 44% | U.S. entered WWII |

| 1942 | $72 | 48% | Defense tripled |

| 1943 | $137 | 70% | |

| 1944 | $201 | 91% | Bretton Woods |

| 1945 | $259 | 114% | WWII ended |

| 1946 | $269 | 119% | Truman's 1st term budgets and recession |

| 1947 | $258 | 103% | Cold War |

| 1948 | $252 | 92% | Recession |

| 1949 | $253 | 93% | Recession |

| 1950 | $257 | 86% | Korean War boosted growth and debt |

| 1951 | $255 | 74% | |

| 1952 | $259 | 71% | |

| 1953 | $266 | 68% | Recession when war ended |

| 1954 | $271 | 69% | Eisenhower's budgets and Recession |

| 1955 | $274 | 64% | |

| 1956 | $273 | 61% | |

| 1957 | $271 | 57% | Recession |

| 1958 | $276 | 58% | Eisenhower's 2nd term and recession |

| 1959 | $285 | 55% | Fed raised rates |

| 1960 | $286 | 54% | Recession |

| 1961 | $289 | 52% | Bay of Pigs |

| 1962 | $298 | 50% | JFK budgets and Cuban missile crisis |

| 1963 | $306 | 48% | U.S. aids Vietnam, JFK killed |

| 1964 | $312 | 46% | LBJ's budgets and war on poverty |

| 1965 | $317 | 43% | U.S. entered Vietnam War |

| 1966 | $320 | 40% | |

| 1967 | $326 | 40% | |

| 1968 | $348 | 39% | |

| 1969 | $354 | 36% | Nixon took office |

| 1970 | $371 | 35% | Recession |

| 1971 | $398 | 35% | Wage and price controls |

| 1972 | $427 | 34% | Stagflation |

| 1973 | $458 | 33% | Nixon ended gold standard and OPEC oil embargo |

| 1974 | $475 | 31% | Watergate and budget process created |

| 1975 | $533 | 32% | Vietnam War ended |

| 1976 | $620 | 33% | Stagflation |

| 1977 | $699 | 34% | Stagflation |

| 1978 | $772 | 33% | Carter budgets and recession |

| 1979 | $827 | 32% | |

| 1980 | $908 | 32% | Volcker raised fed rate to 20% |

| 1981 | $998 | 31% | Reagan tax cut |

| 1982 | $1,142 | 34% | Reagan increased spending |

| 1983 | $1,377 | 37% | Jobless rate 10.8% |

| 1984 | $1,572 | 38% | Increased defense spending |

| 1985 | $1,823 | 41% | |

| 1986 | $2,125 | 46% | Reagan lowered taxes |

| 1987 | $2,350 | 48% | Market crash |

| 1988 | $2,602 | 50% | Fed raised rates |

| 1989 | $2,857 | 51% | S&L Crisis |

| 1990 | $3,233 | 54% | First Iraq War |

| 1991 | $3,665 | 58% | Recession |

| 1992 | $4,065 | 61% | |

| 1993 | $4,411 | 63% | Omnibus Budget Act |

| 1994 | $4,693 | 64% | Clinton budgets |

| 1995 | $4,974 | 64% | |

| 1996 | $5,225 | 64% | Welfare reform |

| 1997 | $5,413 | 63% | |

| 1998 | $5,526 | 60% | LTCM crisis and recession |

| 1999 | $5,656 | 58% | Glass-Steagall repealed |

| 2000 | $5,674 | 55% | Budget surplus |

| 2001 | $5,807 | 55% | 9/11 attacks and EGTRRA |

| 2002 | $6,228 | 57% | War on Terror |

| 2003 | $6,783 | 59% | JGTRRA and Iraq War |

| 2004 | $7,379 | 60% | Iraq War |

| 2005 | $7,933 | 61% | Bankruptcy Act and Hurricane Katrina. |

| 2006 | $8,507 | 61% | Bernanke chaired Fed |

| 2007 | $9,008 | 62% | Bank crisis |

| 2008 | $10,025 | 68% | Bank bailout and QE |

| 2009 | $11,910 | 82% | Bailout cost $250B ARRA added $242B |

| 2010 | $13,562 | 90% | ARRA added $400B, payroll tax holiday ended, Obama Tax cuts, ACA, Simpson-Bowles |

| 2011 | $14,790 | 95% | Debt crisis, recession and tax cuts reduced revenue |

| 2012 | $16,066 | 99% | Fiscal cliff |

| 2013 | $16,738 | 99% | Sequester, government shutdown |

| 2014 | $17,824 | 101% | QE ended, debt ceiling crisis |

| 2015 | $18,151 | 100% | Oil prices fell |

| 2016 | $19,573 | 105% | Brexit |

| 2017 | $20,245 | 104% | Congress raised the debt ceiling |

| 2018 | $21,516 | 105% | Trump tax cuts |

| 2019 | $22,719 | 107% | Trade wars |

| 2020 | $27,748 | 129% | COVID-19 and 2020 recession |

| 2021 | $29,617 | 124% | COVID-19 and American Rescue Plan Act |

| 2022 | $31,420 | 119% | Inflation Reduction Act and student loan forgiveness |

| 2023 | $34,001 | 122% | Fed raises rates |

Frequently Asked Questions (FAQs)

Who owns the national debt.

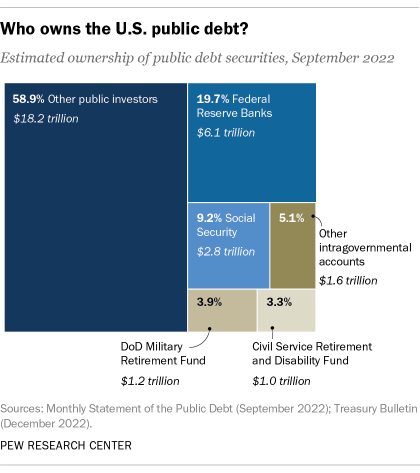

The public holds the largest portion of the national debt. This includes individuals, corporations, Federal Reserve banks, state and local governments, and foreign governments. A smaller portion of the national debt, known as "intragovernmental debt," is owned by other federal agencies.

How is the national debt calculated?

The national debt is the total of all outstanding government liabilities owed to the public or to intragovernmental agencies. It includes Treasury bills , notes, and bonds, as well as Treasury inflation-protected securities (TIPS) and government account series.

When did the national debt start?

The U.S. has carried a debt ever since its founding in 1776. The country borrowed money to fund the war effort during the American Revolution .

U.S. Department of the Treasury. “ The Debt to the Penny .”

National Bureau of Economic Research. " Dynamic Scoring: A Back-of-the-Envelope Guide ."

Watson Institute for International & Public Affairs. " United States Budgetary Costs and Obligations of Post-9/11 Wars Through FY2020: $6.4 Trillion ."

World Bank Group. " Finding the Tipping Point - When Sovereign Debt Turns Bad ."

U.S. Treasury. " Historical Debt Outstanding ."

Office of Management and Budget and Federal Reserve Bank of St. Louis via Federal Reserve Economic Data (FRED). " Gross Federal Debt as Percent of Gross Domestic Product ."

Bureau of Economic Analysis. " Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2024 ."

United States Treasury. " Debt to the Penny ."

:max_bytes(150000):strip_icc():format(webp)/nationaldebtandhowitaffectsyou-e0e4d9499e294d628d0f50bc3960e7bc.jpg)

No results found

We're sorry, but there are no results that match your search criteria. Try checking your spelling or using alternate search terms. We add new data to USAFacts all the time; you can subscribe to our newsletter to get unbiased, data-driven insights sent to your inbox weekly, no searching required.

Subscribe to get unbiased, data-driven insights sent to your inbox weekly.

- Government finance

- Defense and security

- Environment

- Guides and reports

What is the US national debt and how has it grown over time?

The national debt is projected to grow to unprecedented levels if the federal government continues to operate at a deficit.

Updated on Thu, August 1, 2024 by the USAFacts Team

The national debt is the total amount of outstanding borrowed money the federal government has accumulated over time.

Every year the US spends more money than it earns results in an annual budget deficit .

These deficits add up over time, creating a shortfall that the US covers, in part, by borrowing money from investors; otherwise, the government would need to cut services, increase revenues, or some combination. These loans — plus the interest owed — are the national debt.

The national debt grows every year there’s a deficit, as the country borrows an increasing amount of money. The US has run a budget deficit every year for the last 20 years, during which time national debt has grown fivefold.

How has the national debt changed over time?

The national debt has grown by $30.71 trillion since 1993, and nearly $16.79 trillion in the last decade. [1] The largest national debt increases followed the Great Recession in 2008 and the COVID-19 pandemic in 2020.

The national debt grew $2.41 trillion over the last 365 days, an increase of about $6.6 billion a day.

The national debt must remain below the debt ceiling , a limit imposed by Congress on the amount the federal government can borrow. (Under the Fiscal Responsibility Act of 2023 , the debt ceiling is suspended until January 1, 2025,. By that date, Congress can either extend the debt suspension, or raise the debt ceiling.)

To fund its budget deficit—the gap between what it spends and what it earns—the government sells various types of government securities like Treasury bills, notes, bonds, and more. This money allows the US to cover its deficit in the short-term by promising to pay back the government securities with interest at a later date.

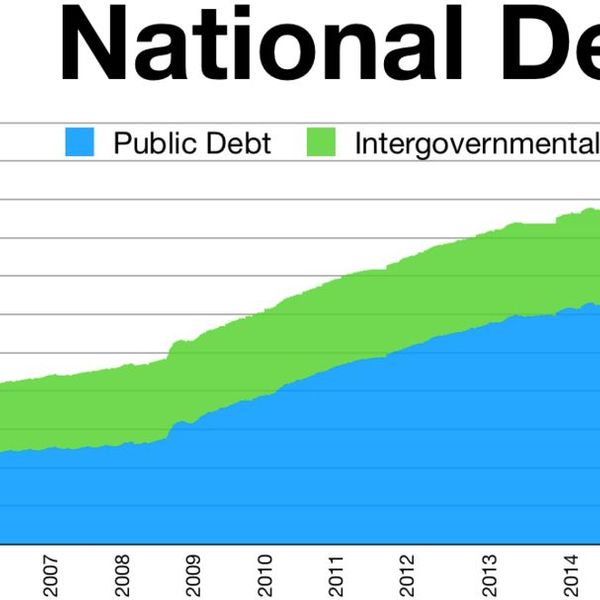

The debt is categorized into two types: public debt and intragovernmental debt. Public debt is owned by individuals, companies, and foreign governments, while intragovernmental debt is held within different parts of the US government itself.

For a 15-minute deep dive, watch founder Steve Ballmer break down immigration in the US by the numbers.

As these securities come with a promise of interest payments, the government's obligation to pay interest increases its financial burden. This means a larger portion of the government’s budget goes towards paying off this debt, which can limit funding available for other government programs.

The growing national debt is considered unsustainable in the intermediate- and long-term, according to a 2022 Government Accountability Office report . The Congressional Budget Office notes that it is unlikely to shrink over the next several years.

Where does this data come from?

This data is sourced from the Treasury Department's ' Debt to the Penny ' dataset. It details the total outstanding public debt, updated daily. Information on the debt ceiling is also drawn from the Treasury's corresponding page , supplemented by historical research on changes to the debt limit.

Additional resources are pulled from the Congressional Budget Office’s Options for Reducing the Deficit publication, which tracks the national debt and projects future rates in different scenarios.

To get a full picture of the US economy , read more about the strength of the US dollar , and get the data directly in your inbox by signing up for our newsletter .

National debt figures are in nominal rather than inflation-adjusted dollars.

Explore more of USAFacts

Related articles, fannie mae and freddie mac: a look at the two mortgage giants under federal control since 2008, minimum wage in america: how many people are earning $7.25 an hour, what is gross domestic product, or gdp, what is inflation and how is it measured, related data, data delivered to your inbox.

Keep up with the latest data and most popular content.

SIGN UP FOR THE NEWSLETTER

Presentations made painless

- Get Premium

129 National Debt Essay Topic Ideas & Examples

Inside This Article

The national debt is a hot topic in politics and economics, with many people debating the best ways to address it. If you're looking for essay topics on the national debt, we've compiled a list of 129 ideas to help you get started. Whether you're interested in exploring the causes of the national debt, analyzing its impact on the economy, or proposing solutions to reduce it, there's a topic on this list for you. Here are some examples to inspire your next essay:

- The history of the national debt in the United States

- The impact of the national debt on future generations

- How political parties differ in their approaches to reducing the national debt

- The role of government spending in contributing to the national debt

- The effects of the national debt on interest rates and inflation

- How the national debt affects the value of the dollar

- The connection between the national debt and economic growth

- The impact of the national debt on social programs like Social Security and Medicare

- The relationship between the national debt and income inequality

- The role of the Federal Reserve in managing the national debt

These are just a few examples of the many essay topics you could explore related to the national debt. Whether you're writing a research paper, persuasive essay, or policy proposal, there's plenty of material to work with when it comes to this complex and important issue. Happy writing!

Want to research companies faster?

Instantly access industry insights

Let PitchGrade do this for me

Leverage powerful AI research capabilities

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2024 Pitchgrade

- Foreign Affairs

- CFR Education

- Newsletters

Climate Change

Global Climate Agreements: Successes and Failures

Backgrounder by Lindsay Maizland December 5, 2023 Renewing America

- Defense & Security

- Diplomacy & International Institutions

- Energy & Environment

- Human Rights

- Politics & Government

- Social Issues

Myanmar’s Troubled History

Backgrounder by Lindsay Maizland January 31, 2022

- Europe & Eurasia

- Global Commons

- Middle East & North Africa

- Sub-Saharan Africa

How Tobacco Laws Could Help Close the Racial Gap on Cancer

Interactive by Olivia Angelino, Thomas J. Bollyky , Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

- Backgrounders

- Special Projects

United States

Book by Max Boot September 10, 2024

- Centers & Programs

- Books & Reports

- Independent Task Force Program

- Fellowships

Oil and Petroleum Products

Academic Webinar: The Geopolitics of Oil

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

- Students and Educators

- State & Local Officials

- Religion Leaders

- Local Journalists

NATO's Future: Enlarged and More European?

Virtual Event with Emma M. Ashford, Michael R. Carpenter, Camille Grand, Thomas Wright, Liana Fix and Charles A. Kupchan June 25, 2024 Europe Program

- Lectureship Series

- Webinars & Conference Calls

- Member Login

The U.S. National Debt Dilemma

- The U.S. national debt has soared to historic levels relative to the size of the U.S. economy.

- Many economists say that a rapidly mounting debt load could soon diminish U.S. economic growth, restrict government spending on important programs, and raise the likelihood of financial crises.

- U.S. lawmakers have been unable to compromise on long-term budget reforms that would tame the debt, and some experts argue that it will soon reach a tipping point.

Introduction

Economists, investors, and lawmakers are again raising alarm bells about the U.S. national debt. Years of elevated budget deficits, exacerbated by massive federal spending during the COVID-19 pandemic, have taken the debt to historic levels: totaling more than $26 trillion in 2023, U.S. federal government debt is now at its highest percentage of gross domestic product (GDP) since World War II. Equally alarming to many experts is the debt’s unsustainable trajectory, as spending is projected to continue outpacing revenues under current law.

Today, the national debt is almost the same size as the entire U.S. economy, and the debt is on track to double within the next thirty years. Some economists say that could expose the country to a number of dangers, including a budget crisis, rising interest rates, greater economic instability, and a diminished global leadership role. Reducing the debt will require Congress to make politically difficult decisions to either curb spending, raise taxes, or both. Other experts say the United States can safely afford to continue borrowing at present levels because it pays relatively little interest due to its unique position in the global economy.

How did the debt get where it is today?

- Budget, Debt, and Deficits

- U.S. Economy

- Fiscal Policy

The United States has run annual deficits—spending more than the Treasury Department collects in taxes—almost every year since the nation’s founding. (The deficit is a yearly measure, while debt refers to the cumulative amount that the government owes. Measuring both as a proportion of GDP is a standard way of comparing spending over time, because this method automatically adjusts for inflation, population growth, and changes in per capita income.) The end of World War II, after which the United States emerged as a global superpower, is a good starting point from which to examine modern debt levels. Defense spending during the war led to unprecedented borrowing, with the debt skyrocketing to more than 100 percent of GDP in 1946.

Daily News Brief

A summary of global news developments with cfr analysis delivered to your inbox each morning. weekdays., the world this week, a weekly digest of the latest from cfr on the biggest foreign policy stories of the week, featuring briefs, opinions, and explainers. every friday., think global health.

A curation of original analyses, data visualizations, and commentaries, examining the debates and efforts to improve health worldwide. Weekly.

Over the next thirty years, sustained economic growth gradually reduced the debt as a percentage of the economy, despite expensive wars in Korea and Vietnam and the establishment of major entitlement programs, including Medicare and Medicaid. Overall, debt as a percentage of GDP bottomed out in 1974, at 24 percent.

In the 1980s, the Ronald Reagan administration vastly increased defense spending and enacted sweeping tax cuts, ushering in a new period of rising debt. During the 1990s, a combination of tax increases, defense cuts, and an economic boom reduced the debt as a percentage of GDP. In 1998, President Bill Clinton and a Republican-controlled Congress oversaw the first of four consecutive years of budget surpluses—the first such streak in forty years.

Deficits returned under President George W. Bush, who led a period of tax cuts, war spending in Afghanistan and Iraq, and major new entitlements, such as Medicare Part D, which added prescription drug coverage to the program. Annual deficits hit record levels—more than $1 trillion—under President Barack Obama, who, in response to the Great Recession, continued the Bush administration’s bank bailout program and provided hundreds of billions of dollars in fiscal stimulus.

What does the government spend money on?

The federal budget is divided between mandatory and discretionary spending and interest payments on the debt. Most of the budget goes toward mandatory spending, which is automatic unless Congress alters the legislation authorizing it. This spending primarily consists of entitlement programs, such as Social Security, Medicare, and Medicaid. The remainder goes toward discretionary spending, which Congress must authorize each year through the appropriations process, and debt service. In fiscal year 2022, only 27 percent of federal spending went toward discretionary programs, with the heaviest spending, about $750 billion, going to defense-related agencies and programs. Other major discretionary outlays, including health, education, veterans’ benefits, and transportation, each made up less than $150 billion.

What are the primary drivers of debt growth?

On the spending side of the ledger, the nonpartisan Congressional Budget Office (CBO) projects the main drivers to be mandatory spending programs, namely Social Security—the largest U.S. government program—Medicare, and Medicaid. (These CBO projections assume that the laws underlying federal revenue and spending remain unchanged.) Their costs are expected to rise as a percentage of GDP as the U.S. population ages and health expenses climb without any corresponding increase in revenue.

In the immediate future, interest payments on the debt are also expected to increase dramatically in relation to GDP. They have recently risen to their highest levels in more than twenty years as the Federal Reserve raised rates to combat inflation sparked by the pandemic and the Russian invasion of Ukraine. In fiscal year 2023, net interest payments on the national debt reached $659 billion—about 2.5 percent of GDP—and they are projected to surge to nearly 7.5 percent over the next thirty years. On the other hand, discretionary spending—including, for example, spending on defense and transportation—is expected to remain constant as a share of GDP.

The steady growth in federal spending in the coming decades is expected to occur while government tax revenue remains low relative to the size of the economy. In 2017, President Donald Trump signed off on the Tax Cuts and Jobs Act, the most significant tax legislation in a generation. Trump and some Republican lawmakers said the bill’s tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists disagreed. The CBO said the law would actually increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the next ten years.

Tax cuts will add another roughly $1.8 trillion to the debt over the next ten years.

The national debt swelled during the COVID-19 pandemic as the government spent trillions of dollars to boost the flagging economy, including on stimulus checks for citizens and aid for businesses and state and local governments. These measures increased the federal deficit to $3.1 trillion in 2020, about 15 percent of GDP—the highest level since World War II.

President Joe Biden has signed into law several initiatives that are projected to increase the debt, including an infrastructure bill the CBO projected will increase the federal deficit by more than $250 billion over the next decade and landmark climate legislation that independent experts say will add $750 billion to the deficit over the next decade. (CBO and independent models initially projected that legislation would reduce the deficit by almost $250 billion). Biden has also forgiven $127 billion in student loans, though a wider forgiveness plan was rejected by the Supreme Court. Meanwhile, U.S. foreign-assistance spending reached a seventy-year high in 2022 as the United States provided Ukraine tens of billions in aid to fight off Russia’s invasion, though it remains less than 1 percent of total government spending. As of September 2023, the deficit measured as a proportion of GDP was larger than in any fiscal year in which the United States did not face war, recession, or another emergency.

How does U.S. debt compare to that of other countries?

The pandemic sharply increased borrowing around the world, according to the International Monetary Fund . Among advanced economies, debt as a percentage of GDP increased from around 75 percent to more than 80 percent. As of 2023, the United States’ debt-to-GDP ratio is among the highest in the developed world, behind only Japan and Italy .

However, the United States has long been the world’s largest economy, with no record of defaulting on its debt. Moreover, the U.S. dollar has been the world’s reserve currency since the 1940s.

High domestic and international demand for the dollar has helped the United States finance its debt. This is because many investors, including central banks around the world, hold dollar-denominated assets, such as U.S. Treasury bills, notes, and bonds, due to their relative safety (low risk), the unparalleled size of the U.S. debt market , and more recently, the opportunity to generate a higher yield than on safe euro- or yen-denominated securities. (These Treasurys are the primary financial instruments that the U.S. government issues to finance its spending.)

Who holds the debt?

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. They include domestic and foreign investors , as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 30 percent of the total. Japan holds the most, with more than $1 trillion; China, which was the United States’ largest creditor for much of the last decade, holds the next most, though its reported holdings have fallen in recent years. Apart from China, Japan, and the United Kingdom, no other country holds more than $500 billion . An increasing share of foreign holdings now comes from governments with large financial-services industries, including Belgium, Ireland, Luxembourg, and the Cayman Islands.

How much does rising U.S. debt matter?

The sheer volume of accumulating deficits, alongside a long-running lack of political will to raise revenue or cut spending, has renewed debate over the peril posed by the national debt.

Some economists fear that continued growth of the national debt could undermine U.S. global leadership by leaving fewer dollars for U.S. military, diplomatic, and humanitarian operations around the world. Other experts worry that large debts could become a drag on the economy or precipitate a fiscal crisis, arguing that there is a tipping point beyond which large accumulations of government debt begin to slow growth. Under this scenario, investors could lose confidence in Washington’s ability to right its fiscal ship and become unwilling to finance U.S. borrowing without much higher interest rates. This would result in even larger borrowing costs, or what is sometimes called a debt spiral. A fiscal crisis of this nature could necessitate sudden and economically painful spending cuts or tax increases.

What is the debt ceiling?

The debt ceiling is the congressionally mandated limit on how much the Treasury Department can borrow, including to pay debts the United States already owes. Since it was established during World War I, the debt ceiling has been raised dozens of times.

Some experts say that servicing the debt could divert investment from vital areas, such as infrastructure, education, and the fight against climate change.

In recent years, this once-routine act has become a highly partisan game of brinkmanship that has brought the United States near default on several occasions. Experts such as CFR’s Brad W. Setser argue that the United States has both domestic and international incentives to scrap the debt ceiling, which they view as an unnecessary risk. The only other advanced economy to have one is Denmark, and it has never come close to reaching its ceiling.

What are the policy options for dealing with the debt?

Politicians and policy experts have put forward countless plans over the years to balance the federal budget and reduce the debt. Most include a combination of deep spending cuts and tax increases to bend the debt curve.

Cutting spending . Most comprehensive proposals to rein in the debt include major cuts to spending on entitlement programs and defense. For instance, the 2010 Simpson-Bowles plan , a major, bipartisan deficit-reduction plan that failed to win support in Congress, would have put debt on a downward path and reduced overall spending, including for the military. It also would have reduced Medicare and Medicaid payments and put Social Security on sustainable footing by reducing some benefits and raising the retirement age. Economists including CFR’s Benn Steil have called on Congress to create a new bipartisan commission similar to the Simpson-Bowles model.

Raising revenue . Most budget reform plans also seek to raise tax revenue, whether by eliminating deductions and other tax subsidies, raising rates on higher earners and corporations, or introducing new taxes, such as a carbon tax. Simpson-Bowles would have raised more than $1 trillion in new tax revenue. However, more than 80 percent of Republicans in Congress have signed a pledge never to raise taxes, limiting lawmakers’ ability to find compromise on revenue generation.

Some optimists believe that the federal government could continue expanding the debt many years into the future with few consequences, thanks to the reservoirs of trust the U.S. economy has accumulated in the eyes of investors. But many experts say this is simply too risky, and that time is running out to get the debt under control. Economists at the Penn Wharton Budget Model estimate that financial markets cannot sustain more than twenty additional years of deficits. At that point, they argue, no amount of tax increases or spending cuts would suffice to avert a devastating default. “The debt doesn’t matter until it does,” says Maya MacGuineas, president of the bipartisan Committee for a Responsible Federal Budget. “By taking advantage of our privileged position in the global economy, we may well lose it.”

Recommended Resources

This Backgrounder by CFR’s Noah Berman looks at what happens when the United States hits its debt ceiling.

In this blog post, economist Benn Steil of CFR and Glenn Hubbard of Columbia University give their respective takes on the U.S. national debt.

In this In Brief, CFR economics expert Brad W. Setser argues that the United States has every reason to abolish the debt ceiling.

For Foreign Affairs , economists Jason Furman and Lawrence H. Summers write that Washington should end its debt obsession .

The Peterson Institute for International Economics’s Olivier Blanchard suggests that the United States reduce its deficit but accept that debt ratios will remain high.

The University of California, Berkeley’s Barry Eichengreen and coauthors trace the evolution of sovereign debt.

Andrew Chatzky contributed to this report. Will Merrow created the graphics.

More From Renewing America

Currency Reserves

The Future of the U.S. Dollar

Virtual Event with Eswar S. Prasad, Carmen M. Reinhart, Benn Steil and Laura D. Tyson October 6, 2020 Greenberg Center for Geoeconomic Studies

Is Industrial Policy Making a Comeback?

Backgrounder by Anshu Siripurapu and Noah Berman September 18, 2023 Renewing America

Why Are Supply Chains Blocked?

Blog Post by A. Michael Spence November 3, 2021 Renewing America

Top Stories on CFR

The Harris-Trump Debate: Foreign Policy Issue Guide

Article by Noah Berman and Diana Roy September 6, 2024

Indo-Pacific

Guam’s Strategic Importance in the Indo-Pacific

In Brief by Clara Fong and Diana Roy September 6, 2024

Getting Economic Security Right

Article by Matthew P. Goodman September 4, 2024 RealEcon

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

5 facts about the U.S. national debt

President Joe Biden and the Republican-controlled House of Representatives appear to be on a collision course over raising the statutory limit on the national debt. House Republicans say they want Biden to accept significant (but unspecified) spending cuts in exchange for raising the limit. But the president has insisted that raising the limit – which allows the government to continue paying its obligations under the law on time – shouldn’t be a budgetary bargaining chip.

Public concern about federal spending is on the rise. In a new Pew Research Center survey about the public’s policy priorities, 57% of Americans cited reducing the budget deficit as a top priority for the president and Congress to address this year, up from 45% a year ago. Concern has risen among members of both parties, although Republicans and Republican-leaning independents are still far more likely than Democrats and Democratic leaners (71% vs. 44%) to view cutting the deficit as a leading priority. (When the government spends more than it takes in, it borrows to make up the difference. The debt, therefore, can be seen as the accumulated sum of previous years’ deficits that is still outstanding.)

Federal borrowing has essentially already hit the current debt limit of $31.38 trillion, though Treasury Secretary Janet Yellen has said she can use a variety of accounting maneuvers to postpone a government default for a few months. So far, neither the administration nor the House is budging from the positions they’ve staked out, so the standoff continues.

With that in mind, here’s a primer on the national debt of the United States. (For more on the statutory debt limit, read “Why does the U.S. have a debt limit, anyway?” below.)

Aside from Denmark , the United States is the only country with a law setting a specific monetary limit on its national debt. (Australia enacted such a limit during the 2007-09 global financial crisis, only to repeal it a few years later.)

Some other countries have debt caps linked to their gross domestic product, meaning that as their economies grow the monetary value of the debt limit rises as well. European Union member countries, for example, are supposed to keep their public debts to no more than 60% of GDP, though in practice many countries are well in excess of that limit and enforcement has been inconsistent. (The EU limit was suspended during the COVID-19 pandemic but is due to return later this year.) And a handful of other countries, including Kenya and Malaysia , have laws limiting their public debt to a percentage of GDP, though those limits seldom generate the kind of recurring political battles that the U.S. debt limit does.

The U.S. has had public debt for longer than it’s been a country , but it managed to get along without a debt limit for more than a century and a half. The standard practice was for Congress to authorize specific debt issues for specific purposes – $11.25 million to fund the Louisiana Purchase , $500 million to wage the Civil War , $130 million to build the Panama Canal , and so forth. Along with the size of the bond issue, Congress might also specify the bonds’ denominations, interest rates, maturity dates, early redemption rules, and other terms and conditions.

But when the U.S. entered World War I in 1917, it was confronted with the need to borrow unprecedented sums of money. By the time the Treaty of Versailles formally ended the war in 1919, the U.S. had sold $21.5 billion in bonds , along with $3.45 billion in short-term certificates, with varying lengths, interest rates, redemption rules and tax treatments. Administering and paying down that debt proved to be too complex for Congress to micromanage.

The laws authorizing the World War I bonds – primarily what became known as the Second Liberty Bond Act – originally spelled out in some detail the terms and conditions of each bond issue. But throughout the 1920s and 1930s, as the various bond issues approached maturity and had to be either paid off or refinanced, Congress gave the Treasury Secretary more and more discretion to issue new and different types of debt securities – short-, medium- and long-term – under terms the secretary thought best.

Gradually, the specifications in the Second Liberty Bond Act (which in amended form came to govern most government borrowing) were replaced by broad caps. In 1939, the few remaining limits were replaced by an overall $45 billion cap that covered nearly all public debt – the birth of the statutory debt limit as we know it today.

Most of this analysis deals with “total public debt outstanding,” which excludes roughly $19 billion in debt issued by Fannie Mae, Freddie Mac and a few other government-sponsored enterprises. Of the nearly $31.46 trillion or so in public debt, about $73.5 billion is not subject to the statutory debt limit ; most of that represents the accounting treatment of certain Treasury securities sold at a discount to their face value ($68.2 billion) and debt held by the Federal Financing Bank ($4.8 billion).

The Treasury Department makes available extensive information on U.S. public debt, from detailed analyses of its composition and ownership to the exact daily balance, calculated down to the penny . For this analysis, Pew Research Center used data from several of these publications and datasets, but our primary source was the department’s Monthly Statement of the Public Debt .

Data on gross domestic product came from the federal Bureau of Economic Analysis . Figures on interest payments on the debt and overall federal spending came from the Office of Management and Budget . FRED, a database of economic and financial data maintained by the Federal Reserve Bank of St. Louis, was our source for historical data on the Fed’s holdings of government debt.

The federal government’s total public debt stood at just under $31.46 trillion as of Feb. 10, according to the Treasury Department’s latest daily reckoning . Nearly all of that debt – about $31.38 trillion – is subject to the statutory debt limit, leaving just $25 million in unused borrowing capacity.

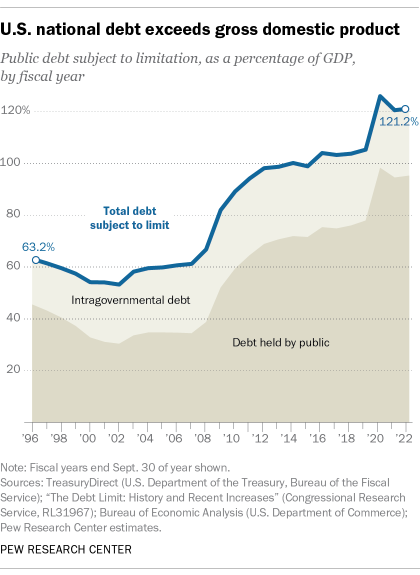

For several years, the nation’s debt has been bigger than its gross domestic product, which was $26.13 trillion in the fourth quarter of 2022 . Debt-to-GDP is a useful metric for analyzing the debt over long time spans, as it puts the debt into relative terms by comparing it against the size of the national economy. Looked at this way, debt as a share of GDP has gone through three main growth phases in recent decades. These have corresponded with periods when the federal government ran large budget deficits: the Reagan-Bush years of the 1980s and early 1990s; the 2008 financial crisis and subsequent Great Recession ; and the pandemic-caused recession of 2020, when federal debt spiked to an all-time high of 134.8% of GDP. The ratio has come down a bit since but remains well above pre-pandemic levels.

While U.S. government debt is perhaps the most widely held class of security in the world, 21.8% of the public debt, or $6.87 trillion, is owned by another arm of the federal government itself. That includes Medicare; specialized trust funds, such as those for highways and bank deposit insurance; and civil service and military retirement programs. But the biggest chunk of those “intragovernmental holdings” belongs to Social Security. As of the end of January, the program’s retirement and disability trust funds together held more than $2.8 trillion in special non-traded Treasury securities, or 9% of the total debt. (For many years, Social Security collected more in payroll taxes than it paid out in benefits; the surplus was required by law to be invested in Treasuries. That made Social Security, for a time, the federal government’s single biggest creditor.)

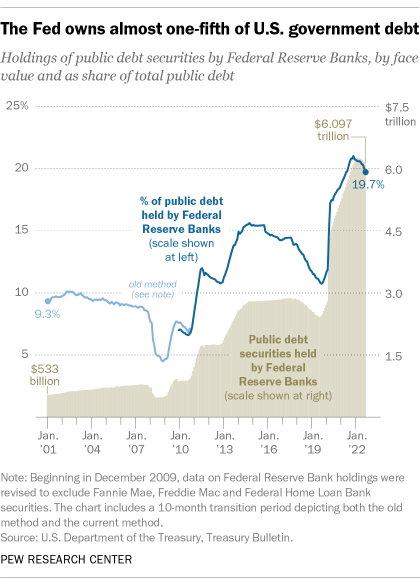

Today, the Federal Reserve System is the single largest holder of U.S. government debt. While the Fed regularly buys and sells Treasury securities to execute monetary policy, it bought Treasuries in massive quantities during the COVID-19 pandemic in an effort to keep the U.S. economy from buckling under the strain of shutdowns and quarantines.

At its peak in April 2022, the Fed held more than $6.25 trillion in U.S. government debt, more than double its holdings just before the pandemic hit the U.S. in March 2020. Even as the Fed has begun to scale back its holdings, it held nearly $6.1 trillion in government bonds – almost a fifth of the entire public debt – as of Sept. 30, 2022, the most recent data available. A decade earlier, by contrast, the Fed’s share of the debt was just under 11%. (Because the Fed is formally independent of the federal government, its stash isn’t included among the intragovernmental holdings discussed above.)

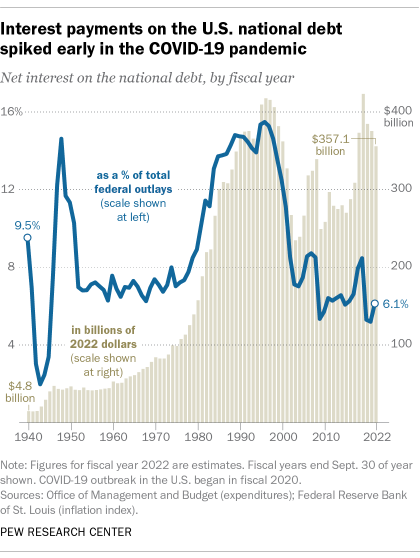

Servicing the debt is one of the federal government’s biggest expenses. Net interest payments on the debt are estimated to total $395.5 billion this fiscal year, or 6.8% of all federal outlays, according to the Office of Management and Budget . That’s more than $100 billion more than the government expects to spend on veterans’ benefits and services and more than it will spend on elementary and secondary education, disaster relief, agriculture, science and space programs, foreign aid, and natural resources and environmental protection combined .

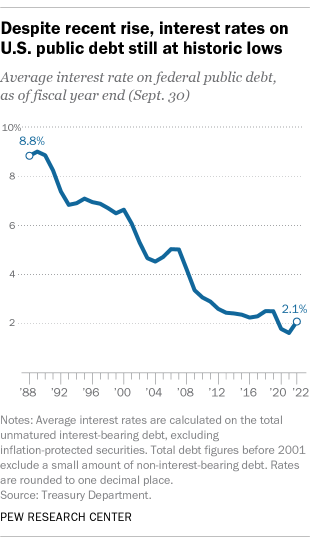

Debt service as a share of federal outlays peaked at more than 15% in the mid-1990s, but generally falling interest rates have helped hold down payments even as the dollar amount continues to grow. In fiscal 2021, the average interest rate on federal debt was a record-low 1.605%. But with the Fed raising its policy rate to try to cool off the economy, the U.S. has started paying more to borrow: The average interest rate on federal debt last year ticked up to 2.07%.

Note: This is an update to a post originally published on Oct. 9, 2013.

- Economic Conditions

- Economic Policy

- Government Spending & the Deficit

- Political Issues

- Social Security & Medicare

Drew DeSilver is a senior writer at Pew Research Center .

Eggs, gasoline and car insurance: Where inflation has hit Americans hardest

Public’s positive economic ratings slip; inflation still widely viewed as major problem, economic ratings are poor – and getting worse – in most countries surveyed, biden’s job rating slumps as public’s view of economy turns more negative, trust in america: how do americans view economic inequality, most popular.

901 E St. NW, Suite 300 Washington, DC 20004 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan, nonadvocacy fact tank that informs the public about the issues, attitudes and trends shaping the world. It does not take policy positions. The Center conducts public opinion polling, demographic research, computational social science research and other data-driven research. Pew Research Center is a subsidiary of The Pew Charitable Trusts , its primary funder.

© 2024 Pew Research Center

- Winter 2020

Tackling the National Debt

The National Debt Worries Americans, but We Are Not Clear About the Solutions

Tackling the issue of the debt means making difficult choices. While Americans support addressing the issue in theory, settling on the best path of compromise and sacrifice is less clear-cut.

Americans have known for decades that the national debt is growing at an unsustainable pace. The accumulation of all our deficits over time has been a concern that ranks high on the list of issues people want our president and Congress to tackle, and deservedly so.

Still, addressing the debt has been a difficult issue around which to galvanize momentum. So far, there’s been no progress by policymakers in Washington, D.C.

How do Americans feel about deficits and debt? According to data from organizations like Gallup and the Peterson Foundation, people have consistently been worried about budget deficits and the national debt for decades. Strong majorities of people think the United States is on the wrong track in managing the national debt.

However, in polling by the Pew Research Center, Americans currently view the issue as important, but less so than in the past decade. When asked to rank their top policy priorities for Congress and the president, the budget deficit has experienced a significant drop in importance in the past several years. The percentage of Americans who say that reducing the budget deficit should be a top policy priority in 2019 was 48 percent, which is a 24-point point drop from the percentage who said that in 2013.

Americans currently view the issue as important, but less so than in the past decade. When asked to rank their top policy priorities for Congress and the president, the budget deficit has experienced a significant drop in importance in the past several years.

That tells us that while Americans are concerned about the debt, other issues are ranking higher on the list of public policy priorities, including increases in percentages of people who are concerned about health care costs and the strength of Medicare. People are also prioritizing the environment, immigration, and climate change more than in prior years at the same time that the budget deficit has moved down the priority list.

With the main drivers of future debt in the United States being mandatory spending programs — Social Security, Medicare, and Medicaid — tackling this issue can mean difficult policy choices, usually some combination of spending cuts and tax increases to change the long-term trajectory of our fiscal future. While Americans are supportive in theory of tackling the debt and understand its importance, there is a real disconnect in terms support for the specific policy solutions to address this challenge.

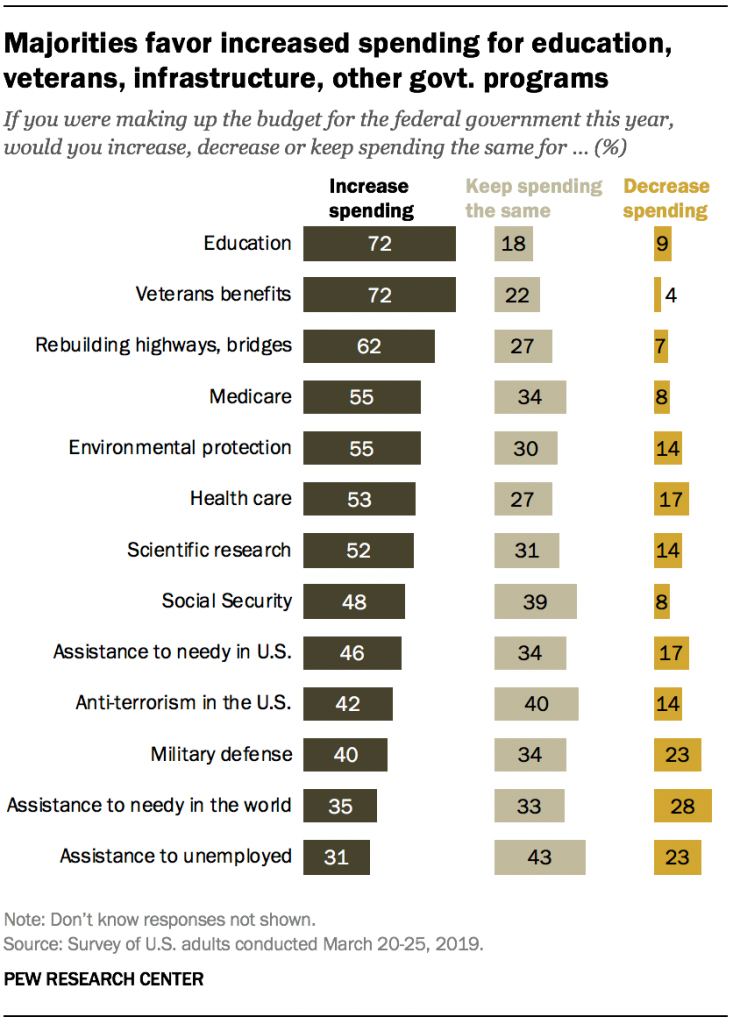

Spending cuts in particular hold no interest to the American public. In polling last year, the Pew Research Center tested 13 different issues areas and asked Americans whether they would support increased spending, decreased spending, or keeping spending about the same across 13 different issue areas, from health care to defense to environmental protection. None of the 13 areas elicited more than 28 percent of the American public who believed funding should be cut. (Only cutting foreign aid reached as high as 28 percent in support.)

While Americans are supportive in theory of tackling the debt and understand its importance, there is a real disconnect in terms support for the specific policy solutions to address this challenge. Spending cuts in particular hold no interest to the American public.

When asked whether they supported smaller government providing fewer services or a bigger government providing more services, results were split down the middle. Equal numbers of people favored each.

The fact that people under 30 are more likely to support a bigger government illustrates one of the real challenges in addressing the debt. Americans don’t seem to be able to square how they would specifically reduce the debt with their overall desire to do so. This dichotomy presents a real conundrum for policymakers.

This is an especially difficult issue to tackle when our younger generations aren’t terribly interested in addressing the debt, at least compared to a front-page topic like climate change. After all, the longer we wait to tackle this issue, the more it will impact younger Americans.

Whenever we get around to tackling the difficult issue of the debt, reforms will likely be phased in over time. That means today’s retiree population is unlikely to face the effect of the policy choices that will likely change Social Security or Medicare, reductions in spending, and tax reforms. Instead, many of the inevitable policies will much more likely affect the under-30 population.

Americans don’t seem to be able to square how they would specifically reduce the debt with their overall desire to do so. This dichotomy presents a real conundrum for policymakers.

All of this is occurring at a time when candidates running for president in the 2020 election are saying little about the national debt and any plans they might have to address it. That is despite the fact that the debt sits at over $23 trillion, the highest it’s ever been.

Any policymaker interested in addressing this issue must demonstrate real political leadership, which translates into a willingness to make tough choices and to convince the American public that there is an urgency to addressing this issue. The battle is indeed uphill, but more important than ever.

- Previous Article Our $23 Trillion National Debt: An Inter-generational Injustice An Essay by Michael A. Peterson, Chairman and CEO of the Peter G. Peterson Foundation

- Next Article How Would You Balance the Budget? An Essay and Reader Quiz by Robert Bixby, Executive Director of the Concord Coalition

- THE FOUNDATION

- OUR FOUNDER

- PGPF Facebook

- PGPF Twitter

- PGPF YouTube

- PGPF Linkedin

The Fiscal Challenge

Fiscal & economic impact, finding solutions, comprehensive plans, understanding the budget.

- Budget Process

National Security

Budget process reforms, what we're doing, research and analysis.

- Chart Archive

Education & Awareness

- Fiscal Confidence Index

- Current Debt and Deficit

- The Fiscal Summit

- Economic Forum

What You Can Do

I want to lead, i want to learn, register for the newsletter, resource library, budget, deficits, and debt, demographics, defense and national security, other programs, retirement security, taxes and revenues, infographics, expert views: inflation, interest and the national debt | peter g. peterson foundation, expert views, inflation, interest and the national debt.

America faces an array of complex fiscal and economic challenges, including high inflation, rising interest costs, unsustainable debt and recession fears. We asked experts with diverse views from across the political spectrum to share their perspectives and insights to help understand the landscape and identify solutions.

The Fiscal and Economic Experts

David Beckworth

Senior research fellow.

Mercatus Center, George Mason University

Responsible Fiscal Policy in a Low Interest Rate World

Read the essay

William C. Dudley

10th president and ceo of the federal reserve bank of new york and senior advisor.

Griswold Center for Economic Policy Studies, Princeton University

Five Fundamental Changes for U.S. Fiscal Policy

Karen Dynan

Professor of the practice.

Harvard University

High Inflation and Fiscal Policy

Wendy Edelberg

Director of the hamilton project.

Brookings Institution

Recession Remedies in the Face of High Inflation

Nela Richardson

Chief economist, help wanted: a fiscal policy for the future.

Brian Riedl

Senior fellow.

Manhattan Institute

Rising Interest Rates Threaten Washington’s Solvency

Sita Slavov

Professor of public policy.

Schar School of Policy and Government, George Mason University

Mad Money: How to Fight the Inflation Tax

Marc Sumerlin

Managing partner.

Evenflow Macro

Fiscal and Monetary Policy Work Best Together

Diane Swonk

A meteor shower: inflation in a post-pandemic world.

William G. Gale and Swati Joshi

William g. gale, arjay and frances fearing miller chair in federal economic policy, swati joshi, research assistant, inflation, interest rates, and the budget: new challenges, old solutions.

Dana M. Peterson and Lori Esposito Murray

Dana m. peterson, chief economist & center leader of economy, strategy & finance.

The Conference Board

Lori Esposito Murray

Committee for Economic Development of the Conference Board

Inflation Fighting and Ensuring Fiscal Health Starts Now

Questions for the experts.

We asked each expert to respond to the same set of specific questions, encouraging them to focus on their areas of expertise, and what they viewed as the most important areas of the policy discussion.

The questions are:

- What is the impact of inflation and rising interest rates on our nation’s fiscal outlook?

- • Where do you see rates heading over the medium term (next ten years), and what are the factors that might drive them higher or lower?

- • How do these trends impact expectations for the level of federal interest costs in coming years

- • How does higher inflation impact your assessment of our economic outlook and stability?

- How should fiscal policy be used in this period of high inflation?

- • What factors and data should be considered in determining the right balance of fiscal policy to help limit inflation going forward while trying to prevent a recession?

- • How do fiscal and monetary policy interact, and how can they be used in a consistent approach to achieve the best overall outcome?

A note from Michael Peterson

Chairman and ceo of the peterson foundation.

A year ago, we began this initiative to bring together a diverse range of expert voices from around the nation to help guide us through these challenging fiscal and economic times.

Last year’s project, America’s Fiscal and Economic Outlook: Where Do We Go from Here? , took place as our nation continued to grapple with the pandemic, outlining the connection between national preparedness, economic strength, and a sustainable fiscal outlook.

This year, we are once again navigating a range of rapidly evolving, complex and interconnected challenges. As we face the storm of inflation, there are many questions surrounding the optimal set of fiscal, monetary and economic policy to steer us through and give our economy the best chance for a soft landing amidst elevated interest rates and unsustainably high debt and deficits.

With diverse views from across the political spectrum and deep policy expertise, these authors provide valuable analysis and insight on timely topics including the impacts of and outlook for inflation and interest rates; concerns about an economic recession; the unsustainable national debt and growing interest costs; the interplay between fiscal and monetary policy; shortfalls in the social safety net; and the role that labor market productivity plays in our economy.

By sharing the thoughts and perspectives of this distinguished group of experts, we hope to foster conversations and inspire policy solutions that will help move our nation towards a more sustainable future.

Read the essays from past Expert Views

24/7 writing help on your phone

To install StudyMoose App tap and then “Add to Home Screen”

National Debt - Free Essay Examples and Topic Ideas

National debt is the total amount of money owed by a country’s government to its creditors. It is the sum of all borrowing and accumulated deficits over time. The debt can be in the form of bonds, Treasury bills, and other securities that the government issues to investors. High levels of national debt can have negative economic consequences, including higher interest rates, inflation, and reduced access to credit. Governments often attempt to manage and reduce their national debt through various economic policies and strategies.

- 📘 Free essay examples for your ideas about National Debt

- 🏆 Best Essay Topics on National Debt

- ⚡ Simple & National Debt Easy Topics

- 🎓 Good Research Topics about National Debt

Essay examples

Essay topic.

Save to my list

Remove from my list

- How The Economic Challenges and a Constantly Rising National Debt Has Continued to Threaten Job Security

- Causes of the US National Debt

- How Do People Fall into Debt?

- The United State’s Debt Problem and The American Politician

- The Current Federal Budget

- British national identity

- National debt definition and termsOne might think that defining national debt is

- Lebanese National Debt

- Efforts to Reduce the USA State Budget Deficit

- National TV Turn-off Week

- Alexander Hamilton’s Financial Plan After the Revolutionary War

- Macroeconomic Aims of a Government

- Business Cycle and Suitable Fiscal policy

- Economic Crisis and Response in the Philippines

- A Cause and Effect Essay on The Impact of National Debt on The Us Government and Its Citizens

- National Management

- Individual Rights Vs. National Security

- National Income

- National Security vs. Civil Liberties

- The National Policy

- Explanation on National Interest

- National Power

- Diamond of National Advantage

- With the advancement and improvement of national economy just as

- The national institute of education

- National Semiconductor Ethics Case

- Difference Between Local and National Newspapers

- Kenya through the national government and in association with

- Divorce and Our National Values

FAQ about National Debt

👋 Hi! I’m your smart assistant Amy!

Don’t know where to start? Type your requirements and I’ll connect you to an academic expert within 3 minutes.

The Edvocate

- Lynch Educational Consulting

- Dr. Lynch’s Personal Website

- Write For Us

- The Tech Edvocate Product Guide

- The Edvocate Podcast

- Terms and Conditions

- Privacy Policy

- Assistive Technology

- Best PreK-12 Schools in America

- Child Development

- Classroom Management

- Early Childhood

- EdTech & Innovation

- Education Leadership

- First Year Teachers

- Gifted and Talented Education

- Special Education

- Parental Involvement

- Policy & Reform

- Best Colleges and Universities

- Best College and University Programs

- HBCU’s

- Higher Education EdTech

- Higher Education

- International Education

- The Awards Process

- Finalists and Winners of The 2023 Tech Edvocate Awards

- Award Seals

- GPA Calculator for College

- GPA Calculator for High School

- Cumulative GPA Calculator

- Grade Calculator

- Weighted Grade Calculator

- Final Grade Calculator

- The Tech Edvocate

- AI Powered Personal Tutor

Teaching Students About King Henry of France

A year after cuts, wv still bleeding faculty, administrators, kentucky is working hard to educate non-traditional students in higher ed | opinion, more australians repaying student loans early, uhv school psychology grant funds 10 students’ education, university of dayton to shed faculty, weigh program cuts, 30 higher ed it influencers to follow in 2024, roanoke higher education- retail, oklahoma voice: most grads from state’s higher education system are retained in state workforce, n.c. a&t enrollment tops 14,311, simple & easy national debt essay topics.

Simple & Easy National Debt Essay Titles

- The Issue of the U.S. National Debt and Balanced Budget Amendment

- The Cause and Effect of National Debt on the Citizens and U.S. Government

- Changes that Impact the Country’s Deficient and National Debt

- American Politicians and the Issue of National Debt Problem in the United States

- How Did John Adams Address the National Debt

- The History of National Debt that Has Constantly Plagued the U.S.

- Analysis of the Cutting of the National Debt of the U.S. of America

- How War Affects the United States of America’s National Debt and Economy

- Budget Deficit and National Debt: Sharing India’s Experience

- The Methods to Reduce the National Debt of America

- National Debt Is Necessary for the Funding of Federal Programs

- Financial Uncertainty of the U.S. National Debt

- How Britain’s National Debt Rose Significantly after the French-Indian War

- The Government Corruption and National Debt of Spain

- The National Debt and Deficit Spending of the United States of America

- Introduction to the History and Effects of National Debt in the U.S.

- The Borrowing of Money from Foreign Sources to Cover the American National Debt

- The Approaches of President Obama to Handling the Deficit of the National Debt

Most Interesting National Debt Topics to Write about

- How Rising National Debt Has Continued to Threaten Job Security

- Monetary Policy Coordination and the Level of National Debt

- The Threat of Questionable Job Security Brought on by Steadily Building National Debt

- The Economic Impact of the Increasing National Debt of America

- Relationship between National Debt and Debt of the Federal Government

- Strategies for Relieving the National Debt

- How Inflation Reduces the Burden of the National Debt

- The Causes Behind the Growth of the National Debt of America

- The Effect of Marijuana Legalization on National Debt

- National Debt Sustainability and the Dynamics in the Economy of Diamond

- USA: The Largest in Terms of National Debt

- Budget Deficit and Its Effect on the National Debt

- National Debt: The Biggest Issue of the Global Politics

- How to Pay off the National Debt Quickly

- The Pros and Cons of the National Debt

- The Short- and Long-Term Effects of Budget Deficits and the National Debt

- Nonlinear Exchange Rate Pass-Through: The Role of National Debt

- An Analysis of the Economic Distress in Greece Regarding National Debt

- Relationship between National Debt and Excessive Social Spending

19 Ways to Help Students Who Do ...

Nokia essay topics.

Matthew Lynch

Related articles more from author, research topics about electoral college, essay topics about chocolate, good essay topics on mindfulness, balanced scorecard essay topics, easy a midsummer night’s dream essay questions & topics, fascinating essay topics about corn.

Forget interest rates or unemployment. 'Unsustainable' U.S. debt could menace our economy

4-minute read.

You could feel whiplash this summer as, on July 25, the media reported that the nation’s second quarter GDP expanded at a “healthy” rate of 2.8%.

This was followed on Aug. 5 with the S&P index nose-diving 3%, attributed by observers to a spike in unemployment and fears of a recession. It was the usual parade of shiny objects — explanations for events that change seemingly with the wind or the politics of the observer — while the objective, well-defined threat to the economy remains hidden in plain sight.

Sleepy Hollow, New York resident Michael Doorley, a certified public accountant and former chief financial officer, has been on a crusade to educate the media and the public as to the dire financial condition of our nation because of uncontrolled debt. He educates civic groups and the media about a document few have even heard of, the Financial Report of the United States Government , prepared annually by the Treasury Department, in coordination with the White House Office of Management and Budget.

The Financial Report of the United States Government

Instead of economists, who seem unable to agree on much, the Financial Report is prepared by accountants, adhering to financial reporting standards called Generally Accepted Accounting Principles. Since the 1990s, it has allowed Americans to see the financial position and condition of the federal government, just like a publicly traded corporation — complete with a balance sheet and adapted income statement for government.

It’s not pretty.

This month, the gross national debt entered uncharted territory as it reached $35 trillion — $104,000 for every American man, woman and child. The term “not sustainable” or “unsustainable” appears more than 20 times in the 2023 Report, principally in relation to the increase in our debt held by the public relative to GDP. This represents all of the debt held by Americans and foreigners, including the Federal Reserve. For context, the highest ratio of debt-to-GDP in history occurred just after World War II at 106%.

“The debt-to-GDP ratio was approximately 97% at the end of FY 2023," the report states. "Under current policy and based on this report’s assumptions, it is projected to reach 531% by 2098. The projected continuous rise of the debt-to-GDP ratio indicates that current policy is unsustainable.”

Equally bad is the state of Medicare and Social Security, with Social Security projected to become insolvent in 2035:

“The Statement of Social Insurance (SOSI) shows that the PV [Present Value] of the government’s expenditures for Social Security and Medicare Parts A, B and D, and other social insurance programs over 75 years is projected to exceed social insurance revenues by about $78.4 trillion, a $2.5 trillion increase over 2022 social insurance projections,” -the report states.

The snapshot from the Financial report's executive summary shown below lists the budget deficit for 2023 at about $1.7 trillion on a cash basis, but the Net Operating Cost, the accrual basis “bottom line” is double that number. The net position on the U.S. Government balance sheet — its total assets and total liabilities — is negative $37.5 trillion.

Need for large tax Increases and/or spending caps to reduce the debt

The consequences of allowing the deficit to grow are well chronicled in the histories of Germany prior to World War II, Argentina and Zimbabwe, with rampant inflation, unemployment and social unrest. And yet Congress and the Biden administration have allowed the debt to increase by $1.9 trillion since the start of this fiscal year, neither hiking taxes nor reducing spending, as recommended in the report to avoid a crisis:

“To illustrate the magnitude of policy changes needed, if policymakers choose to close the fiscal gap solely through increased revenues, they would need to make policy changes over a 75-year period (fiscal years 2024 to 2098) that increase each year's projected revenues by 23.8%. If policymakers choose to close the fiscal gap solely through reductions in noninterest spending, they would need to make policy changes over a 75-year period (fiscal years 2024 to 2098) that reduce each year's projected noninterest spending by 19.8%. The projections show that the longer policy changes are delayed, the more significant the magnitude of policy changes will need to be to achieve the debt-to-GDP target.”

Republican and Democratic administrations since 2000 have become comfortable ratcheting up the debt with popular unfunded tax cuts, such as former President Donald Trump’s tax cut, which added $2 trillion to the national debt, or massive spending bills. The non-partisan Committee for a Responsible Federal Budget has a comparison of the two presidents. President Joe Biden was so comfortable with increasing the national debt that he tried by executive order to forgive a large share of student loans, the largest asset on the nation’s balance sheet. Only the U.S. Supreme Court stopped him from a decision that would have increased the federal budget deficit by 27%, according to the Congressional Budget Office. His latest proposal for student loan forgiveness is currently forecast to add between $870 billion and $1.4 trillion to the debt.

More from The Roberts Report: The issue is not Joe Biden’s age. Can we trust his cognitive capacity?

Treasury Secretary Yellen ignores the debt

Previous treasury secretaries in their introductory messages to the Financial Report have at least paid lip service to the need to address the “unsustainable” levels of national debt. For example, in 2010, Obama Treasury Secretary Tim Geitner said, “But as we combat unemployment, we must also address the challenge of bringing future debt down to sustainable levels…. we need to make difficult choices to reduce deficits and the national debt.”

Yet Biden Treasury Secretary Janet Yellen did not even mention the debt in her 2023 introductory message to the Financial Report.

To be fair, some of the nation’s most respected economists and business leaders have been making dire predictions for quite a while now. The best-selling author of "The Black Swan," Nassim Taleb, who predicted the 2008 financial crisis, said in January the economy is in a “debt spiral,” which could become a “ death spiral .”

Fed Chairman Jerome Powell told CBS News' 60 Minutes, "It's probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path." Morgan Stanley CEO Jamie Dimon called the U.S. debt, the “ most predictable crisis in US history ,”

Unfortunately, the people in power don’t seem to be listening.

Comptroller General David Walker speaks out

Former Comptroller General David Walker, who served for ten years during the Clinton and Bush presidencies, has watched our exploding debt with alarm.

In a wide-ranging interview, he told me, “Today, the fastest growing expense in the federal budget is interest … We’re spending more on interest than Defense or Medicare, and based upon current projections, it will be our largest line item in the next couple of decades if we don’t end up changing course.

“As has been said by others,” continued Walker, ‘How do you go bankrupt? First, slowly, and then suddenly.’ And that's the situation here.”

Alexander Roberts is a longtime contributor to lohud.com, The Journal News and the USA TODAY Network. This column is part of a regular, monthly series of columns titled The Roberts Report.

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

National Debt

The national debt is the total amount of money that a country owes to its creditors. It is calculated by adding up all of the government's outstanding debt, including bonds, notes, and bills.

The national debt can be a significant burden on a country's economy. When a country borrows money, it has to pay interest on the loan. This interest can add up over time, and it can make it difficult for the country to repay its debt.

The national debt can also affect a country's credit rating. A high national debt can make it more difficult for a country to borrow money in the future.

- Share on Facebook

- Share on Twitter

- Share by Email

- Financial Debt

- Government debt

- Debt Default

IB Economics - The Budget Outcome

Study Notes

Debt Dilemma: How Developing Countries Are Facing Their Worst Financial Crisis

21st July 2024

UK national debt climbs to highest figure since 1962

20th July 2024

The Fiscal Cost of High Interest Rates

3rd May 2024

In the News Teaching Activity – what’s been happening to public finances? (Apr 2024)

29th April 2024

Edexcel A-Level Economics (A) Theme 4 Knowledge Organiser Pack 2

Exam Support

In the News Teaching Activity –the debate over the Labour party’s £28bn green investment pledge (Jan 2024)

15th January 2024

Record Debt Puts Developing Countries in Crisis

14th December 2023

2.6.2. Fiscal Policy - Budget Deficits Surpluses and Debt (Edexcel A-Level Economics Teaching PowerPoint)

Teaching PowerPoints

Super Villains: Macroeconomic Policies Teaching Activity

Teaching Activities

Is another debt crisis looming for emerging countries?

14th October 2022

The Size of UK Government Debt

2nd August 2022

2022 Exam Application Context - High and Low Government Debt

Topic Videos

Fiscal Policy - The Government Debt Service Burden

Can countries pay back pandemic debt.

20th June 2021

Maximum sustainable debt

16th July 2016

Britain's Government Debt - Who is Buying It?

15th September 2016

The Debt Deficit Distinction

16th January 2017

Government debt and the interest burden

15th January 2017

What's Happening With the Government's Finances?

7th March 2017

External Debt Relief

Greek economy: deficit, debt and austerity, highest december borrowing on record as uk national debt approaches 100% of gdp.

22nd January 2021

Government debt - how much is too much?

9th September 2020

Benefits and Costs of High Inflation for a Government

Uk government debt hits £2tn for first time.

24th August 2020

Why debt sustainability will be a crucial issue in the years ahead

29th July 2020

Monetary Financing

Surge in borrowing takes uk national debt above 100% of gdp.

19th June 2020

Evaluating the effects of rising national debt

Fiscal policy: the national debt, debt and economic development, a* exam technique: evaluating government borrowing to promote development.

Practice Exam Questions

Development economics - new essays for practice

Case for cutting the national debt (revision essay plan), debt crisis warning for poorest countries.

4th April 2019

UK Economy Update 2019: Monetary and Fiscal Policy

State of the uk economy (may 2018), cyclical and structural budget deficits, fiscal policy in the uk - key facts in 2018, explaining bond prices and bond yields (financial economics), fiscal deficits and the national debt, difference between national debt and external debt, macro risks: china's addiction to debt.

22nd August 2017

Managing the National Debt

13th June 2017

Public Debt - A Long Run Perspective

29th April 2017

Debts and Deficits

11th June 2016

Fiscal Policy Revision: Focus on UK Government Debt

26th March 2016

Supply-side growth, not inflation, is the cure to the debt overhang problem

24th April 2014

Richard Koo - Japan and the Balance Sheet Recession

24th December 2014

GDP Bonds and Greek Debt

12th March 2015

Zero inflation is the new normal

1st April 2015

Europe's Orphan - The Future of the Euro

29th August 2015

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

Economic Recession: The US National Debt Research Paper

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment