What is Online Transaction? Meaning, Steps & Examples of Online Transaction

Table of Contents

What is an Online Transaction?

Online transactions are a payment method where money or funds are transferred electronically using options like RTGS , IMPS, NEFT , UPI, cards, and similar methods.

It is the process of exchanging money or goods between two or more parties over the internet. It can involve various activities, such as buying and selling via e-commerce platforms, paying bills, transferring funds, donating to charities, and more.

These transactions offer convenience and accessibility to people who want to engage in financial activities from the convenience of their homes. You can perform transactions anytime and anywhere, as long as there is an internet connection and a suitable payment method.

Digital transactions also reduce the need for physical cash, paper checks, or postage stamps, making them more efficient and eco-friendly.

What Is Online Transaction Number?

An online transaction number, also known as a transaction ID, is a unique alphanumeric code assigned to each online transaction. It acts like a digital receipt that helps to track and confirm transactions, providing a digital “paper trail” for both consumers and businesses.

These numbers enhance transparency and accountability in online financial activities, as they show the date, time, amount, and parties involved in the transaction.

Online transaction numbers also contribute to fraud prevention and dispute resolution by offering a verifiable record of the transaction details. If there is any discrepancy or dispute, this number can be used to trace the transaction and resolve the issue.

Online transaction numbers are usually generated by the payment service provider or the bank that processes the transaction.

Related Read: What is UPI Reference Number and How to Track it?

Stages of Online Transaction

The online transaction involves three main stages such as pre-purchase/sale stage, purchase/sale stage, and delivery stage.

1. Pre-purchase/Sale Stage

This is the stage where you, as a customer, decide whether to proceed with a purchase. It is essential to set the foundation for a successful online transaction by providing precise and accurate information about the product or service, such as its features, benefits, price, availability, and delivery options.

Being a customer, you also need to trust the seller and the payment platform and feel secure about their personal and financial data.

2. Purchase/Sale Stage

This is the stage where you, as a customer, acquire the desired product or service. You need to select the product or service, add it to your shopping cart, and proceed to the payment gateway . You also need to provide your personal and delivery details and choose your preferred payment method; you may opt for online card payment.

Next, the payment platform verifies the payment and confirms the transaction. The seller must also send a confirmation email or message to you and provide a receipt and an invoice.

3. Delivery Stage

This is the phase following the purchase where the product or service is provided to you.

The seller should ensure that the product is delivered on time and in perfect condition and meets the customer’s expectations. The customer should also be able to track the delivery status and contact the seller or the courier service if there are any issues or delays.

The seller must also follow up with the customer, ask for feedback or reviews, and offer after-sales service and support. The customer should also be able to return or exchange the product or service if they are not satisfied and receive a refund or a replacement.

Related Read: What is TPT Transfer in Banking? – Methods, Limit & Fees

What Are The Steps Involved in an Online Transaction?

1. registration.

Registration is the process of creating an account with your personal information, such as your name, email, and password.

Registration helps save your payment information, address book, and order tracking features for future transactions. It also enables you to receive notifications and offers from the seller.

However, registration also requires you to share your personal information with the seller, be careful about what information you provide and how the seller uses it. It is also important to employ strong password practices, like incorporating a mix of letters, numbers, and symbols and periodically changing your password, to bolster the security of your registered account.

2. Placing an Order

Add the products you wish to purchase by tapping on the “Add to Cart” button.

Once you have added the products or services to your cart, you can move to the checkout page by selecting the “Checkout” button. On this page, you can review your order specifics, including the products or services, their prices, the shipping fees, and any applicable taxes.

Payment is transferring money from your credit card, bank account, debit card, or any other payment system to the seller’s account. Payment is the most crucial step of online transactions, as it involves your financial data, such as your card number, expiry date, CVV, and PIN. You must ensure the best payment gateway page is secure and encrypted before entering your payment details. You can check the security of the payment page by looking for a padlock icon or a “https” prefix in the address bar of your browser.

To avoid online payment fraud , payment page security is vital for safeguarding your financial data. You should never share your payment details with anyone or enter them on unsecured or suspicious websites or apps. You should also avoid saving your payment details on the seller’s website or app, as this may increase the risk of data leaks.

What are the Accepted Payment Methods for Online Transactions?

Here are some of the most common methods:

1. Credit Cards and Debit Cards

These are the most widely accepted payment methods for online transactions. They offer convenience and security, as the payment is processed through a secure network.

2. E-wallets

Digital wallets like PayPal, Google Pay, and Apple Pay allow you to store your credit card or bank account information securely and use it to pay for online purchases without having to enter your details each time.

3. Bank Transfers

This method involves transferring money directly from your bank account to the merchant’s account. It can be a secure option, but it may take longer to process than other methods.

4. Buy Now, Pay Later

This method allows you to split your purchase into installments without any upfront interest.

5. Cash on Delivery (COD)

This method allows you to pay for your order in cash when it is delivered. However, it may not be available for all merchants or all products.

Read More: What are the 12 Types of Payment Methods?

Frequently Asked Questions (FAQs)

1. what is the limit of online transaction.

The online transaction limit depends on the mode of payment, the bank, and the merchant. For example, in UPI-based transactions, the limit is Rs 1 lakh. In the case of credit or debit cards, the limit is decided by the issuing bank.

2. Is it safe to make online transactions?

Online transactions are generally safe, encrypted and protected by various security measures. Still, take some precautionary measures like not sharing your PIN, OTP, CVV, or password with anyone. You must also avoid clicking on suspicious links or attachments in emails or messages.

3. What should I do if an online transaction fails?

If the transaction is unsuccessful, check the reason for the failure. If the transaction is debited from the user’s account but not credited to the merchant’s account, the user should contact the bank or the payment mode provider and complain.

4. How long does it take for an online transaction to be processed?

The processing time of an online transaction depends on the payment mode, the bank, and the merchant. Some payment modes, such as UPI, debit card, credit card, and net banking, are usually instant or take a few minutes to complete. However, some payment modes, such as NEFT, RTGS, IMPS, and cheque, may take longer, depending on the bank’s working hours, holidays, and cut-off timings.

5. What fees are associated with online transactions?

The fees associated with online transactions may vary depending on the payment mode, the bank, and the merchant.

Related Posts

How to download aadhaar card by mobile number in 2024, how to check neft transaction status using reference number, what is a utr number examples, importance, & how to check it.

Updated NEFT Timings in 2024 – How Long Does NEFT Take?

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Fraud is Everywhere — Are You Safe? Follow This Guide to Secure Online Transactions The convenience of online transactions comes hand in hand with the rising threat of fraud. As a small business owner, safeguarding your online transactions is paramount to protecting your business and customers.

By Nick Chandi Edited by Micah Zimmerman Feb 29, 2024

Key Takeaways

- Transaction notifications are a powerful shield against financial fraud and uncertainty.

- Stay updated on new threats, educate your team on online security best practices, and make safety and integrity top priorities in your business operations.

Opinions expressed by Entrepreneur contributors are their own.

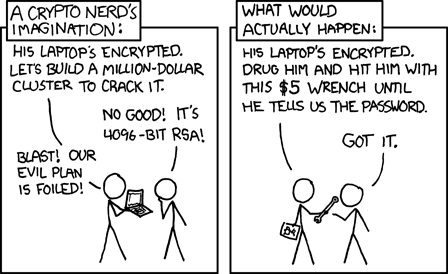

The prevalence of payment fraud is a growing concern for both consumers and businesses, as highlighted in a 2021 report by fraud prevention firm SEON , which recorded 1,862 data breaches affecting a staggering 293 million individuals. Cybercriminals employ sophisticated tactics, exploiting vulnerabilities in online systems to gain unauthorized access to sensitive data . According to a recent survey, 65% of respondents said their organizations experienced attempted or successful fraud activity in 2022.

For small business owners, ensuring the safety of online transactions is non-negotiable. Beyond financial losses, falling victim to fraud can tarnish your reputation and erode customer trust. Prioritizing security measures is key to safeguarding your business and maintaining credibility. Investing in robust security protocols and staying vigilant against emerging threats can instill confidence in your customers and protect your brand's integrity. With payment fraud expected to keep rising, it's projected to cost $40.62 billion by 2027, highlighting the importance of staying proactive in protecting your business against online threats.

Related: Slow Payment Options Are Costing Your Business — Here's the Alternatives of the Future

Banking services' role in security

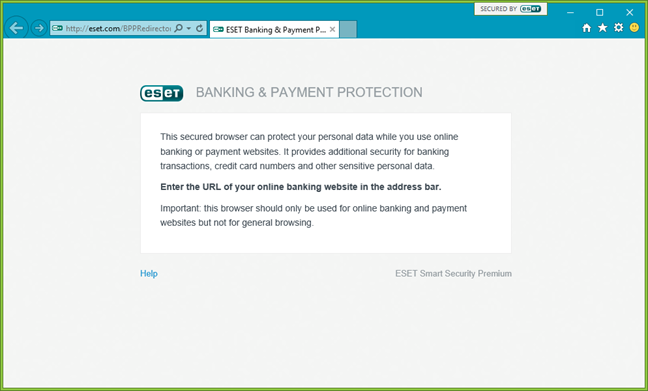

Banks use strong encryption to keep online transactions safe. Encryption scrambles important information so only authorized people can read it. This stops hackers from stealing or changing it during the transaction. Banks follow strict security rules to protect customer data from the start to the end of each transaction. This means your personal and financial details are safe from cybercriminals who might try to access them illegally.

By focusing on security, banks protect your information and build trust with customers, making online banking safer for everyone. This commitment to security ensures that your online transactions are secure, giving you peace of mind knowing that your sensitive data is well-protected every step.

Spot phishing scams

Phishing scams remain a prevalent threat, with cybercriminals using deceptive tactics to trick individuals into divulging confidential information. About 22 percent of all data breaches are because of phishing scams, making them one of the most common cybercrimes. These scams often involve fraudulent emails, texts, or phone calls impersonating legitimate entities like banks or government agencies.

Small business owners must educate themselves and their employees about the telltale signs of phishing scams, including suspicious links, misspelled domain names, and requests for sensitive information. By exercising caution and verifying the authenticity of communications, businesses can mitigate the risk of falling victim to these malicious schemes.

Related: 4 Cash Flow Trends To Know About in 2024

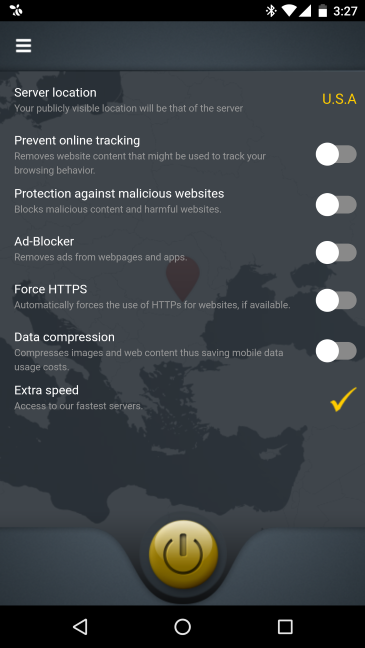

Enhance security with two-factor authentication

Two-factor authentication (2FA) is a widely used method for online payment security. 2FA and Multi-Factor Authentication (MFA) are powerful tools that can prevent over 99.9% of account compromise attacks. It adds an extra layer of protection to your accounts by requiring two verification forms before granting access. This typically involves a combination of something the user knows (such as a password) and something they possess (such as a mobile device or security token).

With 2FA, you get immediate alerts if someone tries to breach your account using phishing or other scams. Even if one factor is compromised, the second one acts as a barrier against unauthorized entry. Implementing 2FA is a smart move for small businesses, as it greatly decreases the risk of unauthorized access and enhances protection against cyber threats. The anticipated growth of 2FA by 17.28% and its projected value of USD 44.05 billion by 2030 underscore its significance in addressing the rising cybersecurity risks.

Get notifications for transactions

Transaction notifications are a powerful shield against financial fraud and uncertainty, empowering small business owners and customers. Instant alerts buzz on your phone when a transaction occurs, giving you the upper hand in spotting any suspicious activity before it spirals out of control.

With this kind of real-time monitoring, businesses can nip unauthorized or fraudulent transactions in the bud, keeping losses to a minimum and risks under control. But it's not just about protecting the bottom line; it's also about building trust and transparency in every interaction. Transaction notifications empower customers to take an active role in safeguarding their accounts, strengthening the bond between businesses and their valued clientele.

Partner with secure payment providers

Choosing a reliable payment provider is essential for small businesses looking to secure their online transactions. Trusted providers offer strong fraud detection, follow industry regulations, and maintain high-security standards. When picking a partner, businesses should assess factors like encryption methods, compliance with PCI DSS regulations, transaction fees, and customer support quality.

With numerous B2B payment companies available, selecting the right one is crucial. By teaming up with a reputable payment provider, small businesses can boost transaction security and ensure a smooth, safe payment experience for customers.

Related: Busywork Sucks — How Automation Can Eliminate Boring Tasks for Entrepreneurs

Safeguarding your small business against online payment fraud requires a proactive security and risk management approach. By familiarizing yourself with fraudsters' tactics, implementing strong security measures , and teaming up with trustworthy service providers, you shield your business and customers from the ever-present danger of cybercrime. Stay updated on new threats, educate your team on online security best practices, and make safety and integrity top priorities in your business operations. With these steps, you create a robust defense against online fraud, ensuring your business's safety and your customers' trust.

Entrepreneur Leadership Network® Contributor

CEO & Co-Founder of Forwardly

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- She Imagined a Specific Type of Culture Before Starting Her Business — Then Grew It From 1 Cart to Cult Status: 'Magical Things Happening'

- Lock 'Finances Fuel Life Goals.' These Top Money Secrets Can Make You Happier and More Successful, According to an Expert.

- The Reddit Co-Founders Faced a Transformative Rejection in College — Here's How They Bounced Back to Start a $6.5 Billion Business

- Lock 5 Successful Podcasters Share the 'Golden Advice' That's Making Them Money in a Crowded Industry

- Jersey Mike's Has Opened Over 1,000 New Stores in the Past 5 Years and Is Planning 300 International Outposts – Find Out Where

- Lock All Entrepreneurs Think About Writing a Book — Here's How to Know If You're Ready for Your Own

Most Popular Red Arrow

From hire to hero — 4 strategies for onboarding senior executives.

Setting up high-level hires for success requires forethought, the right environment and a flexible runway.

'Let It Go': A Couple Has Spent $400K Suing Disney After Being Banned From the Park's Exclusive 33 Club. Social Media Reactions Have Not Been G-Rated.

After getting banned from the exclusive members-only club for alleged bad behavior, a California couple has spent a fortune trying to get back to paling around with Mickey.

The August Jobs Report Didn't Live Up to Expectations — Here's What It Means For Interest Rates

Economists expected U.S. employers to add about 20,000 more jobs in August than reported.

Taco Bell's New Mountain Dew Baja Blast Gelato Is Causing a Frenzy — But Fans Have One Big Complaint

The company released the dessert to mark the 20th anniversary of the iconic Mountain Dew Baja Blast, which has garnered a cult-like following since its debut in 2004.

5 Strategies That Helped Me Achieve 10x Returns on My Marketing Efforts

These five marketing tactics have delivered remarkable returns for my business.

This NFL Team Is Owned By the Fans — Here's How Much Shares Cost and What Ownership Gets You

The Cheeseheads even own their hat maker.

Successfully copied link

- Online Transactions and Security of e-Transactions

Online transaction is a payment method in which the transfer of fund or money happens online over electronic fund transfer. Online transaction process (OLTP) is secure and password protected. Three steps involved in the online transaction are Registration, Placing an order, and, Payment. Let us learn more about the different stages of Online Transaction in detail.

Suggested Video

Online transactions.

Online transaction processing (OLTP) is information systems that facilitate and manage transaction-oriented applications, typically for data entry and retrieval transaction processing. So online transaction is done with the help of the internet. It can’t take place without a proper internet connection.

Online transactions occur when a process of buying and selling takes place through the internet. When a consumer purchases a product or a service online, he/she pays for it through online transaction. Let’s find out more about it.

Browse more Topics under Emerging Modes Of Business

- Benefits and Limitations of e-Business

- Outsourcing

Stages of Online Transaction

There are three stages of Online Transactions

- Pre-purchase/Sale: In this stage, the product or service is advertised online with some details for the customers.

- Purchase/Sale: When a customer likes a particular product or service, he/she buys it and makes the payment online

- Delivery Stage: This is the final stage where the goods bought are delivered to the consumer.

Steps Involved in Online Transaction

The following are the steps involved in Online Transaction:

1] Registration

- The consumer has to register online on the particular website to buy a particular good or service.

- The customer’s email id, name, address, and other details are saved and are safe with the website.

- For security reasons, the buyer’s ‘Account’ and his ‘Shopping Cart’ is password protected.

2] Placing an Order

- When a customer likes a product or a service, he/she puts the product in the ‘shopping cart’.

- The shopping cart gives a record of all the items selected by the buyer to be purchased, the number of units or quantity desired to be bought per item selected and the price for each item.

- The buyer then proceeds to the payment option after selecting all the products.

The buyer then has to select the payment option, he/she has various payment options. These payment pages are secured with very high-level encryptions so that the personal financial information that you enter (bank/card details) stay completely secure. Some ways in which you can make this payment are:

- Cash On Delivery: The Cash on Delivery option lets the buyer pay when he/she receives the product. Here, the payment is made at the doorstep. The customer can pay in cash, or by debit or credit card.

- Cheque: In this type of payment, the buyer sends a cheque to the seller and the seller sends the product after the realization of the cheque.

- Net Banking Transfer: Here, the payment is transferred from the buyer’s account to the seller’s account electronically i.e. through the internet. After the payment is received by the seller, the seller dispatches the goods to the buyer.

- Credit or Debit Card: The buyer has to send his debit card or credit card details to the seller, and a particular amount will be deducted from his/her account.

- Digital Cash: Digital Cash is a form of electronic currency that exists only in cyberspace and has no real physical properties. Here the money in buyer’s bank account is converted into a code that is saved on a microchip, a smart card or on the hard drive of his computer. When he makes a purchase, he needs to mention that particular code to the website and thereafter the transaction is duly processed.

Solved Example For You

Q. What is e-commerce?

- it refers to the use of the computer network

- it refers to the idea of extracting business intelligence

- both a and c

- it refers to the buying and selling of goods and services

Sol. The correct answer is the option ”D”. E-commerce is the buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, primarily the internet.

Q. In which of the following, personal digital assistants (PDAs) are used for buying and selling of goods and services?

- All of the above

Sol. The correct answer is the option ”B”. M-commerce (Mobile Commerce) is the buying and selling of goods and services through wireless handheld devices such as cellular telephone and personal digital assistants (PDAs)

Customize your course in 30 seconds

Which class are you in.

Emerging Modes of Business

5 responses to “benefits and limitations of e-business”.

Nice to meet you

oppnads.com, Thank you for the knowledgeable post which has helped me a lot. Keep it up for providing valuable information..

Any businessman is accurately tested when he or she decides to exploit the right opportunity at the right time. These businessmen not only decide, but also have the courage to put their decisions in execution as well. E-Businesses are one of them.

Its vey helpful i think there is a small mistake in advantages of e-business i.e cheaper than traditional business. but its written cost taken to setup a e-business is much higher than traditional business.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Talk to our experts

1800-120-456-456

- Online Transactions or E- Transaction

An Introduction

Online transaction is when we buy any goods online and we pay for those goods online. Everything is safe and secure in online transactions. In this, It happens via confirmation of the OTP sent to your phone, which is very well secured. There is no need to do any kind of paperwork in online transactions.

There are three stages of online transaction i.e. first - registration, second - placing the order, and third - online payment. This online transaction is completed by combining all three stages. Online transactions are used to buy or sell any item on an online platform such as Flipkart, Amazon, or eBay etc.

Stages of Online Transactions:

There are three stages of online transactions-

Pre-purchase/Sale- The company advertises the product in this stage, it tells about some important things through the advertisement so that the customer can get to know about that product. These advertisements are made in such a way that the customer who is attracted to the advertisement is ready to buy the product.

Purchase / Sale - In this stage, when the customer is attracted to buy goods, he likes the goods, then he buys the goods and he pays online for those goods.

Delivery Stage - In this stage the customer buys the final goods and gets the delivery to the themself.

Steps Involved in Online Shopping (Online Transaction):

The following steps involved in online shopping (online transaction)

Registration: The first step is registration in online transactions. In this step, the customer has to register himself on a website such as Flipkart, Amazon. To register, he has to provide his email id, name, address and all other similar details, which the website saves and Always keep these details secure and only. After registering on the website, an account is created and he has a shopping cart, both these things are password-protected.

Placing an Order: In this, the customer puts whatever items he likes from his registered shopping website in the shopping cart. This shopping cart then keeps the details of all the items saved, such as how much money it is in, how much is in the amount, it saves all the things with the shopping cart. Then whenever the customer has to order those things, by paying online, he can get all those things.

Payment: The buyer gets a lot of options for placing orders, which are safe and secure, the payment options that are available here are very secure, they have high-level encryption so that the financial details of the buyer cannot be leaked like his/her card number, his/her bank account number, his/her password, all these things could not be leaked. Below are some payment methods in which the buyer can choose how to pay.

Cash on Delivery: In cash on delivery, the customer pays wherever he wants his product to be delivered. He can make the payment from any method, whether it is through card or cash.

Cheque: In this step, after selecting the cheque option in the payment method, the payment is made in the cheque. First, the customer has to send the cheque to the seller and when the seller withdraws the cash from the cheque then he sends the goods to the customer whatever he ordered.

Net Banking Transfer: Payment in this step is from the buyer's account. First, the buyer transfers money through electronic methods to the seller's account. When that money comes from the seller's account, then the seller dispatches the product to the buyer's address.

Credit or Debit Card: In this step, the buyer has to share the details of his credit or debit card with the seller. When the buyer shares his details with the seller, the seller extracts the specific amount of money from the buyer's account. The confirmation message for the transaction goes through the OTP to the buyer and then when the buyer enters that OTP, the specific amount is deducted from the buyer’s account.

Security and Safety of E- Business:

1. Transactional Risks: The common transactions risks of online dealings are:-

Default an Order- Suppose you bought something online from a site and paid for it, but the seller can deny that you have placed the order or paid for the order. The seller can also refuse to deliver the goods in this way.

Default on Delivery - It often happens that you have placed an order and the product sent to the address of someone else instead of your address (that you have inserted).

Defaulter Payment - It happens very often that the seller does not get the same payment, but the customer who claims that he paid. To avoid this problem, the website provides cookies which are like a personal ID or caller ID which extracts the name, address, and previous purchase records of the customer.

2. Data Storage and Transaction Risk: Upon registering on a site, we share some personal information on it, such as our name, our address, email ID, phone number. All this information is saved and kept in its data. Due to this, the probability increases that our personal information can be stolen by anyone and can put us at high risk.

The risk involved in data storage is- Virus (Vital information under siege)- A lot of computer viruses are deadly, which can enter your computer in any way such as through a pen drive, through an email ID, or through a disk, which can enter your computer. All the data present in it, all the important information can be deleted. Because of which you may have a lot of problems and there may be too much time wasted.

Hacking – Hackers are unauthorised people. They can destroy all your data and can also steal it, due to which there is a lot of damage to the website.

3. The Risk of Threat Intellectual Property and Privacy: The information you provide to the website may get copied by any other online vendors, who may start sending you promotional messages and even hackers may pretend to be customers themselves. A fake website may be developed instead of the original website and they take away advance money from customers and not supply any product to the customers.

Risks Related to Online Shopping

Besides the risks related to data storage, transactions, and threat to privacy, there are some other risks involved with online shopping too. These are as follows:

Customer disputes

Online security issues

Credit card fraud

The problems related to the return of goods and their warrant

Logistic issues

Warehousing issues

FAQs on Online Transactions or E- Transaction

1. How can a person register on any online website?

The first step is registration in online transactions. In this step, the customer has to register himself on a website such as Flipkart, Amazon etc. To register, he has to provide his email id, name, address and all other similar details, which the website saves and keep these details secured. After registering on the website, an account is created and he has a shopping cart, both these things are password-protected.

2. How can i make online transactions?

There are various ways to make online transactions - net banking transfer, using credit and debit card, or online wallet (such as GPay) or through UPI ID.

3. What are the steps to be followed to do an online transaction if i want to purchase something online?

In case you want to buy something online, you can follow these steps that are given below.

Registration (on an e-shopping portal)

Place an order

Payment (Under this section, the buyer can choose for the online transaction option.)

4. Why are E-transactions encouraged?

There are various benefits associated with online transactions which make it a very favourable method. These are as follows:

Online payment is very time-efficient and convenient. Unlike traditional methods of paying, this saves both the customer as well as the seller a lot of time.

It reduces the need for cash and checks which in turn reduces various security risks.

It is easily manageable as it reduces the need for both cash as well as checks and minimises other administrative tasks for the other party as well.

It tends to offer a way better customer experience as compared to traditional methods.

It accepts a wide range of payment methods from debit and credit cards to e-checks and various other modes.

When you make online payments, the online portals make sure to store all your billing information in one place, thereby adding yet another benefit of convenient storage of one’s data

5. State the precautions associated with online transactions.

There are certain precautions that are to be kept in mind while engaging in any kind of online transaction. They are as follows:

Make sure you are using secure connections only to make an online transaction.

Make sure the website you’re dealing with is a reputed and a known one so as to avoid your financial and personal information from falling into the wrong hands.

It is advisable to use credit cards for online shopping over debit cards. This is because the latter tends to be linked to your bank account and credit cards also have a spending limit, which makes it difficult for them to be misused the way debit cards can be.

Avoid using public computers. Make sure you’re using your own computer or phone while making online transactions to keep the financial security intact.

6. What does payment risk mean?

The possibility of an incomplete payment refers to risk in payments. This risk generally exists in those payment systems that aren’t settled on a real-time basis. The risk also tends to depend on the value of transactions along with the volume in the payment system and its impact can be measured in terms of either the level of confidence in the system, or the damaging value. The causes of such payment risks tend to vary but one of the major, most commonly seen causes is what is known as counterparty risk, which refers to credit banks and liquidity.

7. What are some ways through which the process of online transactions can be improved?

There are certain ways through which online and E-transactions can be improved. They are as follows:

By keeping the payment and financial information as safe and secure as possible.

By providing the widest range of payment options and methods possible.

By keeping the requests regarding information minimal.

By avoiding the redirects that tend to happen in the middle of the payment process.

By not requiring the site visitors to have an account as a compulsion if they want to go ahead with a particular payment.

8. Discuss the different modes of online transactions.

There are various types of online financial transactions. They are as follows:

National Electronic Fund Transfer or NEFT: this tends to facilitate one-to-one funds transfer. Firms, corporates, and individuals can easily transfer funds from any given branch of a bank to the account of the other party, given they are participating in this scheme.

Real Time Gross Settlement or RTGS: this is referred to as a continuous real-time settlement of the transfer of funds on an order by order transfer basis.

Electronic Clearing System or ECS: this is a great alternative for transactions that involve utility-bill payments such as electricity bills, telephone bills, etc.

Immediate Payment Service or IMPS: this tends to offer an instant, 24 hour-long, electronic fund transfer service through individuals’ mobile phones. It is a very safe as well as economically viable mode of payment.

What is Online Payment? Types, Modes, Methods, Meaning

By Pine Labs | August 01, 2022

Online payment allows you to pay money via the internet. Buyers will use this type of payment when they purchase goods online or offline. They can use different types of online payment methods, including debit/credit cards, wire transfers, net banking, and digital wallets. Online payments can be done at the discretion of consumers. They can pay online to e-commerce stores to buy clothing or other items, subscriptions, mobile, DTH recharges, etc.

Four entities will be involved in the online payment process, such as the consumer, merchant or business, the consumer's bank, and the bank of the merchant or business. Although, more than one entity is involved during the online payment process, the entire process is electronic and completed within seconds.

With the advent of the internet, online payments have become extremely popular among buyers and sellers, owing to their benefits. They help consumers considerably save much of their time, allowing the process to be completed quickly and efficiently. Buyers do not need to handle physical cash, as online payments allow them to make cashless purchases. Consumers can buy their preferred goods and pay for them with the greatest security by propelling a payment confirmation message to consumers.

What is Online Payment?

When it comes to knowing online payment meaning , in essence it is an exchange of currency, electronically through the internet. The process in these payments is the transfer of money from the bank account, debit card, or credit card of a customer to the bank account of a seller. This online e-payment is handy for purchasing the merchandise or services of sellers.

Buyers and sellers make online transactions with the help of online payment apps. On the buyers' side, the transaction is to purchase goods and services and products or services deliverance from the sellers' end. These easy online payment options involve several steps while transferring a buyer's funds and seller's offerings. Both parties will use some online payment apps to complete their transactions successfully.

Types of online payments

The World Wide Web lets people know which is the best online payment app. Different online payment methods have become extremely popular among people, offering many benefits to them. Paying money online through trusted platforms is the safest and best online payment mode amongst buyers and sellers. Some of the common types of online payments are as follows:

Credit Cards

Credit cards are one of the payment sources in the list of payment methods online. These online payment modes allow cardholders to buy their preferred merchandise and services. Credit cards are one of the alternative online payment methods, offering a higher rate of cash back. They allow users to have little to no liability for fraudulent fees. They help users get reward points that they can redeem for several purposes.

Paying with a credit card makes it easier to avoid losses from fraud. When a thief uses your debit card, the money is missing from your account instantly. Legitimate expenses for which you've scheduled online payments or mailed checks may bounce, triggering insufficient funds fees and affecting your credit.

Credit cards come in different types, such as Mastercard, Visa, Discover, and American Express. All the handiest online payment methods in India. However, Mastercard and Visa credit cards have global recognition, but Discover and American Express cards also have extensive coverage. Similarly, each of these credit cards provides users with unique benefits. They will provide users with a bounty of benefits, including travel insurance, rental car insurance, and purchase protection. However, the benefits may count on the discretion of credit unions and banks offering these credit cards.

Debit Cards

Banks will issue debit cards to their account holders as part of their online payment services. They allow them to use their cards to make purchases online. The banks will deduct the amount automatically from the cardholders' bank accounts. Similar to a credit card payment system, the debit card online payment system is one of the most preferred online payment options among people. The major ones are Visa, RuPay, and MasterCard. Visa cards are the most acceptable cards by worldwide merchants for all online and digital transactions. Debit cards provide an easy way for people who are seeking to make online payments.

They offer the best online payment solutions, which makes them the most sought-after payment tool amongst global buyers. They provide immediate money access to users to perform many online transactions comfortably. Similar to credit cards, debit cards are extensively accepted online.

Third-Party Payment Services

The most prevalent online payment method is third-party transfer. It entails making out and depositing a sum into the account of a third party that receives the payment. However, users need to know how to make payments online through this transaction mode.

Third-party transfer in banking allows banks to manage it manually or use digital technology to complete it. Buyers and sellers can send and receive money through these services. They facilitate users to avail of these services online or through their mobile phones by attaching their bank accounts to a third-party payment service. These services help vendors that wonder how to accept online payments on a website, allowing them to acknowledge payments without opening a merchant account. However, they may need to open a bank account to hold cash received through card payments.

Electronic Cheques

Electronic cheques are one of the most popular online payment processing systems. They will deduct money from a checking account. This online payment mechanism eradicates the need for users to prepare their cheques in written form, helping sellers deposit them into their bank accounts. Electronic cheques have many security features compared to traditional paper checks, including verification, digital signatures, public key cryptography, and encryption.

Owners of these checks can perform a function similar to what they can carry out through a traditional paper check. The benefit of using these e-checks is that they need fewer steps to process them. The processing costs of e-cheques are comparatively lower than the standard paper checks. The direct deposit system offered by several employers is one of the more regularly used versions of the e-cheques.

Bank Transfers

Transactions involved in a bank transfer are the same as debit card transactions. This transfer method transfers money from one bank account to another, so a debit card is not required physically. Bank transfers provide a faster and safer form of payment than other modes of transactions, such as paying or withdrawing money from a bank account.

People can also set up online payment system on their telephones. If you are wondering how to online payment, you need to access your online account and choose the option for making your payments. Some banks also provide their account holders with online payment apps, allowing them to transfer funds.

Benefits Of Using Online Payments

Buyers and sellers can reap many benefits from online payments by choosing the most trusted online payment website. The benefits include:

| Security | Efficiency: | Convenience: | Contactless option |

|

|

|

|

|

Related Posts

What Are the Benefits of Using a Payment Gateway?

NACH e-mandate: Everything you must know

Online Transaction

What Is an Online Transaction?

Also known as a PIN-debit transaction, online transactions are password-protected payment methods that authorize a transfer of funds over an electronic funds transfer (EFT)

Types of Online Transactions

When you pay for goods or services with your debit card, you have an option for the payment to be processed in two different ways:

- an offline transaction via a credit card processing network

- an online transaction via an EFT system, which requires a personal identification number (PIN) to complete the process.

What Is Required for Online Transactions?

There are three steps to completing an online transaction:

1. Registering

In order to make a purchase, consumers save their personal details (e.g. email, name, address) to create a password-protected profile.

2. Ordering

After placing products (or services) in a shopping cart, consumers determine the number of items they want and move to the payment option.

Most purchasers will be provided multiple payment options (e.g. Paypal, credit card, digital cash). To ensure that your personal details are safe, these payment pages are required to be secured with high-level encryptions.

Note: For online transactions, an EFT network (e.g. Star, Pulse, Interlink) is based on whichever one your bank’s associated with. Transaction costs typically amount to an interchange fee of 1% of the total purchase price, which is charged to the vendor/merchant.

Laws About Online Transactions

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed by Congress, and included in the Act was an amendment to address interchange fee reform (the Durbin Amendment). The Federal Reserve is now authorized to review and reform debit card transaction fees.

Related Articles

Checking vs. Savings Accounts: Which One Makes Sense for Me?

You’ve probably heard of a checking and savings account before, and you might even have your own accounts. But which is the best place to keep your money? Below we’ll compare ...

How to Avoid Paying Bank Fees Once and For All

Bank fees can rob you of your hard-earned money. Fortunately, you don't have to pay hundreds of dollars in bank fees every year. Below our expert financial advice covers how ...

How to Choose the Best Reloadable Prepaid Debit Cards

Prepaid debit cards are a great tool for sticking to a budget or as an alternative to carrying cash. You can use these reloadable debit cards in multiple ways, just like ...

- How to Profit from Real Estate Without Becoming a Landlord

- Robo Advisors - Here's Why 15+ Million People Have Already Opened Up Accounts

- Fundrise - 23% Returns Last Year from Real Estate - Get Started with Just $10

- CrowdStreet - 18.5% Average IRR from Real Estate (Accredited Investors Only)

- Personal Capital - Our #1 Choice for Free Financial Planning Tools

Subscription Billing

Reliable recurring payments

Fraud Shield

Fine-tune your fraud detection

Invoicing made simple

Hosted Payment Page

Built with your brand in mind

Easy account automation

Accelerate your cash flow

Cryptocurrency

Join the crypto economy

SMS Invoicing

Reduce late payments

Buy Now Pay Later

Increase customer loyalty

Digital Wallets

Frictionless checkout experience

Embrace the future

AI Marketing Tool

Unleash intelligent marketing

- Integrations

- Knowledge Base

Explore the top online payment methods for secure transactions

Apparel eCommerce involves the selling and buying of clothing and accessories over the Internet.

- January 19, 2024 August 8, 2024

Introduction to Online Payment Methods

The landscape of online payment methods is as dynamic as it is intricate, with numerous options available for both consumers and businesses. This comprehensive review seeks to delve into the mechanics, adoption rates, and innovation within the realm of digital transactions. From the earliest iterations of electronic fund transfers to the latest in blockchain-backed digital currency, we will explore how these methods have evolved to meet the demands of a digital economy.

Traditional Online Payment Systems: These include bank transfers, credit/debit card transactions, and online banking services.

Modern Innovations: We look at payment gateways, digital wallets, and peer-to-peer payment apps that have transformed convenience and security for users.

Emerging Technologies: An exploration into how new technologies like cryptocurrency and mobile commerce are redefining the meaning of currency and payment.

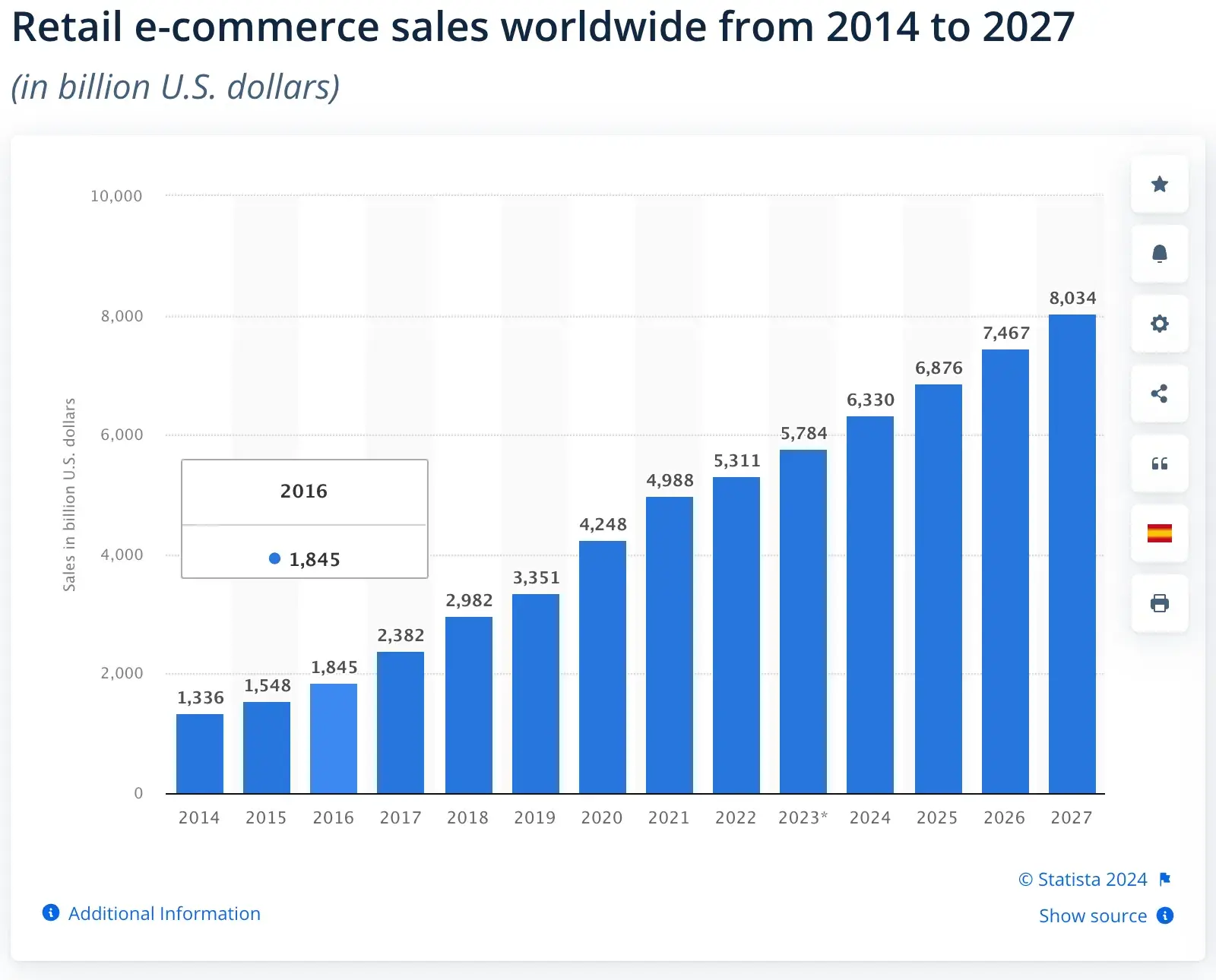

The review dissects each method’s infrastructure, user interface, processing times, and fee structures to provide a detailed understanding of the operational nuances of online payment mechanisms. Citing industry reports such as Statista , we reveal current trends and statistics that shed light on user preferences and market penetration of these various methods.

The Significance of Comprehending Different Payment Methods Online

Understanding the myriad online payment methods is crucial for several reasons:

Consumer Confidence: Users equipped with knowledge about payment options are more likely to trust and engage with online transactions.

Business Strategy: Companies that comprehend the spectrum of available payment methods can tailor their checkout process to optimize for conversion, align with customer preferences, and cater to global audiences.

Fraud Prevention: Awareness of the different types of online payment methods helps in recognizing potential vulnerabilities and implementing stronger security measures.

We take insights from authoritative sources like the Payment Card Industry Data Security Standard ( PCI DSS ) to emphasize the importance of security in payment method selection and the understanding thereof.

Effect of Online Payment Methods on Everyday Financial Management

The sheer diversity of online payment methods has profound implications on the day-to-day financial management of individuals and businesses alike:

Budgeting and Spending: Instantaneous transactions and digital tracking tools have facilitated real-time budgeting and spending oversight, fundamentally altering how users manage their finances.

Financial Inclusion: Digital payments have opened doors for unbanked populations by providing access to financial services without the need for traditional banking infrastructures.

Investment and Savings: The ease of online payments has streamlined saving strategies and investment opportunities, as users can transfer funds seamlessly across accounts and investment platforms.

Experts from the Financial Inclusion Global Initiative highlight the role of online payment methods in promoting financial inclusion globally.

In summary, this section serves as a primer, providing a robust foundation on which the subsequent sections will build.

Overview of Various Methods of Online Payment

Credit and debit cards remain the cornerstone of online payment systems due to their widespread acceptance and user familiarity. This section delves into the reasons for their sustained popularity and how they’ve adapted to the demands of the digital marketplace.

Ubiquity in E-commerce: Retailers around the globe accept credit and debit cards, making them a default payment option for consumers. This universal acceptance is largely due to the infrastructure established by major card networks such as Visa , MasterCard, American Express, and Discover.

Ease of Use: Making a purchase with a credit or debit card online is straightforward. Customers typically enter their card number, expiration date, and CVV code. This simplicity contributes to the cards’ dominance in the online payment space.

Security Measures: Credit and debit card transactions online are backed by robust security protocols. The implementation of CVV codes, two-factor authentication, and tokenization ensures transactions are both secure and compliant with industry standards like the Payment Card Industry Data Security Standard ( PCI DSS ).

Consumer Protection: These cards come with consumer protection mechanisms, such as the ability to dispute fraudulent charges and secure refunds for transactions that do not meet buyer satisfaction.

Loyalty and Rewards Programs: Many credit cards offer rewards, cashback, or points for purchases, which incentivize consumers to use their cards more frequently when shopping online.

Credit Building: Credit cards, when used responsibly, can help consumers build and maintain their credit scores, which is an important aspect of financial health.

Integration with Online Services: Credit and debit card information can be stored within digital wallets or online merchant accounts for faster checkout processes. Many online services and subscriptions also rely on card details for recurring payments.

Despite their benefits, merchants must navigate fees associated with accepting credit/debit card payments, including transaction fees, which can affect their pricing and margins. Moreover, chargebacks can be a costly issue for businesses, requiring both preventive measures and efficient management.

For consumers, maintaining the security of their card information is crucial. Regular monitoring of statements and using secure networks when entering card details can mitigate the risk of data breaches and fraud.

Emergence of Digital Currencies (Cryptocurrency) in eCommerce Payments

The integration of digital currencies into e-commerce has introduced a new paradigm in online transactions. This part of the article will explore the factors that have contributed to the rise of cryptocurrencies as a legitimate payment method in the digital economy.

Decentralization: Cryptocurrencies operate on decentralized platforms, which means that transactions are not reliant on central financial institutions. This aspect appeals to users seeking autonomy in their financial dealings.

Lower Transaction Fees: Without the need for intermediaries, cryptocurrency transactions can be completed with relatively lower fees compared to traditional online payment methods. This is particularly advantageous for cross-border transactions.

Privacy and Anonymity: Cryptocurrencies offer a level of privacy as transactions do not necessarily require personal information to be completed. This privacy can be a double-edged sword, attracting both privacy-conscious users and those with less savory intentions.

Fraud Reduction: Transactions made with cryptocurrencies are irreversible, which significantly reduces the risk of chargebacks and fraud for merchants.

Market Expansion: Accepting cryptocurrencies can open businesses to a global market of tech-savvy consumers who prefer or exclusively use digital currencies.

However, volatility in the value of cryptocurrencies remains a significant challenge, as does the evolving legal landscape governing their use. Additionally, the environmental impact of mining digital currencies is a growing concern.

Factors to Consider When Choosing the Right Online Payment Methods

When it comes to selecting the ideal online payment methods for your business or personal use, the sheer number of available options can be overwhelming. Understanding this challenge requires careful deliberation and strategic thinking. Below, we explore the intricacies of choosing the right payment solutions that align with specific needs, ultimately leading to a more seamless and efficient financial experience.

Navigating the Abundance of eCommerce Payment Choices

1. analyzing transaction fees.

One of the primary considerations when assessing different payment methods is the transaction fee structure. Each platform typically charges a percentage of the transaction amount, which can significantly impact the cost of business over time. Researching and comparing the fee structures of various payment gateways is crucial for minimizing expenses.

– Example: PayPal typically charges 2.9% + $0.30 per transaction within the US.

2. Examining the User Experience

The user interface and overall customer experience can make or break a consumer’s willingness to complete a purchase. Payment methods that provide a straightforward and secure process tend to have higher conversion rates. Consider how each system facilitates a quick and hassle-free checkout.

3. Understanding Integration Capabilities

The ability to integrate a payment method with existing systems (such as eCommerce platforms , accounting software, or CRM systems) is vital for operational efficiency. Look into the compatibility and integration support for each payment option.

4. Accessibility and Reach

Evaluate the geographic reach and currency support of the payment method, especially if your business operates internationally or is looking to expand. Accessibility can influence customer satisfaction and broaden your market.

5. Customer Preferences and Behaviors

Staying attuned to your target demographic’s preferred payment methods can inform your selection. Factors such as age, tech-savviness, and regional preferences can greatly influence the popularity of certain payment options among your users.

Personal and Organizational Considerations in Online Payments

1. security measures and compliance standards.

Safety is paramount in online financial transactions. Investigate the security protocols each payment provider offers, including encryption standards, PCI DSS compliance, and fraud prevention measures.

Example: Stripe, a leading payment processor, highlights their use of machine learning to detect and prevent fraud.

2. Assessing Financial Stability and Risk

Consider how different payment methods may affect the financial health of your organization. This includes analyzing potential risks, such as chargeback rates and the reliability of the payment service provider.

3. Analyzing Payment Processing Speed

The time it takes for funds to become available can impact cash flow for businesses. Look into the processing times for various payment methods to understand potential delays in revenue recognition.

4. Considering Scalability

As your business grows, so will your payment processing needs. Choose a payment method that can scale with your business, accommodating increased transaction volumes without compromising performance.

5. Evaluating Vendor Support and Service Quality

The level of support and service offered by a payment provider is crucial, especially in the event of technical issues or disputed transactions. Review the support channels and service reputation of providers through customer testimonials and third-party reviews.

6. Long-term Cost Implications

While certain payment methods may seem cost-effective initially, long-term contractual obligations and hidden fees can alter their appeal. Delve into the total cost of ownership for each payment solution you consider.

7. Technology Advancements and Future-proofing

The payment industry is continually evolving, with new technologies and trends emerging. Opt for payment methods that demonstrate a commitment to innovation and technology upgrades to future-proof your payment infrastructure.

Selecting the right online payment methods is not just about accommodating current needs but also about positioning oneself or one’s business for future success. It requires a comprehensive analysis of the market landscape, an understanding of consumer behavior, and a forward-looking approach to technology and financial management. By prioritizing these factors, one can make a more informed decision that aligns with both personal and organizational objectives.

Identifying the Best Online Payment Methods

Choosing the right online payment method is crucial for optimizing the user experience and achieving operational efficiency. Several factors can influence this choice, each tied closely to individual preferences and specific objectives:

Transaction Costs: Consideration of transaction fees that may impact the overall cost for users or affect a business’s profit margins is essential. High fees might deter customers, while low fees can encourage transactions.

Security Measures: Ensuring that payment methods have robust security protocols such as encryption and fraud prevention tools protects users’ sensitive financial data.

Payment Processing Time: The speed with which transactions are processed can be a determining factor for users who need immediate access to services or for businesses managing cash flow.

User Convenience: Payment methods that offer ease of use, such as one-click purchasing or auto-fill forms, can enhance the user experience and increase the likelihood of repeat transactions.

Compatibility and Integration: The ease of integrating payment methods with existing eCommerce platforms and their compatibility with other tools and applications influences their suitability for businesses.

Customer Preference: Understanding demographic trends and customer preferences can help in selecting methods that are more likely to be embraced by the target audience.

Consumer vs. Business-centric eCommerce Payment Solutions

Consumer-centric payment methods:.

Consumers prioritize speed, simplicity, and safety. They often favor payment solutions that integrate seamlessly with their lifestyle, such as:

Digital Wallets: Apps like PayPal, Apple Pay, and Google Wallet offer a secure and quick way to pay online without entering card details for every transaction.

Mobile Payments: With the ubiquity of smartphones, options like Samsung Pay appeal to users who appreciate paying through a device they always carry.

One-Click Payments: This feature, made popular by platforms like Amazon, saves users’ payment information for future use, making the checkout process faster and more straightforward.

These consumer-centric methods cater to the need for convenient, quick, and secure transactions, reflecting the payment preferences of individual shoppers who engage in eCommerce activities.

Business-Centric Payment Methods:

Businesses, on the other hand, have a broader set of concerns when it comes to selecting online payment methods:

Merchant Accounts: Providing the ability to accept various forms of payments such as credit and debit cards, these accounts are vital for businesses that wish to cater to a wide audience.

Payment Processors: Services that handle the transaction process from start to finish, such as Stripe or Square, are crucial for businesses looking for a streamlined payment ecosystem.

Recurring Billing Systems: For businesses that operate on a subscription model or require regular payments, systems that automate these processes are invaluable.

International Payment Options: For global businesses, the ability to accept payments in multiple currencies and conform to different countries’ regulations is a priority.

Business-centric payments are engineered to provide versatility, scalability, and compliance with financial regulations, addressing the multifaceted needs of businesses operating in the digital marketplace.

Understanding the distinct requirements and preferences of consumers and businesses is fundamental when identifying the most suitable online payment methods. Each group approaches transactions with different expectations and needs, which must be met to ensure satisfaction and maintain a competitive edge in the eCommerce space.

Best Online Payment Methods for Businesses

Understanding your target audience’s payment preferences.

Businesses aiming to succeed in the digital marketplace must comprehend the payment preferences of their target audience. By analyzing purchasing habits and payment method usage patterns, companies can not only align their transactional processes with customer expectations but also foster trust and convenience, leading to increased customer satisfaction.

Market Research: Conduct surveys, focus groups, and utilize analytics tools to gather data on the payment methods your customers frequently use and prefer.

Customer Segmentation: Determine if certain demographics favor different payment options. For example, younger audiences may gravitate towards mobile payments or digital wallets, while older customers might still value the use of credit cards .

Competitor Analysis: Research what payment methods competitors are offering and how well these options are received by their customers.

Feedback Channels: Implement a system for collecting ongoing customer feedback on payment options to stay updated on changing preferences.

Understanding these aspects ensures that the business provides relevant and convenient payment solutions, which can enhance the user experience and potentially increase conversion rates.

Essential Considerations for Selecting Online Payment Methods

Selecting the most effective online payment method for your business involves a comprehensive analysis of several key factors:

Transaction Fees: Consider the costs associated with different payment methods and how they impact your profit margins. A balance between affordable fees and quality service is crucial.

Integration Capabilities: Ensure that the payment methods can seamlessly integrate into your current eCommerce platform to provide a smooth checkout experience.

Global Reach: If your business caters to an international audience, prioritize payment methods that are widely accepted across different countries and currencies.

Security Features: Opt for payment solutions that offer robust security measures to protect both your business and your customers from fraud and data breaches.

Settlement Times: Look into how quickly funds from transactions become available, as this can affect your cash flow management.

Customer Support: Choose providers that offer reliable customer support to resolve any issues promptly.

Considering these factors helps in making an informed decision that aligns with your business objectives and operational requirements.

The Integral Role of Payment Processors and Merchant Accounts

Payment processors and merchant accounts are foundational components of a business’s eCommerce payment system, playing a pivotal role in facilitating online transactions.

Simplifying Transactions: Payment processors handle the technical side of transactions, from authorization to settlement, thus simplifying the payment experience for both the business and the consumer.

Fraud Prevention: They provide advanced fraud detection and prevention tools to reduce the risk of unauthorized transactions.

Merchant Accounts: Having a dedicated merchant account enables businesses to accept credit and debit card payments, which are among the most preferred payment methods for online shoppers.

Compliance: Payment processors ensure that transactions comply with industry standards such as PCI DSS, contributing to the overall security and trustworthiness of the business.

Scalability: As businesses grow, payment processors can easily scale to handle an increased volume of transactions without compromising on performance or security.

In conclusion, selecting the right payment processors and setting up a proper merchant account is critical for businesses to handle online payments effectively. It is essential to partner with a payment processor that offers a seamless blend of security, compliance, and user-centric features to support your business’s long-term growth and adapt to the evolving online payment landscape.

Best Online Payment Methods for Consumers

Consumers today demand flexibility and convenience as they navigate through various online shopping platforms. The digital marketplace has responded by offering an array of payment options to cater to the diversity of consumer preferences and financial habits. An in-depth analysis reveals several underlying reasons behind this increased flexibility:

Personalized Shopping Experience: Tailoring payment options to match consumer habits creates a more personal connection with shoppers, leading to higher satisfaction rates.

Global Commerce: With cross-border transactions becoming commonplace, platforms provide payment methods that transcend geographical boundaries, facilitating international purchases.

Technological Advancements: Innovations in fintech have led to the development of secure, user-friendly options that complement traditional payment methods like credit cards.

Industry data from sources such as Statista illustrates escalating figures in digital buyers, highlighting the necessity for online retailers to adapt to this varied payment landscape.

The Ascendancy of Digital Wallets in eCommerce

Digital wallets, known for their swift, seamless transactions, have gained substantial ground as preferred methods of payment online. Their unique attributes have fueled their widespread adoption:

Streamlined Checkout: Digital wallets store payment and shipping information, enabling one-click purchases and reducing the friction experienced during checkout.

Enhanced Security Measures: Advanced encryption and tokenization ensure user data is protected, thus instilling trust among consumers.

Rewards and Incentives: Many digital wallet providers offer rewards, cashback, or discounts, which encourage continued use and loyalty.

Moreover, industry giants such as PayPal and Apple Pay have set benchmarks in user adoption, as detailed in Javelin Strategy & Research’s reports. The introduction of contactless payment methods via smartphones and wearable technology has only accelerated this trend further.

To provide a more exhaustive understanding, let’s dive deeper into what makes digital wallets a frontrunner in eCommerce payment systems:

Consumer-Centric Design

Digital wallets are designed with a clear focus on user experience. They feature intuitive interfaces and simple navigation, which greatly appeal to tech-savvy consumers who prioritize speed and convenience in their transactions.

Integration with Mobile Devices

As mobile commerce grows, the synchronization of digital wallets with mobile devices presents a significant advantage. The ease of making payments through a device that is an integral part of daily life is a strong selling point for consumers.

Acceptance Across Merchants

A widening acceptance of digital wallets among merchants, both big and small, ensures that consumers can use their preferred payment method across a majority of online retail stores. This ubiquity is crucial in maintaining the momentum of digital wallet usage.

Fostering Financial Inclusion

Digital wallets also play an essential role in promoting financial inclusion by providing services to individuals who may not have access to traditional banking. This opens up the digital marketplace to an entirely new segment of consumers.

As we analyze the best online payment methods for consumers, it becomes clear that the enriched flexibility offered by multiple eCommerce payment options, coupled with the rising dominance of digital wallets, stands as a testament to the dynamic nature of consumer finance in the digital age. Retailers who prioritize these methods in their payment gateways are set to witness improved customer engagement and retention, aligning themselves with the evolving landscape of online commerce.

Final Thoughts

In conclusion, the ever-evolving sphere of online payment methods reflects the dynamic interplay between consumer preferences, technological advancements, and the strategic imperatives of businesses operating in the digital economy. From the ubiquitous use of credit and debit cards, the rising popularity of digital wallets, to the innovative adoption of cryptocurrencies, each method offers unique benefits and challenges that cater to a diverse range of needs.

As businesses strive to cater to a global customer base, the significance of offering a mosaic of secure, efficient, and user-friendly payment options becomes paramount. Ultimately, the meticulous integration of these payment methods into e-commerce strategies not only aligns with consumer habits but also serves as a crucial factor in sustaining growth, improving customer retention, and maintaining a competitive edge in the market.

Ready to secure your online transactions while embracing the convenience of modern commerce? Look no further than Bankful – your go-to solution for a seamless online payment experience. From the ease of traditional methods like credit/debit cards to the innovative frontiers of digital wallets and cryptocurrencies, Bankful delivers a multifaceted platform that caters to all your financial transactions. With Bankful , benefit from lower fees, enhanced security measures, and a range of options that ensure your business stays ahead of market trends and customer preferences.

A payment method online refers to the way a customer can pay for goods and services over the internet. It can include credit cards, debit cards, electronic wallets, bank transfers and more.

Some ecommerce payment options include credit and debit cards, mobile payments, PayPal, bank transfers, and cryptocurrencies.

Online payments work by transferring funds electronically from the buyer’s account to the seller’s account, after the buyer authorizes the payment through a secure payment gateway.

An e commerce payment system is a platform that allows for the exchange of funds when goods or services are purchased online.

There are numerous payment methods online such as credit/debit cards, PayPal, net banking, mobile wallets, and electronic checks among others.

Ecommerce payment systems are infrastructures that support the online financial transactions of goods and services.

The various methods of online payment include credit/debit cards, PayPal, Google Pay, bank transfers, mobile wallet apps, and even cryptocurrencies.

Payment systems for eCommerce are infrastructures and protocols established to safely and reliably process transactions when customers make purchases online.

Stay up to date

Receive industry news right in your inbox.

- Accountancy

- Business Studies

- Organisational Behaviour

- Human Resource Management

- Entrepreneurship

What is an Online Transaction?

Business transactions conducted through the internet are called online transactions. It is a payment method that aims to settle money transfers or funds settlements via electronic mode. It also requires security and protection using basic methods like password protection and OTP verification to safeguard the transactions better. It is an increasingly popular method and is the backbone of e-commerce. Basically, online transactions permit buyers and sellers to meet online, trade as needed, and exchange goods or services for money, and give a wider reach.

Stages of Online Transactions

There are 3 stages of online transactions.

1. Pre-purchase/Sale Stage: During this stage, advertisements are posted, and social media is engaged to entice the target audience to be customers.

2. Purchase/Sale Stage: This stage consists of steps like price negotiation, closing of purchase and sales deals and payment, etc.

3. Delivery Stage: This stage includes steps related to the delivery of products to the customers.

Steps Involved in Online Transactions

For ease of understanding, we can divide a typical online transaction into three parts.

1. Registration: In the first step, the customer has to register on that specific e-commerce platform by filling in the details required by that online vendor. By register, we mean that one must have an account with the online vendor. The account is usually password-protected for security reasons. It also includes some sensitive information about the person, such as name, email ID, contact details, bank details, etc. Hence, protecting the account is also of significant importance.

2. Placing an Order: After registration with the vendor, the next step is to add products or services, which you want to buy to the cart. This method of adding items to the cart is quite similar to physical stores, as, in physical stores, we put items in the cart. The order is first saved in a ‘shopping cart’, so as to give the option to the customer to order everything they need in one go. After placing all the items, customers can ‘checkout’ and choose the payment method.

3. Payment: The buyer usually has a wide variety of payment options to choose from. This payment page is usually highly encrypted, protected, and secured to protect financial information from being leaked out. As this is the most sensitive information, data is avoided to be collected, and leakage of data on this page could be disastrous for everyone involved, as a malicious hacker could gain access to the buyer’s bank account.

Payment Options

There are various payment options allowed in online transactions.

1. Cash on Delivery: As the order is delivered, the cash is handed over simultaneously to finish the trade on both ends. In this case, as the cash is handed, the goods are also delivered from the other end, or services are given simultaneously on the realization of delivery of goods or services.

2. Cheque: In this mode of payment, a cheque is written from buyer to seller. The seller then takes the cheque, and hands it over to the bank. Goods or services are usually delivered only after the realization of the cheque to avoid bouncing of the cheque.

3. Net Banking: Money is transferred from the buyer to the seller electronically through the internet from bank. After the payment is received by the seller, goods are dispatched or services are provided.

4. Credit or Debit Card: This is one of the most popular methods of online transactions, and these cards are referred to as ‘plastic money’. A credit card allows the customers to make a purchase on credit whereas a debit card allows the customers to purchase products to the extent of the amount in the bank account. The buyer sends his credit or debit card details to the seller, allowing the deduction of a set amount from his/her account. As the seller receives the money, they provide the goods and services for which they have been paid.

5. Digital Cash: Digital cash is a piece of electronic media stored in cyberspace that does not exist physically, but can be traded like real cash. Here, the money is saved on a code in a hard drive, USB or cloud that when shared, can be used to trade money from one account to the other. As the buyer uses digital cash to pay for the goods and services, the seller upon receiving the money, provides the products or services.

Please Login to comment...

Similar reads.

- Best PS5 SSDs in 2024: Top Picks for Expanding Your Storage

- Best Nintendo Switch Controllers in 2024

- Xbox Game Pass Ultimate: Features, Benefits, and Pricing in 2024